MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency

and financial condition reports

year-end 2022

European and UK life insurers

September 2023

Sam Burgess

Neil Christy, FIA, CERA

Isabel Stansfield

MILLIMAN RESEARCH REPORT

Table of contents

INTRODUCTION ..................................................................................................................................................... 1

EUROPEAN MARKET COVERAGE .................................................................................................................. 1

UNDERLYING DATA ......................................................................................................................................... 2

EIOPA REVIEW OF SOLVENCY II .................................................................................................................... 3

UK REVIEW OF SOLVENCY II .......................................................................................................................... 3

SECTION 1: ANALYSIS OF EUROPEAN LIFE INSURERS ................................................................................. 5

ANALYSIS OF BALANCE SHEET ......................................................................................................................... 5

ASSETS ............................................................................................................................................................. 5

LIABILITIES ....................................................................................................................................................... 6

REINSURANCE ................................................................................................................................................. 7

ANALYSIS OF PREMIUMS, CLAIMS AND EXPENSES ....................................................................................... 9

GROSS WRITTEN PREMIUMS ......................................................................................................................... 9

INCURRED CLAIMS ........................................................................................................................................ 10

EXPENSES ...................................................................................................................................................... 12

ANALYSIS OF OWN FUNDS ............................................................................................................................... 12

ANALYSIS OF SOLVENCY COVERAGE ............................................................................................................ 13

ANALYSIS OF SCR ............................................................................................................................................. 18

LONG-TERM GUARANTEE MEASURES ........................................................................................................... 20

CONCLUSION ...................................................................................................................................................... 23

SECTION 2: ANALYSIS OF UK LIFE INSURERS ............................................................................................... 24

UK MARKET COVERAGE ............................................................................................................................... 24

ANALYSIS OF BALANCE SHEET ....................................................................................................................... 24

ASSETS ........................................................................................................................................................... 24

LIABILITIES ..................................................................................................................................................... 25

REINSURANCE ............................................................................................................................................... 27

ANALYSIS OF PREMIUMS, CLAIMS AND EXPENSES ..................................................................................... 28

GROSS WRITTEN PREMIUMS ....................................................................................................................... 28

INCURRED CLAIMS ........................................................................................................................................ 30

EXPENSES ...................................................................................................................................................... 31

ANALYSIS OF OWN FUNDS ............................................................................................................................... 31

ANALYSIS OF SOLVENCY COVERAGE ............................................................................................................ 34

ANALYSIS OF SCR ............................................................................................................................................. 39

ANALYSIS OF MCR ............................................................................................................................................. 41

LONG-TERM GUARANTEE MEASURES ........................................................................................................... 42

CONCLUSION ...................................................................................................................................................... 44

APPENDIX 1: UK LIFE COMPANIES INCLUDED IN THE ANALYSIS ............................................................... 45

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 1 September 2023

financial condition reports year-end 2022

Introduction

This report focuses on the solvency and financial condition reports (SFCRs) published in 2023 which refer to

year-end 2022.

1

The SFCRs contain a significant amount of information on each of the insurance companies,

including details on business performance, risk profile, balance sheet and capital position, amongst other things.

Insurers are also required to publish a great deal of quantitative information in the public quantitative reporting

templates (QRTs) included within the SFCRs.

EUROPEAN MARKET COVERAGE

Our analysis of the European life insurance market covers 675 companies from 31 countries and 3 territories,

representing approximately £686 billion (€774 billion)

2

of gross written premium (GWP) and approximately £6.662

trillion (€7.514 trillion) of gross technical provisions (TPs). This represents a 2% decrease in the number of

companies and a 14% decrease in gross TPs relative to our year-end 2021 report on the SFCRs of life insurers.

The analysis does also represent a 5% decrease in the level of GWP relative to our previous report. This

suggests that overall sales of life insurance were lower in 2022 when compared to 2021. This is supported by

data published by the European Insurance and Occupational Pensions Authority (EIOPA) and is likely driven

primarily by the uncertain economic and geopolitical landscape.

The countries and territories included in the analysis are as follows, with some countries grouped into broad territories:

Austria (AT) ROE

Belgium (BE)

Bulgaria (BG) CEE

Croatia (HR) CEE

Cyprus (CY) ROE

Czechia (CZ) CEE

Denmark (DK) NOR

Estonia (EE) CEE

Finland (FI) NOR

France (FR)

Germany (DE)

Gibraltar (GI) ROE

Greece (EL) ROE

Guernsey (GG) ROE

Hungary (HU) CEE

Iceland (IS) NOR

Ireland (IE)

Isle of Man (IM) ROE

Italy (IT)

Latvia (LV) CEE

Liechtenstein (LI) ROE

Lithuania (LT) CEE

Luxembourg (LU)

Malta (MT) ROE

Netherlands (NL)

Norway (NO) NOR

Poland (PL) CEE

Portugal (PT) ROE

Romania (RO) CEE

Slovakia (SK) CEE

Slovenia (SI) CEE

Spain (ES)

Sweden (SE) NOR

United Kingdom (UK)

NOR – countries included in the Nordics category

CEE – countries included in the Central and Eastern Europe category

ROE – countries included in the Rest of Europe category

Our analysis is based on a sample of insurers that are primarily focused on selling life insurance business, and

as a result, some composite companies have been excluded from the analysis. Reinsurers have been included in

the analysis where their business has been deemed to be predominantly life reinsurance.

The charts and results in this report focus on nine of the largest European life insurance markets by the total

volume of TPs. The top nine markets selected cover approximately 86% of the total European life insurance

market by volume of TPs. The remainder of the nations are split into three categories: the Nordics (NOR), Central

and Eastern Europe (CEE), and the Rest of Europe (ROE). NOR and CEE are well-defined geopolitical

groupings whilst ROE includes the remaining nations and territories not captured within the other categories used

in our analysis.

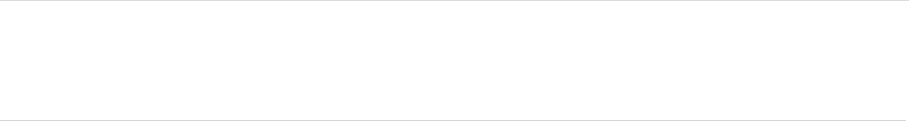

Figure 1 shows the geographical coverage of this report. The UK is highlighted in red and the remaining eight

large European markets are shown in green. The remaining categories are shown as dark blue for the NOR,

orange for CEE and light blue for the ROE.

1

These SFCRs are referred to as the year-end 2022 SFCRs throughout this report as the reporting date for most companies included in the samples

is 31 December 2022. There are a small number of companies included in the sample which had a reporting date other than 31 December 2022.

2

GBP:EUR exchange rate of 1:1.13 for year-end 2022. An exchange rate of 1.19 is used for year-end 2021 figures. These figures are rounded to

three significant figures.

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 2 September 2023

financial condition reports year-end 2022

FIGURE 1: EUROPEAN COUNTRIES INCLUDED IN THE ANALYSIS

UNDERLYING DATA

The analysis underlying this report focuses on the quantitative information contained in the public QRTs. Where

relevant, we have also studied the SFCRs to gain additional insights into some companies, if they displayed

characteristics which differed from market norms. Our focus is on solo entities rather than groups.

In carrying out our analysis and producing this research report, we relied on the data provided in the SFCRs and

QRTs of our sample companies. We have not audited or verified this data or other information. If the underlying data

or information is inaccurate or incomplete, the results of our analysis may likewise be inaccurate or incomplete.

We performed a limited review of the data used directly in our analysis for reasonableness and consistency and

have not found material defects in the data. It should be noted that in some cases errors were spotted in the

underlying data. We have made minor adjustments to the data to correct known errors such as inconsistencies

between QRTs to better inform our analysis. However, we have not made any material changes to the underlying

data. We have not made any changes to the data to reflect additional information or changes following the

reporting date.

This research report is intended solely for informational purposes and presents information of a general nature.

The underlying data and analysis have been reviewed on this basis. This report is not intended to guide or

determine any specific individual situation, and persons should consult qualified professionals before taking

specific actions.

The data analysed in this report has been sourced from Solvency II Wire Data and companies’ disclosed SFCRs.

The data is available via subscription from: https://solvencyiiwiredata.com/about.

Our analysis of the

European life insurance

market covers:

675 COMPANIES

31 COUNTRIES

and three territories

£686 BILLION

in gross written premiums

£6.662 TRILLION

of gross technical provisions

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 3 September 2023

financial condition reports year-end 2022

EIOPA REVIEW OF SOLVENCY II

In 2020, EIOPA published its opinion on the Solvency II Review. Following this, in 2021, the European

Commission (EC) announced its proposals to reform Solvency II taking advice from the recommendations

provided by EIOPA. As part of the legislative procedure, the European Parliament appointed Markus Ferber as a

rapporteur for the file who tabled his draft report.

After more than a year of negotiations, in July 2023, the European Parliament’s Committee on Economic and

Financial Affairs (Econ) approved the proposed amendments to the directive with 55 votes in favour of the

rapporteur’s draft report and 3 against. The rapporteur’s report is considered ‘a step in the right direction’ but

negotiations are still ongoing.

One of the areas under review was the current supervisory reporting and public disclosure requirements,

including the QRTs and the SFCR. These changes will have an impact on future published SFCRs and on the

data contained within them. The proposals accepted by Parliament are broadly consistent with those put forward

by the EC and EIOPA and are intended to ensure that the SFCR remains fit for purpose by all stakeholders which

use the document. Some of the highlights from the proposals in relation to the SFCR are:

To consider the needs of different stakeholders and the different levels of expertise of professional and non-

professional readers, by splitting the SFCR into two sections that are addressed to:

− Policyholders – This section must be short and easy to read, focusing on areas of Solvency II that are

relevant to policyholders. It should include a brief description of the business and performance of the

undertaking as well as the risk profile, including in relation to sustainability risks.

− Non-policyholders – This section should broadly follow the current form of the SFCR and should target

professional readers. It should contain less information than currently provided in some areas, and more

detailed, structured, harmonised information in other areas.

An extension to the reporting deadline for solo SFCRs by four weeks from 14 weeks to 18 weeks, and for the

group SFCRs by four weeks from 20 weeks to 24 weeks.

Changes to the external audit requirements of the SFCR, such that as a minimum the Solvency II balance sheet is

subject to external auditing by a qualified auditor with individual member states able to require the audit of

additional items. Low-risk profile insurers are exempt from this requirement on proportionality grounds.

Additional information included within the SFCR on topics such as sustainability risks; environmental, social

and governance (ESG) factors; and climate change issues. There will also be more explicit reporting of the

impact of long-term guarantee measures (LTGMs).

The publication of a full SFCR will not be required by low-risk profile insurers each year and instead such

firms will report a full SFCR every three years and a simplified disclosure for the other years.

Any changes to the European Solvency II regulations are not applicable to the UK and consequently may not be

adopted by the Prudential Regulation Authority (PRA) as part of the UK Solvency II regime. Therefore, diversions

between the two regimes are likely to arise.

Member states shall adopt the reforms by 30 June 2025, and they should apply to insurers from 1 January 2026.

However, these dates are not yet certain because the duration of the implementation period is part of the

continued negotiations between the rapporteur and Parliament.

UK REVIEW OF SOLVENCY II

Since 1 January 2021, the UK insurance market has only been regulated by the PRA and the Financial Conduct

Authority (FCA) and is no longer required to follow EU regulations. Since the UK’s exit from the European Union,

the PRA has had the ability to make changes and design its own insurance regulatory regime.

This has led to some diversions between the European and UK Solvency II regimes, with further diversions likely

to arise in the future between the UK and European markets adopting different amendments to their regimes.

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 4 September 2023

financial condition reports year-end 2022

His Majesty’s Treasury (HMT) set out the UK Government’s final reform package

3

in November 2022 and

following this a policy statement

4

in December 2022 outlining an implementation plan.

The reform focuses on a few key areas:

Risk margin – with a view to reducing the risk margin for long-term life insurers by around 65%

Matching adjustment – including a reassessment of the fundamental spread

Increasing investment flexibility – increasing the ability of firms to invest in long-term assets

Reducing reporting and administrative burdens

As part of its plans to legislate directly to implement certain parts of the Solvency II reform package, HMT set out

its approach in draft statutory instruments

5

, which brings forward reforms to the risk margin and certain aspects of

the matching adjustment (MA).

Those parts of the reform package not contained in legislation are intended to be implemented through changes

to PRA rules and other policy material. The PRA is currently consulting on its approach in two tranches:

Consultation Paper (CP) 12/23

6

, which sets out the majority of the PRA’s reform proposals, focusses on

simplification, improving flexibility and encouraging entry.

A second consultation planned for September 2023, which will cover reform proposals for life insurers

relating to investment flexibility and the MA.

Some of the highlights

7

from CP12/23 include:

A modified cost-of-capital approach to setting risk margin (RM) was preferred with the cost-of-capital rate

being set to 4% (compared to the current 6%). The changes set out also include the introduction of a lambda

factor

8

of 0.9 with a floor of 0.25.

The transitional measure on technical provisions (TMTP) will be calculated using a new default method,

derived solely using figures produced under Solvency II and therefore removing the need to perform

calculations under a Solvency I basis.

Streaming the requirements which firms (and groups) must meet for permission to use an internal model.

At the time of writing there have been no amendments to the UK Solvency II regime as a result of the HMT

review, although there have been some changes to the UK Solvency II regime relating to the published yield

curves and symmetric adjustment as well as minor changes to the QRTs.

9

Subject to consultation responses, the

PRA expects to issue final policy in relation to most of the proposals nearing the end of 2023. There still remains

uncertainty over what the future UK insurance regulatory landscape will look like, and the impact any changes

may have on UK insurers.

3

Review of Solvency II: consultation – response. (November 2022). HMT. Retrieved on September 7, 2023, from

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1118359/Consultation_Response_-

_Review_of_Solvency_II_.pdf.

4

Building a smarter financial services framework for the UK: Policy Statement. (December 2022). HMT. Retrieved on September 7, 2023, from .

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1122734/Building_a_smarter_financial_servic

es_framework_for_the_UK_.pdf.

5

Draft insurance and reinsurance undertakings regulations. (June 2023). HMT. Retrieved on September 7, 2023, from.

https://www.gov.uk/government/publications/draft-insurance-and-reinsurance-undertakings-prudential-requirements-regulations

6

CP12/23 – Review of Solvency II: adapting to the UK insurance market. PRA. Retrieved on September 7, 2023, from

https://www.bankofengland.co.uk/prudential-regulation/publication/2023/june/review-of-solvency-ii-adapting-to-the-uk-insurance-market

7

Patel, D., Ginghina, F., & Walker, S. (2023, July 7). CP12/23 – Review of Solvency II: adapting to the UK insurance market. Milliman. Retrieved

on September 7, 2023, from https://uk.milliman.com/en-gb/insight/cp-12-23-review-solvency-ii-uk-insurance.

8

The lambda factor is a method of tapering the risks projected under the risk margin calculation. This method has been assessed by EIOPA and

the PRA with options for the potential parameters which will define this approach under discussion. See the Milliman paper on the PRA’s

CP12/23 for more details on this approach.

9

Christy, N. (2022, January 3). PS29/21 – review of Solvency II: reporting (phase 1). Milliman. Retrieved on September 7, 2023, from

https://uk.milliman.com/en-GB/insight/ps2921-review-of-solvency-ii-reporting-phase-1.

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 5 September 2023

financial condition reports year-end 2022

Section 1: Analysis of European life insurers

Analysis of balance sheet

ASSETS

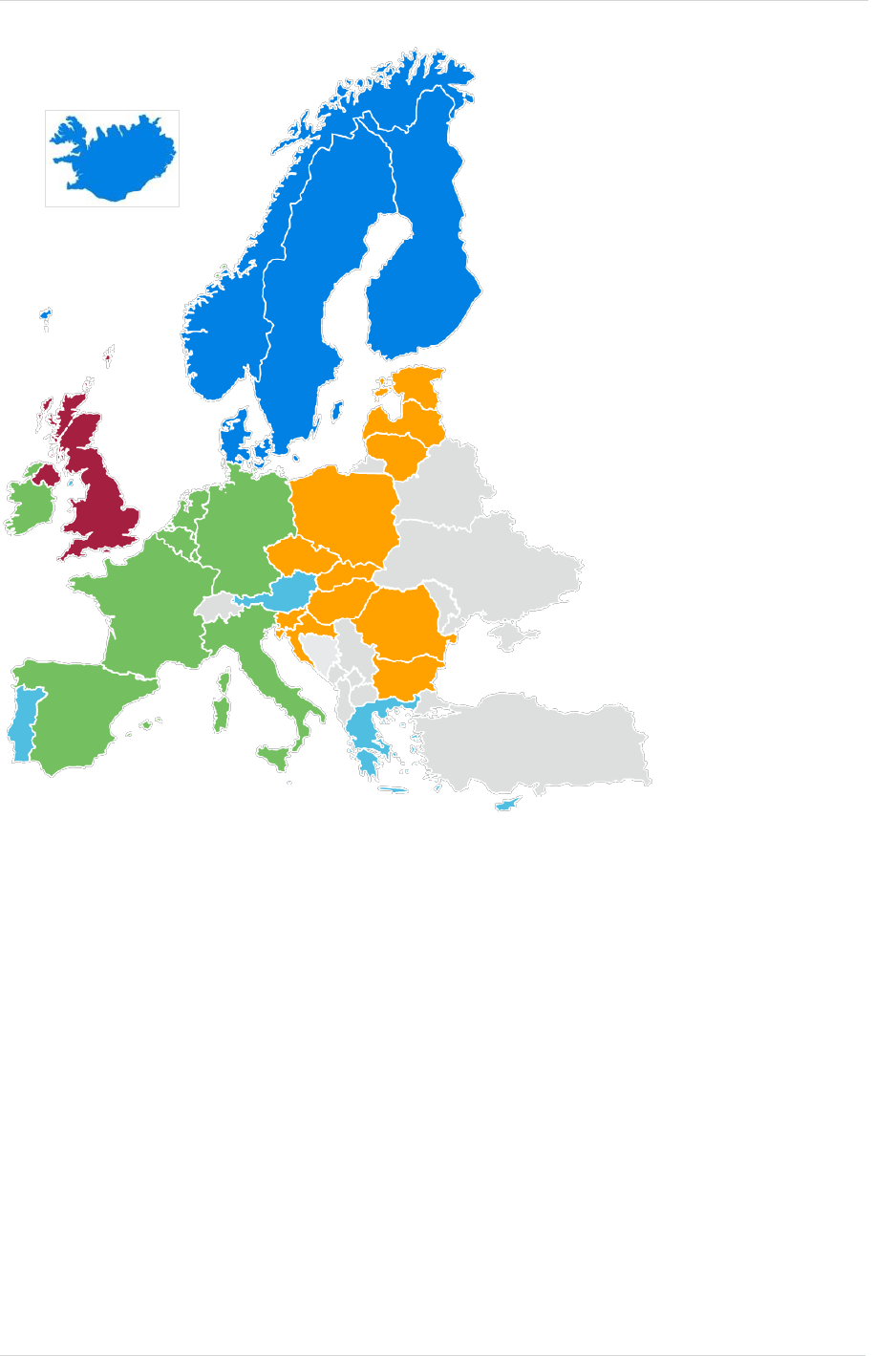

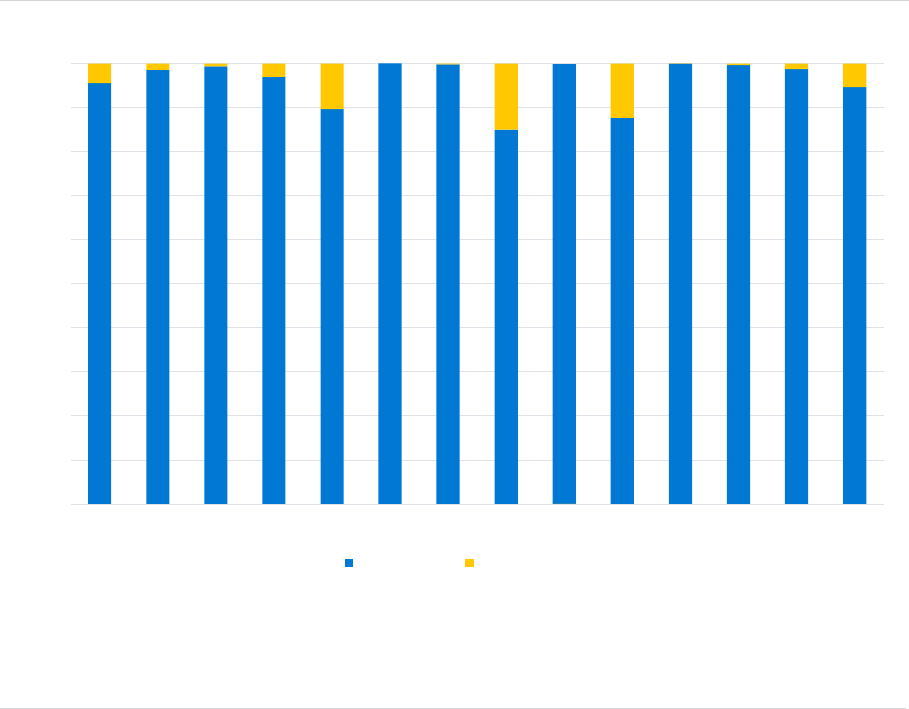

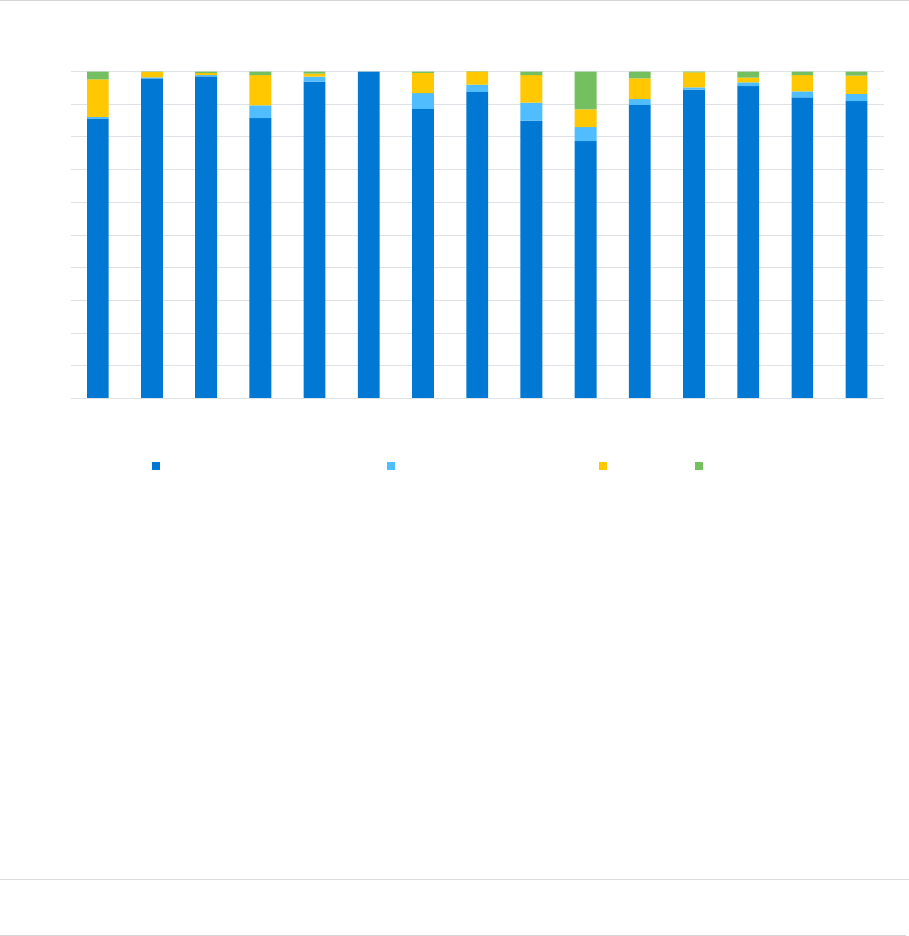

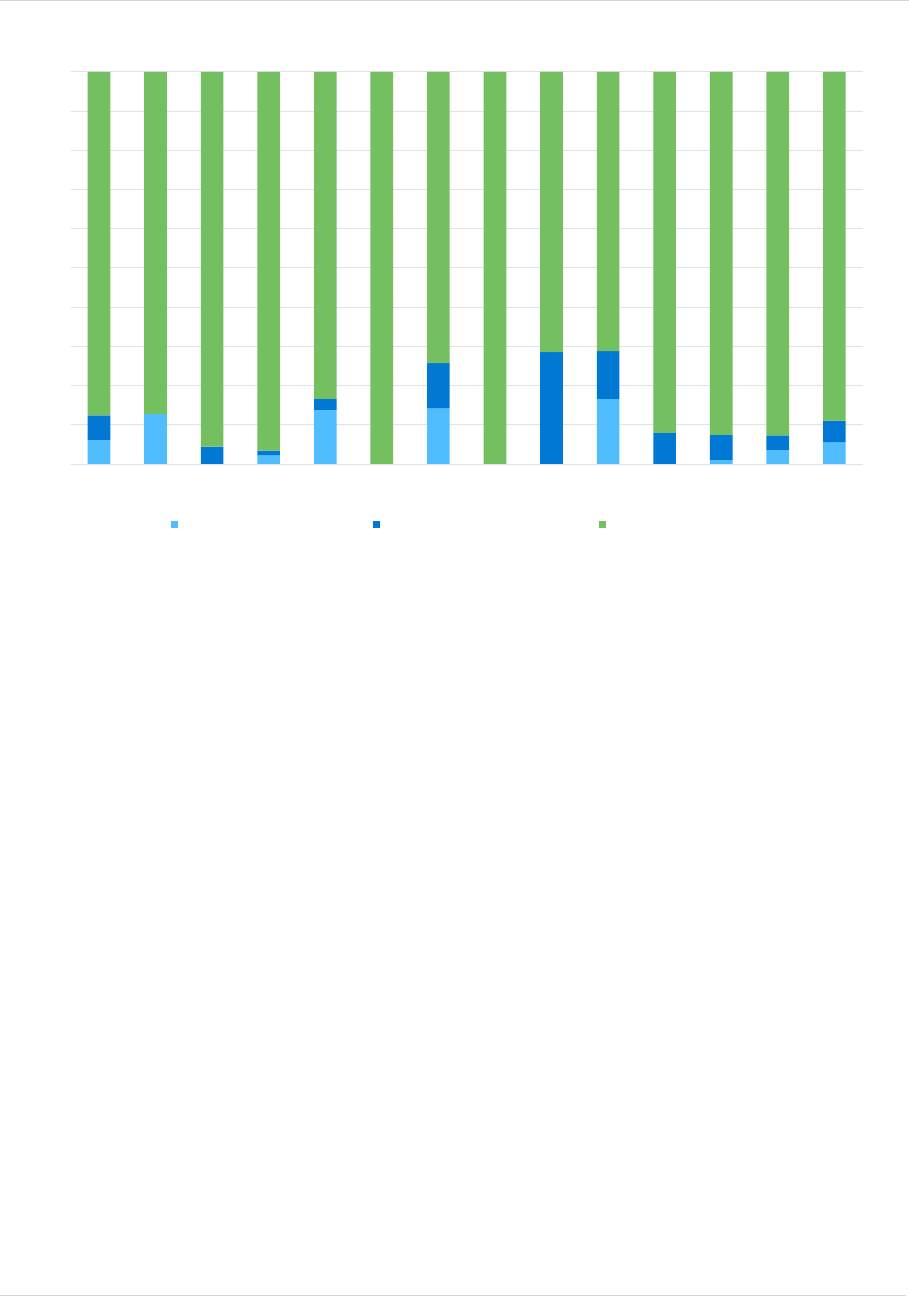

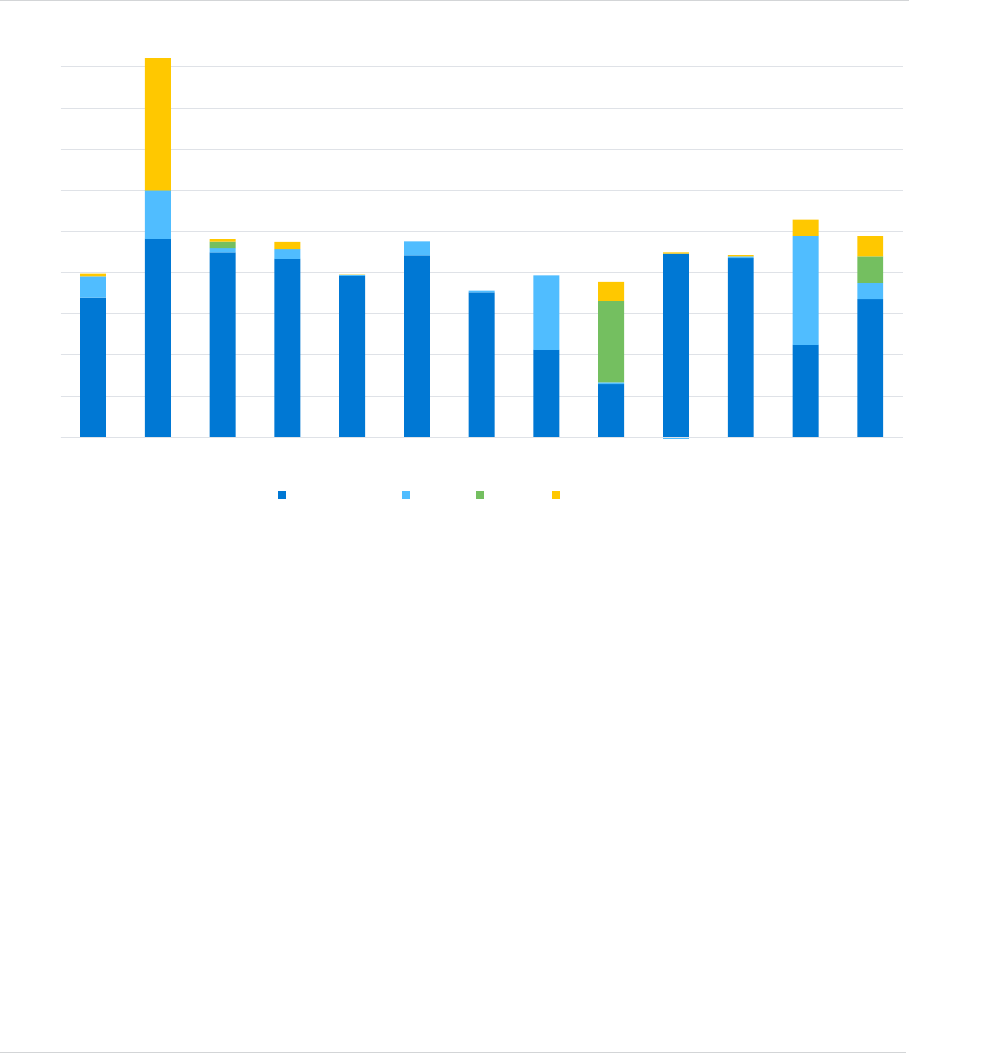

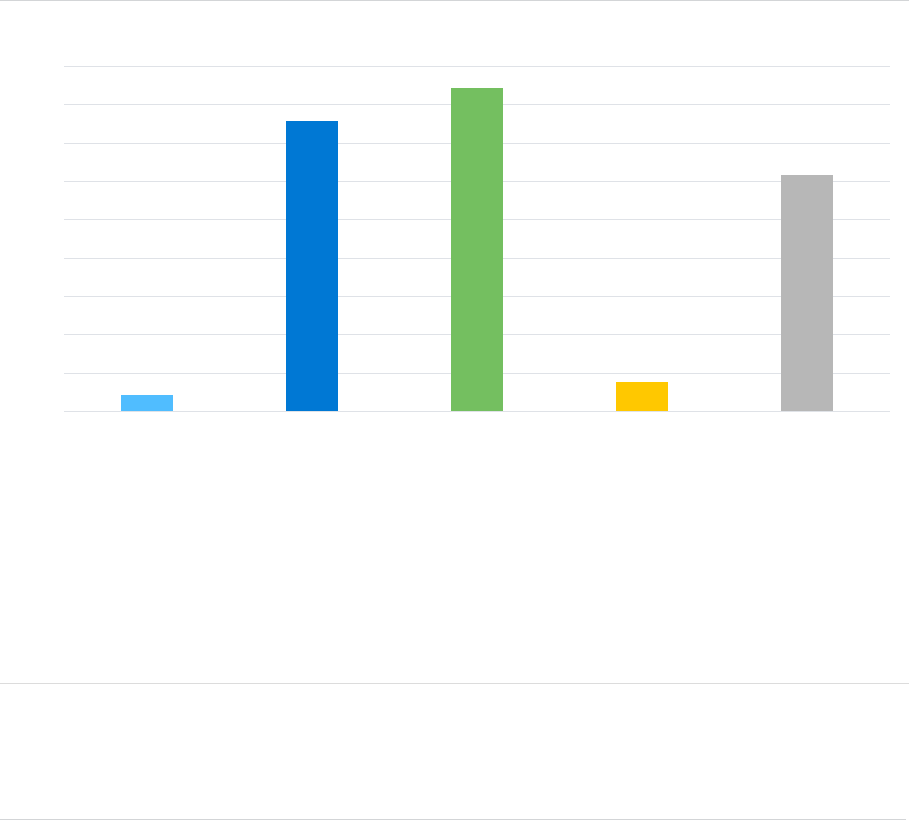

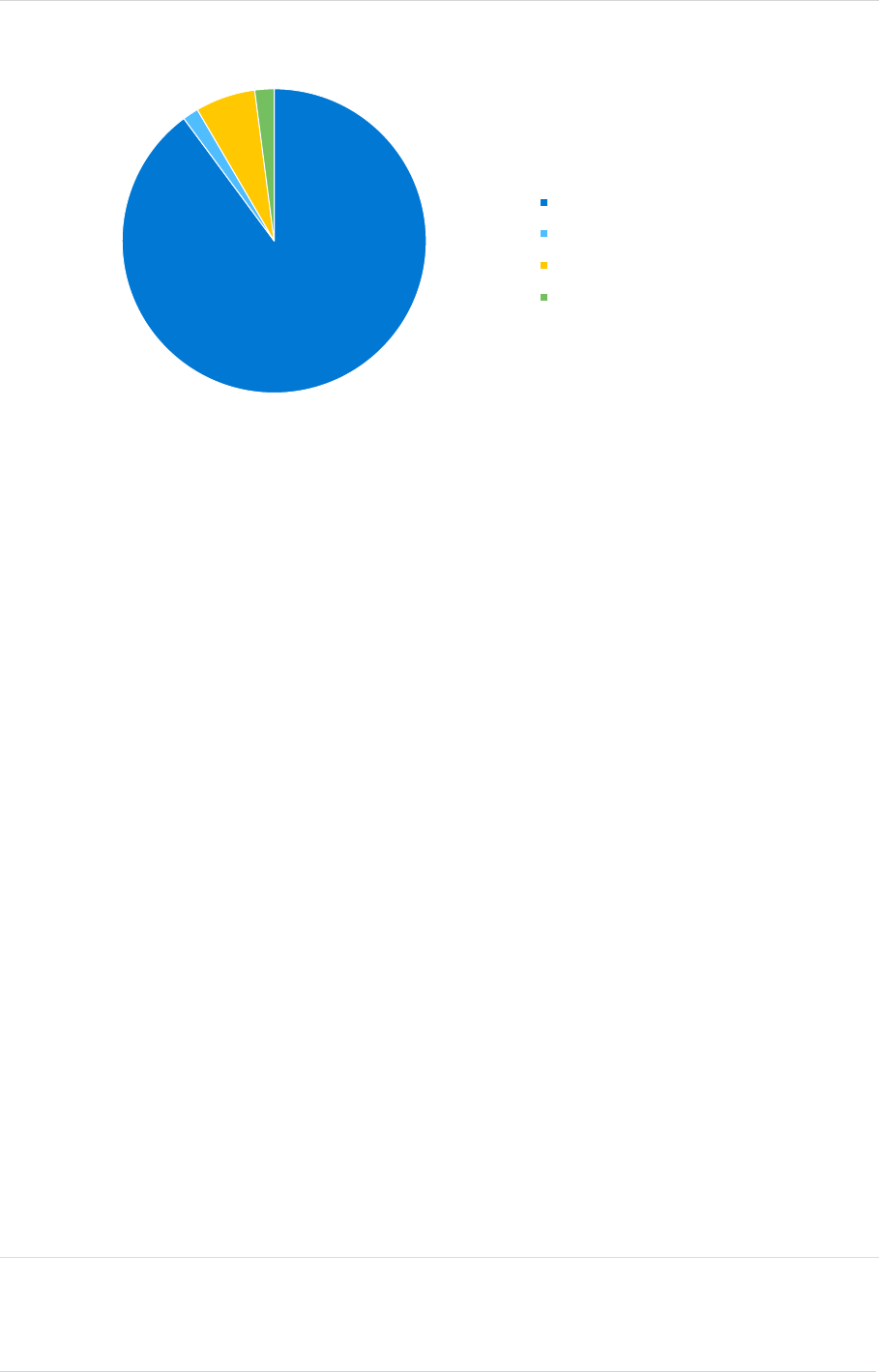

Figure 2 shows the split of financial investments held by life insurers across European countries at year-end

2022, with the total figure for all countries and territories in our analysis represented in the final bar on the right-

hand side of the chart, labelled as ‘Europe.’ This chart comprises financial investments classified as ‘Investments

(Other than Assets Held for Index-linked and Unit-linked Contracts)’

10

and 'Cash and cash equivalents' on the

Solvency II balance sheet.

11

FIGURE 2: SPLIT OF NON-LINKED ASSETS ACROSS EUROPE

In general, investments in

government bonds and corporate

bonds make up the majority of

financial investments on European

life insurers’ balance sheets.

In aggregate, across our sample of

European insurers, government

bonds and corporate bonds make up 29% and 27% of total financial investments, respectively. These proportions

are similar to those observed at year-end 2021 with a slight decrease in the proportion of government bonds of

4%. Government bonds continue to make up a significant proportion of investments in most of the countries,

including approximately 60% of total investments in Spain as well as over 70% in some countries in CEE

(Hungary, Poland and Bulgaria). However, the proportion of total investments held in government bonds did

decrease for some countries by over 10%. This included Liechtenstein and Portugal who reported an offsetting

increase in cash and collective investments respectively.

10

‘Assets held for Index-linked and Unit-linked Contracts’ are excluded as this category provides limited insight into what underlying assets categories

the investments are held in. In some jurisdictions this category is significant and leads to the remainder of the bar being quite difficult to read.

11

The liability side of derivatives is also included to give the net derivative position.

-10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IM IT LU NL UK NOR CEE ROE Europe

OTHER INVESTMENTS DEPOSITS OTHER THAN CASH EQUIVALENTS

OTHER BONDS EQUITY

PROPERTY CASH AND CASH EQUIVALENTS

NET DERIVATIVES HOLDINGS IN RELATED UNDERTAKINGS, INCLUDING PARTICIPATIONS

COLLECTIVE INVESTMENTS UNDERTAKINGS CORPORATE BONDS

GOVERNMENT BONDS

GOVERNMENT AND CORPORATE BONDS

account for 29% and 27%

of all financial investments, respectively.

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 6 September 2023

financial condition reports year-end 2022

Investments in collective investment schemes is the next largest category, accounting for a further 22% of total

financial investments. In particular, the level of holdings is due to large volumes in Germany (43%) as well

accounting for 22% of holdings in France and 19% in the NOR. It is worth noting that these schemes are also

likely to invest primarily in bonds.

Holdings in related undertakings, including participations, make up only 12% of total European financial investments,

but make up a much higher percentage within the UK and the NOR (24% and 34%, respectively). The NOR

percentage is driven by large holdings in related undertakings in the Danish market, accounting for 34% of all assets in

Denmark. Detailed analysis of the asset holdings in the UK is included in Section 2 of this report.

The derivatives shown in Figure 2 represent the net derivative position. Based on the companies in our sample, a

few have net negative positions, meaning that on average the value of derivative liabilities is greater than the

value of derivative assets on the Solvency II balance sheet. This is particularly prevalent in Spain where the

largest net negative derivative position for a firm is in respect of interest rate hedging.

The remaining asset classes such as cash and cash equivalents, equity, property, and other smaller asset

classes only total around 10% of all assets held by European life insurers. There are some regions in our

analysis which do make significant use of some of these asset classes including 33% of all assets in

Liechtensteiner life insurers being invested in cash and cash equivalents, whilst Isle of Man holds 25% of all its

investments in deposits others than cash equivalents.

LIABILITIES

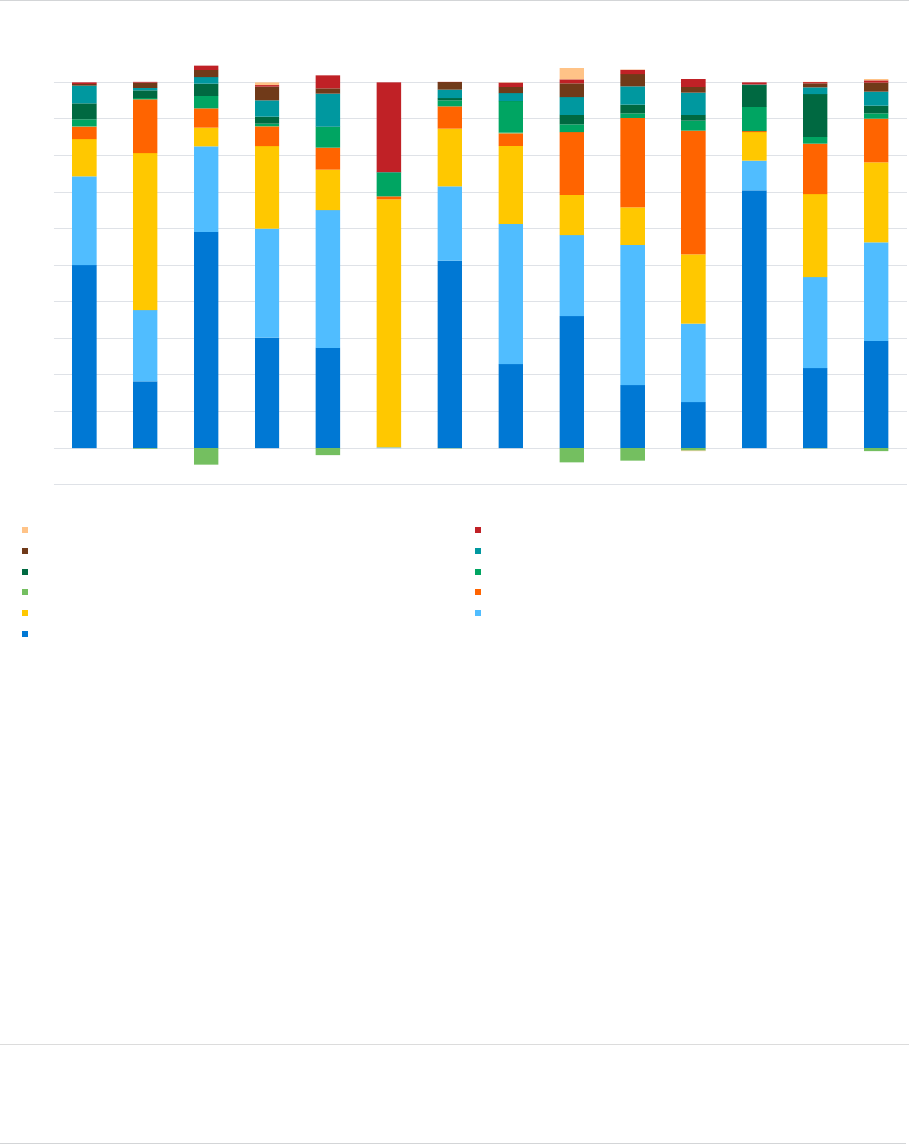

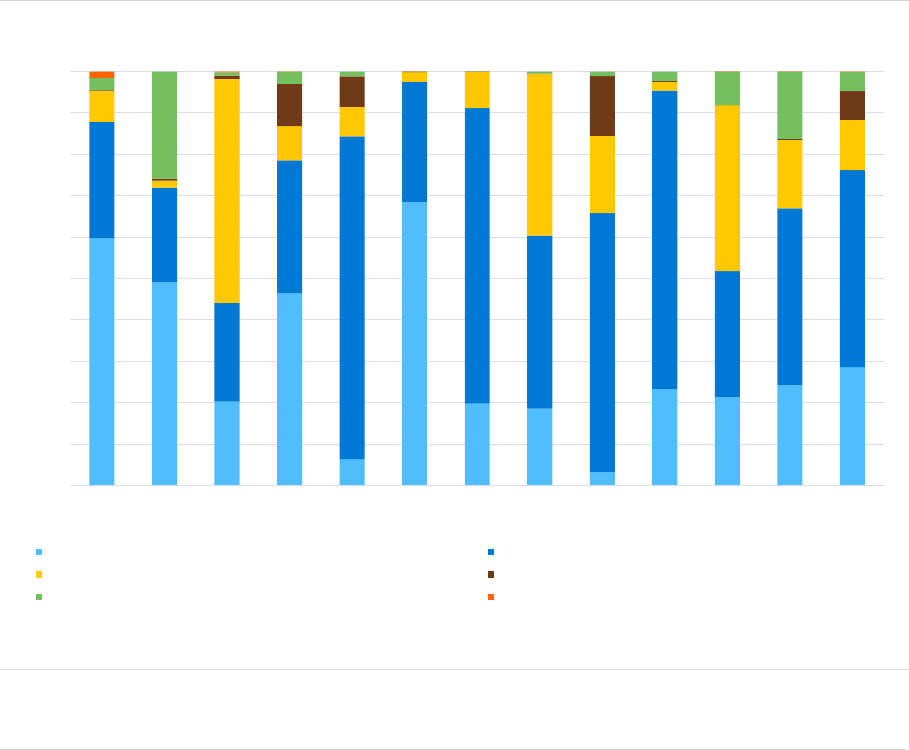

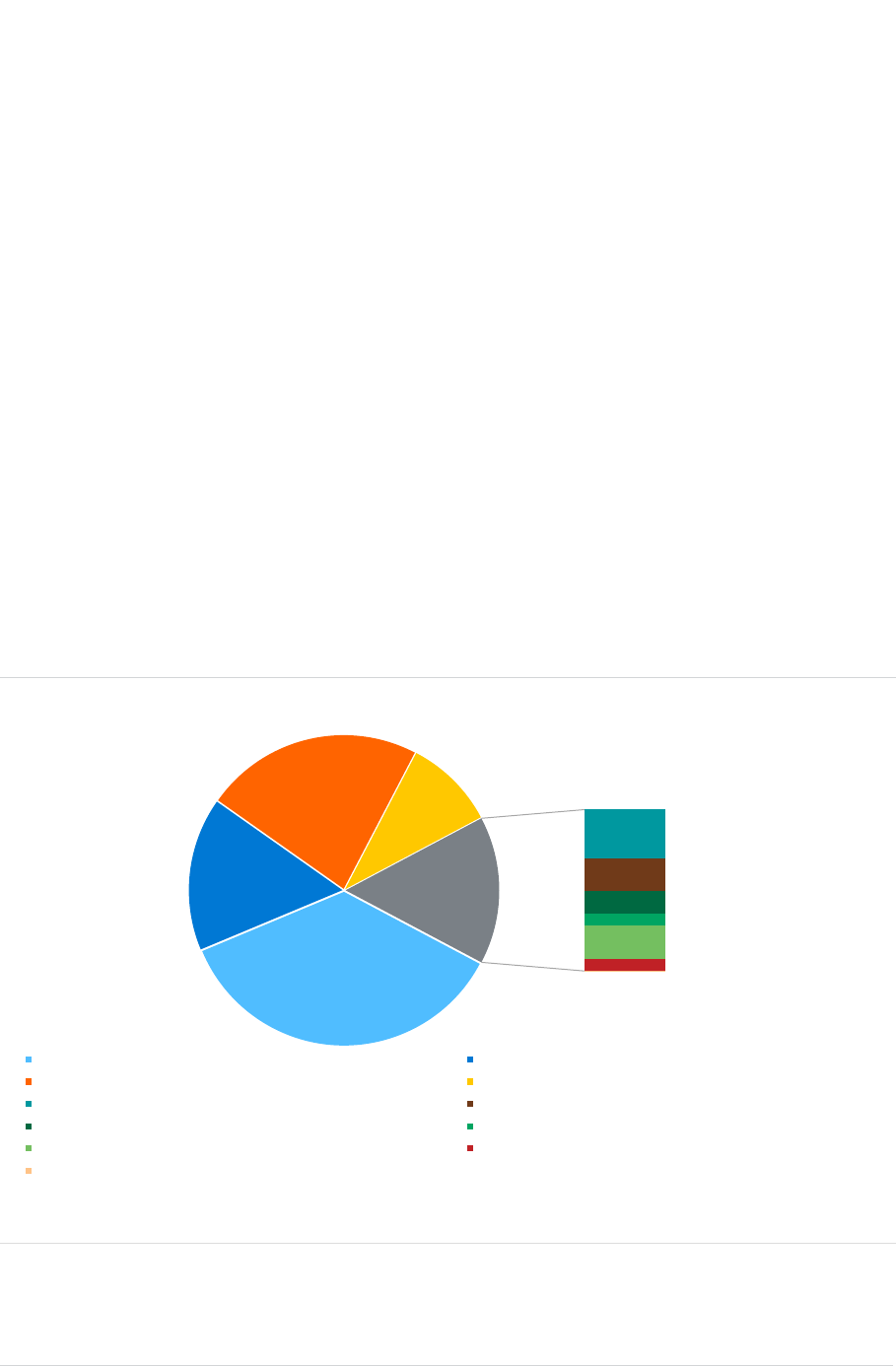

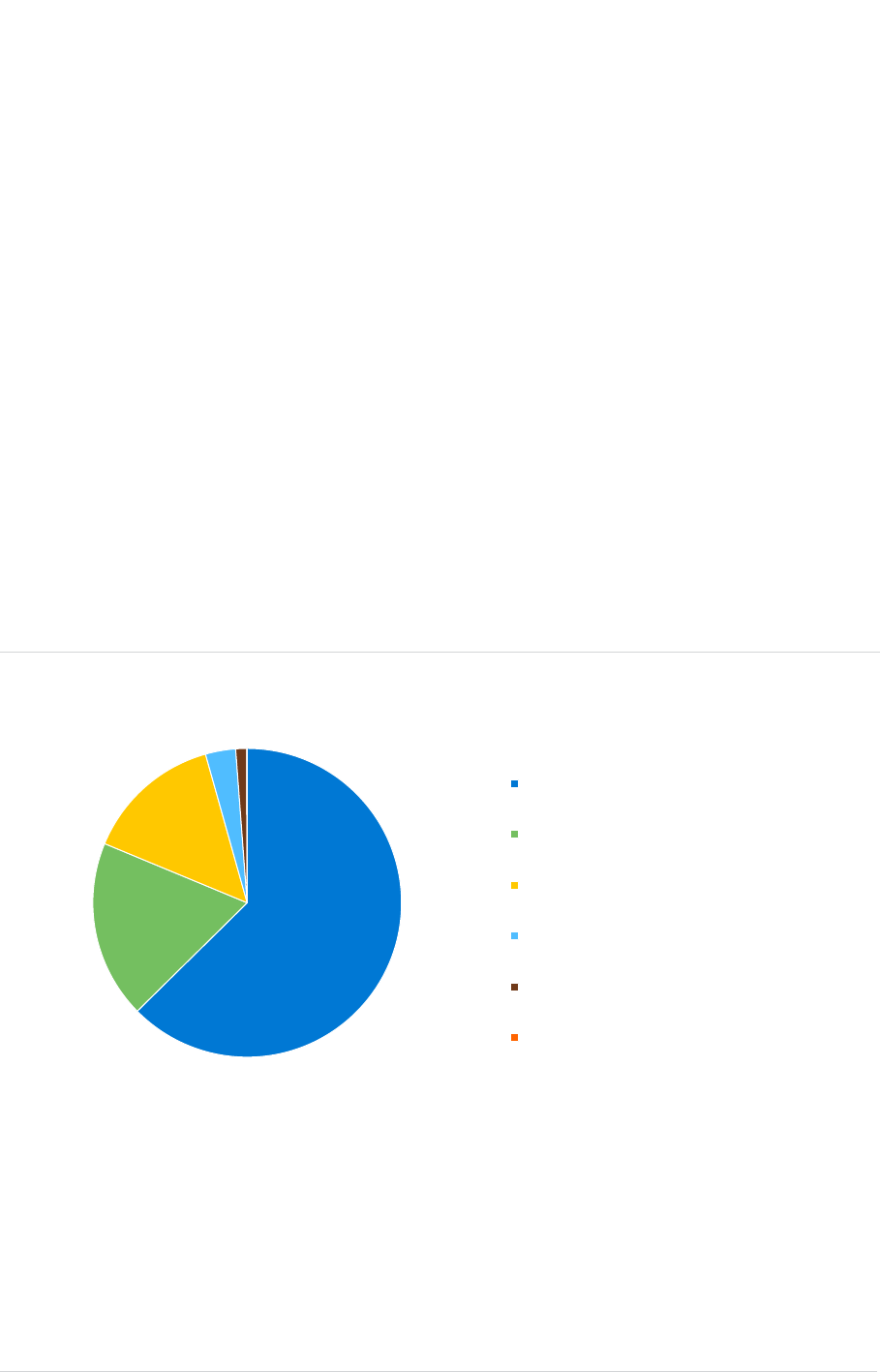

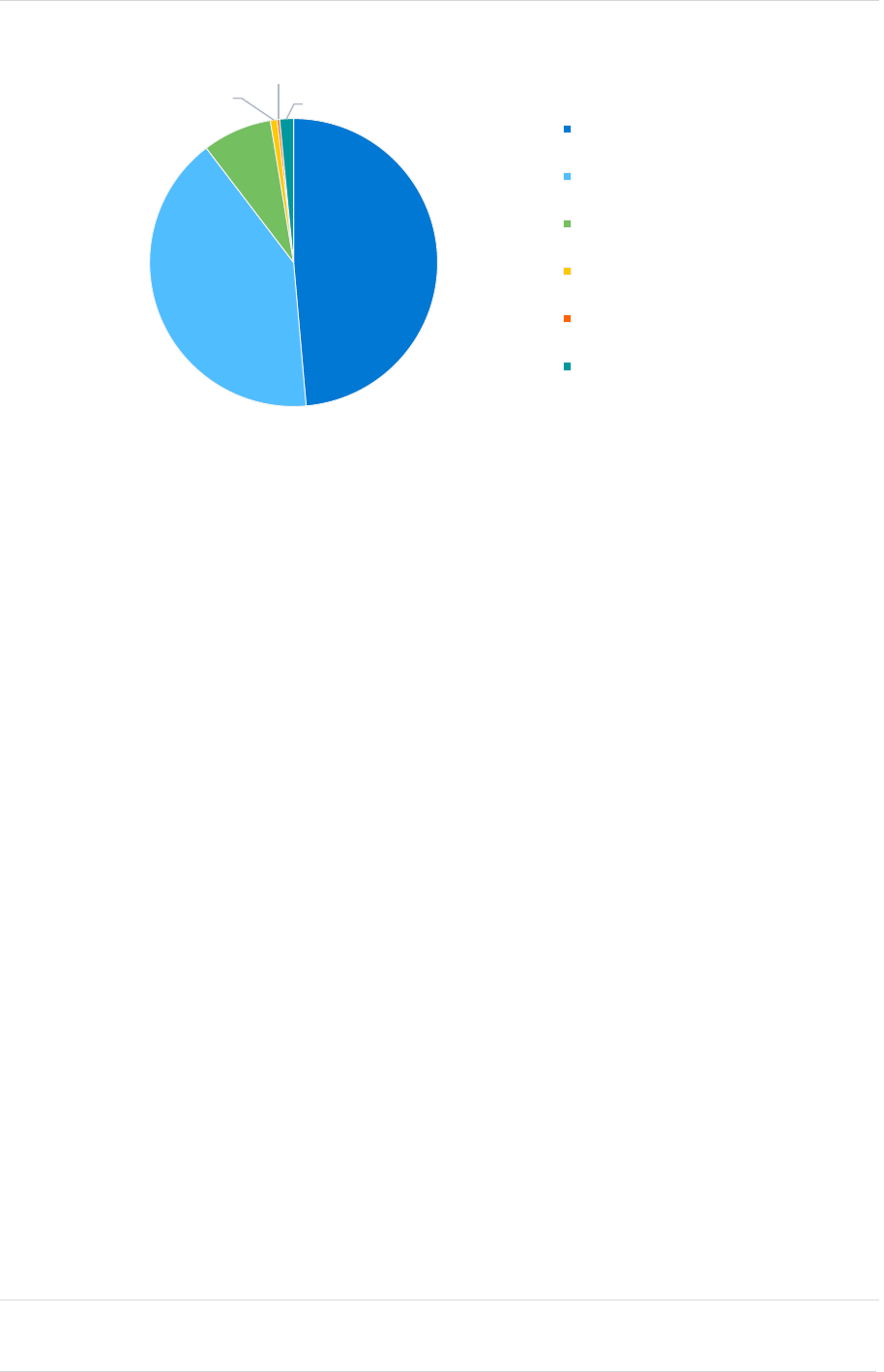

Figure 3 shows the split of TPs by line of business held by life insurers across European countries at year-end 2022.

FIGURE 3: SPLIT OF TECHNICAL PROVISIONS BY LINE OF BUSINESS ACROSS EUROPE

The TPs for many large European insurance markets including the Belgian, French, German and Italian markets

are dominated by ‘Insurance with Profit Participation,’ whereas in the markets of Ireland, Luxembourg and the UK

the TPs are predominantly in respect of ‘Index-linked (IL) and Unit-linked (UL) Insurance’ business. The markets

in the NOR, CEE and ROE also show similar dominance by these two lines of business. The dominant lines of

business in each of the nine largest markets as well as the NOR, CEE and ROE have remained unchanged

relative to year-end 2021 results.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IM IT LU NL UK NOR CEE ROE Europe

INSURANCE WITH PROFIT PARTICIPATION IL AND UL INSURANCE

OTHER LIFE INSURANCE ANNUITIES STEMMING FROM NON-LIFE INSURANCE

ACCEPTED REINSURANCE

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 7 September 2023

financial condition reports year-end 2022

As a result of this dominance, these two lines of business

represent the largest proportion of TPs across Europe on

average. In aggregate, across our sample of European

countries, ‘Insurance with Profit Participation’ makes up just

under half of the total TPs for life insurers (44%). ‘IL and UL

Insurance’ makes up the second-largest portion of TPs (43%).

‘Other Life Insurance’ (8%), which includes products such

as non-profit annuities and traditional protection business,

has the largest share of the market in only two of the

individual countries considered in our analysis: the

Netherlands and Spain.

‘Accepted Reinsurance’ (4%) makes up the bulk of the remaining TPs, whilst ‘Annuities Stemming from Non-Life

Insurance Contracts’ accounts for just over 0.02% of total TPs.

TPs in respect of ‘Health Similar to Life Techniques’ (HSLT) business have been excluded from Figure 3, as

these lines of business are very small on average across the sample of companies considered in the analysis.

Since the previous set of SFCRs was published, the market share of ‘Insurance with Profit Participation’ has

reduced by two percentage points whilst ‘Other Life Insurance’ has reduced by one percentage point. These

reductions have been met by an increase in the proportion of ‘IL and UL Insurance’ technical provisions of three

percentage points. This suggests a shift away from selling new ‘Insurance with Profit Participation’ and ‘Other Life

Insurance’ products towards ‘IL and UL Insurance’ products. This is a trend we have observed over the past few

years of our analysis, and it will be interesting to see if the proportion of ‘IL and UL Insurance’ overtakes that of

‘Insurance with Profit Participation’ in the future as this gap has been narrowing over the years of our analysis.

REINSURANCE

Figure 4 shows how the use of reinsurance varies across European countries at year-end 2022. The ceded rates

represent the difference in the best estimate liability (BEL) gross and net of reinsurance recoverables.

FIGURE 4: ANALYSIS OF USE OF REINSURANCE ACROSS EUROPE

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IM IT LU NL UK NOR CEE ROE Europe

RETAINED CEDED

44% OF TOTAL TPs

for European life insurers are

‘Insurance with

Profit Participation.’

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 8 September 2023

financial condition reports year-end 2022

On average, about 5.3% of the BEL is reinsured across Europe based on the companies in our sample which

also include reinsurers. This varies by country, with Luxembourg (15.0% of BEL reinsured), UK (12.3%) and

Ireland (10.4%) being the most reliant on reinsurance of the individual countries analysed. Overall, the

percentage of the BEL which is reinsured has decreased marginally since the last set of SFCRs were published,

with 5.5% of the BEL reinsured across European life insurers at year-end 2021. It is important to note that the

impact of reinsurance on the BEL may not always provide insight on the full impact of reinsurance on the

Solvency II balance sheet. For example, a longevity swap could potentially lead to a slight increase in the BEL

but will be offset by a larger impact on the solvency capital requirement (SCR) and risk margin.

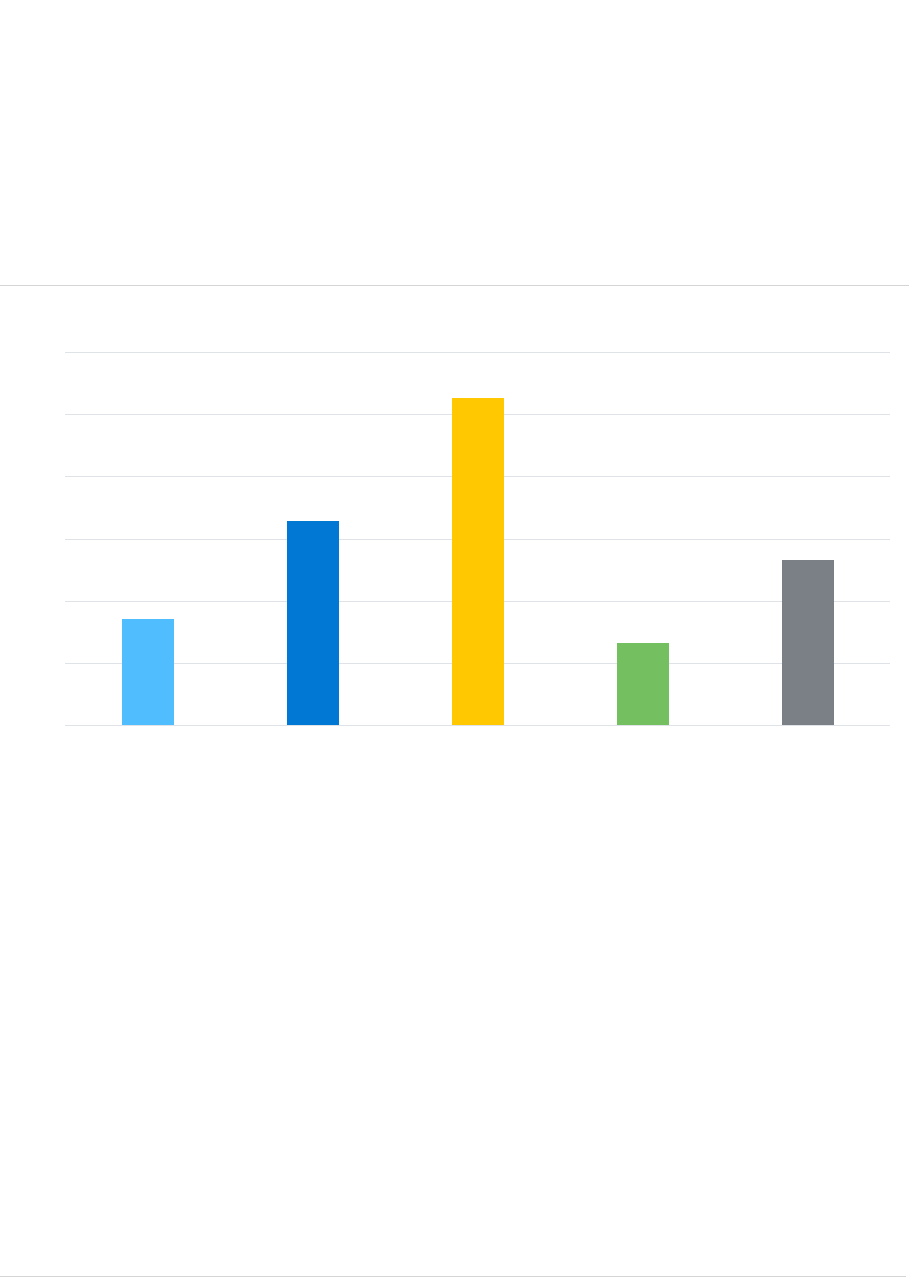

Figure 5 shows the proportion of BEL for each line of business which is ceded to reinsurers by European life insurers at

year-end 2022.

FIGURE 5: PERCENTAGE OF TECHNICAL PROVISIONS WITH REINSURANCE

The line of business with the highest ceded level of reinsurance is ‘Other Life Insurance’ at 10.6%. This is

considerably higher than the second-largest ceded percentage, which is 'IL and UL Insurance’ at 6.6%.

‘Insurance with Profit Participation’ and ‘Accepted Reinsurance’ reinsure 3.4% and 2.7%, respectively.

Overall, the European life insurance industry has life reinsurance recoverables of £347 billion (€392 billion)

across all life TPs in our sample. The results suggest a decrease in the proportion of life insurers’ BEL reinsured

over the year. In particular:

There was a 17% decrease in life reinsurance recoverables, which was bigger than the 15% decrease in the

GBP amount of life TPs over the year.

Considering the EUR figures, the life reinsurance recoverables have decreased from €498 billion to €392

billion, representing a decrease of 21%, whilst the life TPs have decreased from €9,237 billion to €7,514

billion, representing a decrease of 19%.

This result could be explained by the increases in long-term interest rates over the year.

3.4%

6.6%

10.6%

2.7%

5.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

INSURANCE WITH

PROFIT PARTICIPATION

IL AND UL INSURANCE OTHER LIFE

INSURANCE

ACCEPTED

REINSURANCE

TOTAL

On average,

of the BEL of life insurers

is

REINSURED ACROSS EUROPE

5.3%

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 9 September 2023

financial condition reports year-end 2022

Analysis of premiums, claims and expenses

GROSS WRITTEN PREMIUMS

When considering premium volumes related to new business written during 2022, we first looked at the figures

quoted by EIOPA in their published insurance statistics.

12

Comparing the life insurance GWP figures quoted by

EIOPA in 2022 (£572 billion/€646 billion) to those for 2021 (£594 billion/€707 billion)

13

we see that there has

been a decrease in both euro (EUR) and British pound sterling (GBP) denominated premium levels relative to

last year. The movement in EUR is larger due to the weakening of GBP against EUR, with the exchange rate

GBP:EUR decreasing from 1.19 to 1.13 over the year. Comparing the EIOPA figures to our sample shows that

around 82% of all life insurance GWP reported by EIOPA in 2022 is captured within our sample. This is a small

reduction when compared to our year-end 2021 analysis which covered around 84% of GWP reported by EIOPA.

It is perhaps unsurprising that the overall volume of GWP decreased in 2022 given the geopolitical tensions and

uncertain economic environment despite companies and markets recovering from the COVID-19 pandemic.

However, some markets such as Denmark and Spain saw an overall increase in the life insurance GWP

compared to 2021 in our analysis:

In Spain, the increase is driven predominantly by the increase in GWP of one large life insurer who sold

larger volumes of ‘IL and UL Insurance’ and ‘Other Life Insurance’ compared to the previous year. The

increase was also driven by one firm who was included in our analysis at year-end 2022 but not for year-end

2021 due to QRT data being unavailable at the time of drafting last year’s report.

In Denmark, this increase is driven predominantly by two firms which were included in our analysis at year-end

2022 but not for year-end 2021 due to missing QRT entries leading to us not being able to analyse these firms.

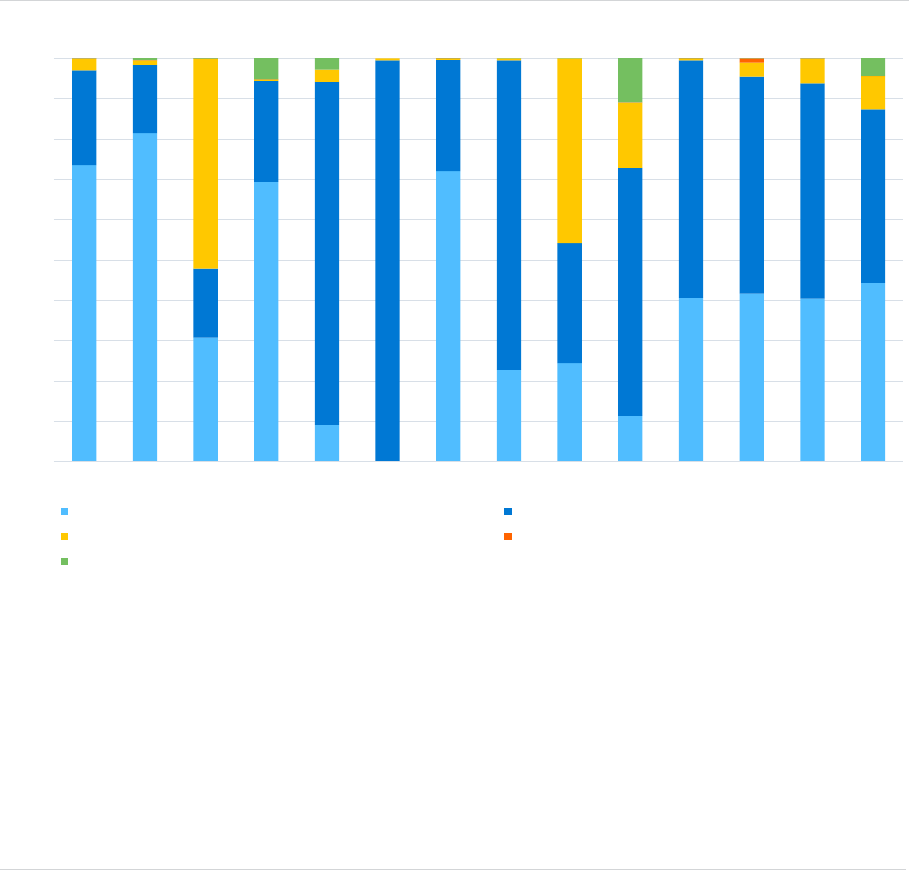

Figure 6 shows the split of GWP by line of business held by life insurers across European countries at year-end

2022 based on our analysis. GWP includes premiums payable on in-force business and on any new business

sales over the reporting period.

FIGURE 6: SPLIT OF GROSS WRITTEN PREMIUMS BY LINE OF BUSINESS ACROSS EUROPE

12

Insurance statistics. EIOPA. Retrieved on September 7, 2023, from https://www.eiopa.europa.eu/tools-and-data/insurance-statistics_en.

13

Note that due to the UK’s exit from the EU, EIOPA’s figures for 2021 and 2022 did not include information on the UK.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IT LU NL UK NOR CEE ROE Europe

INSURANCE WITH PROFIT PARTICIPATION INDEX-LINKED AND UNIT-LINKED INSURANCE

OTHER LIFE INSURANCE LIFE AND HEALTH REINSURANCE

HEALTH INSURANCE ANNUITIES STEMMING FROM NON-LIFE INSURANCE CONTRACTS

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 10 September 2023

financial condition reports year-end 2022

The split of premium volumes by line of business is slightly different from the split of TPs shown in Figure 3. On

average across our entire sample, ‘IL and UL Insurance’ (48%) and ‘Insurance with Profit Participation’ (29%)

make up the largest portions of premium volumes. This contrasts with the split of TPs where ‘Insurance with

Profit Participation’ has the largest share of the market, closely followed by ‘IL and UL Insurance.’ This was also

noted in our previous report, where it was suggested that ‘IL and UL Insurance’ was likely to increase its share of

the market going forward due to higher premium volumes being sold in this category compared to ‘Insurance with

Profit Participation.’ This conclusion aligns with the decrease in the proportion of TPs categorised as ‘Insurance

with Profit Participation,’ and the increase in ‘IL and UL Insurance’ since year-end 2021.

When comparing to the year-end 2021 SFCRs, the proportion of GWP attributable to ‘Insurance with Profit

Participation’ has remained relatively stable at 29%, whilst there has been an overall decrease in the proportion

attributable to ‘IL and UL Insurance’ (50% at year-end 2021; 48% at year-end 2022). In our last few years of

reports, we noted that firms were promoting ‘IL and UL Insurance’ over ‘Insurance with Profit Participation’ due to

the sustained low interest rate environment and the effect this has on the ability to declare future bonuses.

Therefore, the rise in interest rates across Europe over the past year may explain at least some of the change in

trend. A decrease in the proportion of ‘IL and UL Insurance’ GWP and counteracting increase in the proportion of

‘Insurance with Profit Participation’ GWP is particularly apparent in NOR.

The Spanish market is an outlier when looking at the split of GWP, with ‘Other Life Insurance’ making up the

highest proportion in this country. The Netherlands also shows a high proportion of ‘Other Life Insurance.’ This is

consistent with the results seen in our TP analysis. ‘Other Life Insurance’ has been the dominant line of business

in Spain and the Netherlands in past years of our analysis and includes predominantly traditional insurance

products such as endowments, pure endowments, annuities and term life insurance where these have no profit

sharing or linked elements. It is only in the year-end 2022 SFCRs that we have observed the Netherlands having

a slightly higher proportion of ‘IL and UL Insurance’ GWP.

Overall, the breakdown for each of the markets remains relatively consistent when compared to our year-end

2021 analysis of SFCRs.

INCURRED CLAIMS

We conducted a similar analysis of claim volumes incurred for 2022 as that carried out for premiums. Comparing

the life insurance claim figures quoted by EIOPA in 2022 (£489 billion/€552 billion) to those for 2021 (£478

billion/€568 billion) we can see that there has been a slight increase in GBP-dominated claim levels but decrease

in euro-dominated claim levels. This differing movement in currency is again due to the weakening GBP against

EUR over the year.

This means that premiums have reduced whilst claims have increased on a GBP basis, and premiums have

reduced to a greater extent than claims on a euro basis, further highlighting a lack of growth in the industry over

the past year.

Figure 7 shows the split of incurred claims by line of business held by life insurers across Europe based on our

2022 sample, which covered around 85% of claims reported by EIOPA.

‘INDEX-LINKED AND UNIT-LINKED INSURANCE’

account for the largest volume of gross written premiums

48%

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 11 September 2023

financial condition reports year-end 2022

FIGURE 7: SPLIT OF CLAIMS INCURRED BY LINE OF BUSINESS ACROSS EUROPE

The split of claim volumes by line of business does show a similar pattern to the split of GWP shown in Figure 6,

with ‘IL and UL Insurance’ (42%) making up the largest portion of claim volumes across our entire sample.

However, this does display a smaller proportion to the 48% of GWP that is classed under this line of business.

This could provide evidence for the fact that the ‘IL and UL Insurance' market is growing in the long term with

new business being written despite the high interest rate environment we are currently experiencing. In contrast,

the proportions of claims incurred attributable to ‘Insurance with Profit Participation’ (39%) is higher than the 29%

of GWP indicating that ‘Insurance with Profit Participation’ business may be retracting, with claims on with-profit

business exceeding the premiums coming in due to less business being written than serviced.

This pattern was particularly prevalent in certain countries:

As mentioned previously, the French market is dominated by ‘Insurance with Profit Participation’ both in

terms of liabilities and premiums. However, 32% of GWP were classified as ‘IL and UL Insurance,’ whereas

this business line only made up 15% of claims. Comparatively, 46% of GWP were classified as ‘Insurance

with Profit Participation’ compared to the much higher 69% of claims falling under this title. This indicates

that with-profit business is contributing a larger proportion of claims in France than the premiums which it

provides. This may suggest a change in France to move towards ‘IL and UL Insurance.’

Luxembourg classifies 71% of GWP as ‘IL and UL Insurance,’ whereas this business line only makes up

47% of incurred claims. Comparatively, 20% of GWP were classified as ‘Insurance with Profit Participation’

compared to the much higher 47% of claims falling under this business line. This indicates that firms within

Luxembourg are continuing to make a move towards writing more ‘IL and UL insurance’ business as sales

continue to fall for ‘Insurance with Profit Participation’ business.

The proportions of claims incurred attributable to other lines of business are, meanwhile, relatively similar to the

proportions of GWP. The proportions of claims incurred under ‘Other Life Insurance,’ ‘Life and Health

Reinsurance’ and ‘Health Insurance’ were 9%, 6% and 4%, respectively, whilst the equivalent GWP proportions

were 12%, 7% and 5%. The proportions of both claims incurred and GWP under ‘Annuities’ were less than 0.2%.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IT LU NL UK NOR CEE ROE Europe

INSURANCE WITH PROFIT PARTICIPATION INDEX-LINKED AND UNIT-LINKED INSURANCE

OTHER LIFE INSURANCE LIFE AND HEALTH REINSURANCE

HEALTH INSURANCE ANNUITIES STEMMING FROM NON-LIFE INSURANCE CONTRACTS

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 12 September 2023

financial condition reports year-end 2022

EXPENSES

When considering the expenses incurred by the firms within our sample, we found the absolute amount increased over

the year from £66.0 billion in 2021 to £66.5 billion in 2022, representing a small increase of approximately 1%. This is

despite total assets falling by around 11% since year-end 2021 and a reduction in our overall sample size. This result is

likely driven by the high inflation environment leading to increased expenses for most insurers. These movements

combined resulted in an increase to expenses as a percentage of assets from 0.7% to 0.8%.

For countries in our sample, expenses as a percentage of assets (expense ratio) range from 0.3% to 10.2%.

demonstrating that on average firms do not tend to incur expenses of more than 10% of the assets they hold. The

country with the largest proportion of expenses to assets was Iceland hosting a ratio of 10.2%. Our sample for

Iceland only contains two firms with ratios of 10% and 11%, respectively. The CEE region also contained

countries with high average expenses compared to assets with a ratio of 4.4%. The firms with the largest

expense ratios tend to be the smallest companies as they are not benefitting from economies of scale.

In comparison, the largest markets and the Nordics managed to maintain low expenses ratios, with Denmark and

Norway having the lowest average level at 0.3%.

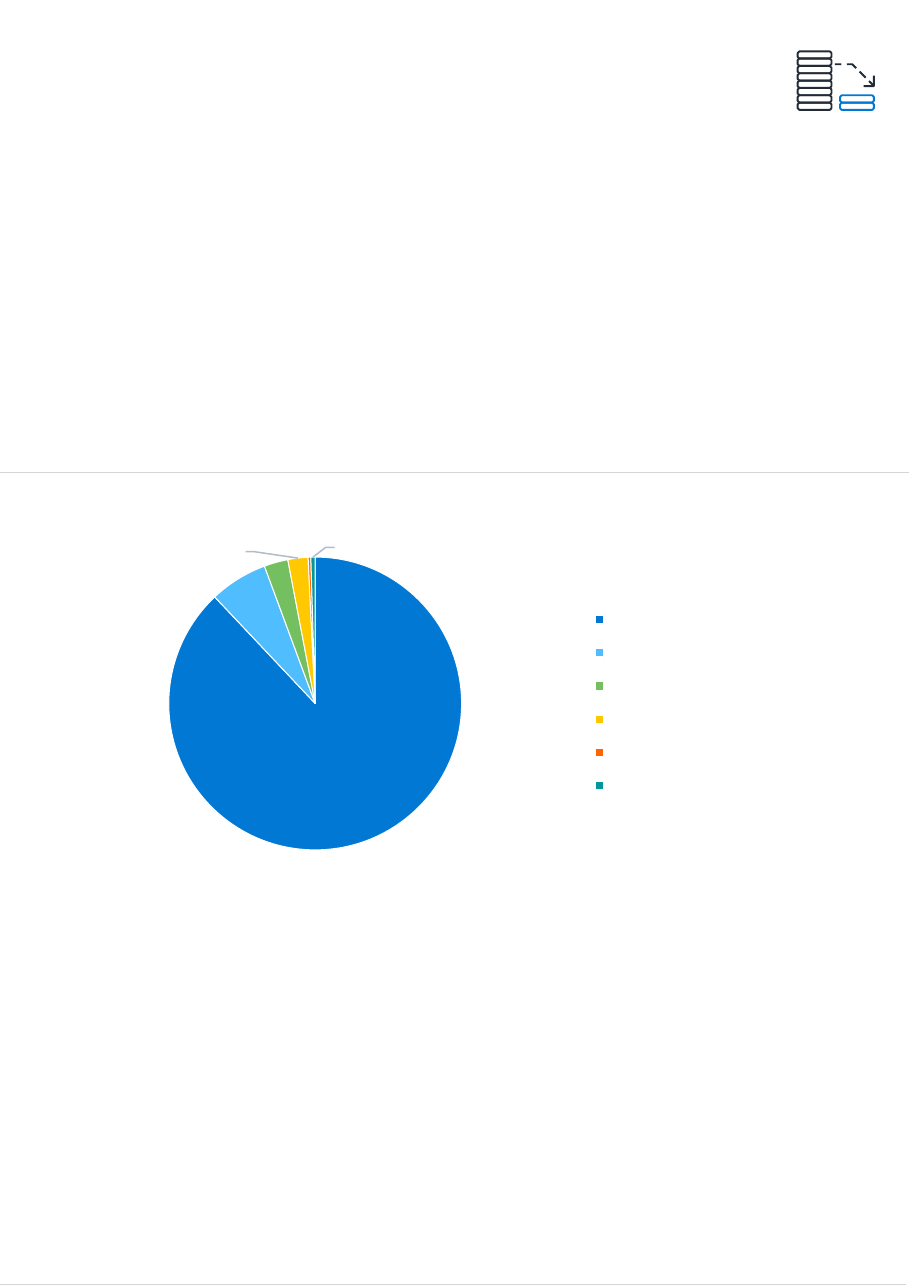

Analysis of own funds

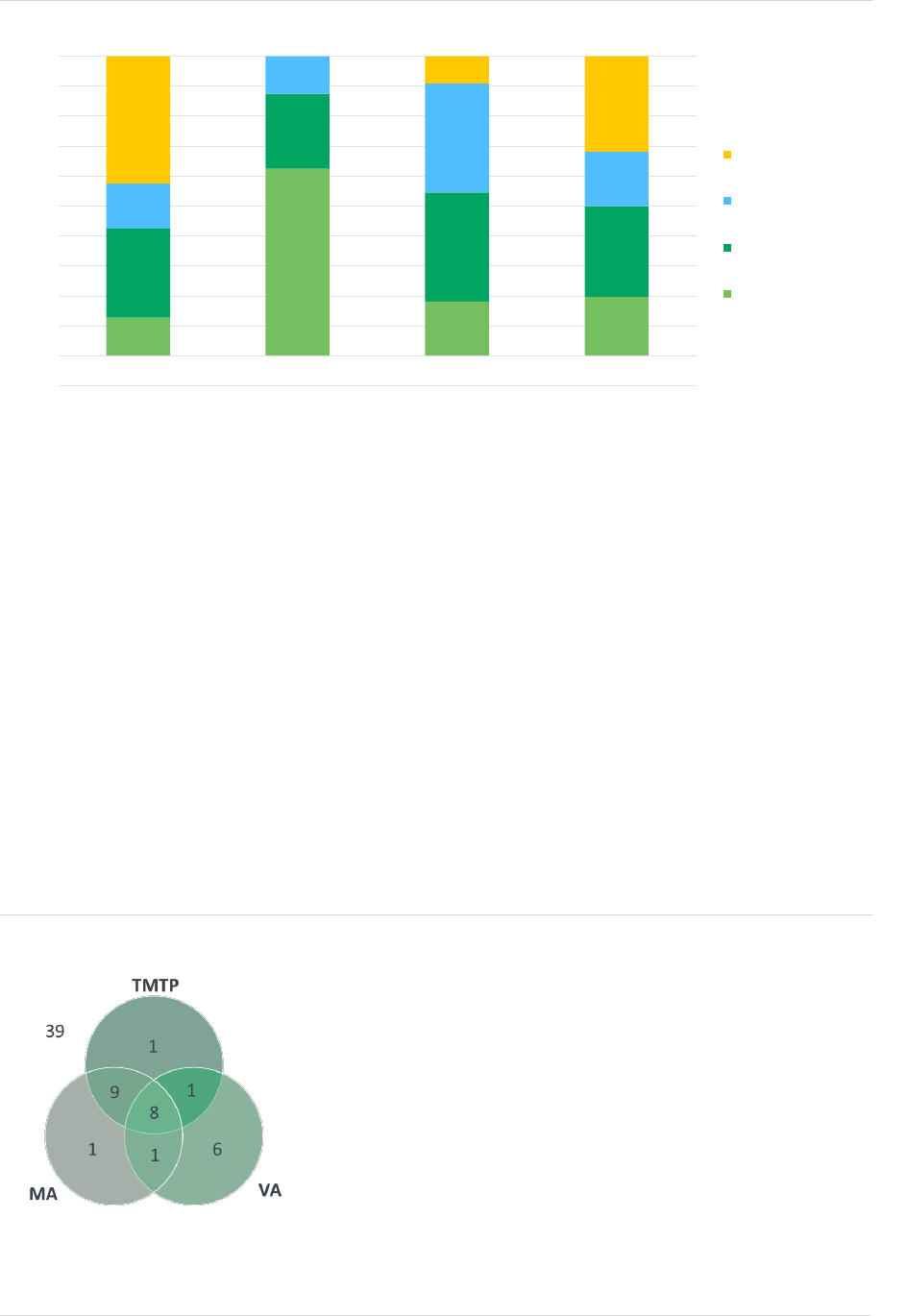

Figure 8 shows the split of own funds across European countries at year-end 2022.

FIGURE 8: SPLIT OF OWN FUNDS ACROSS EUROPE

The majority of own funds (91%) held by EU

life insurers in our sample are classified as tier

1 unrestricted own funds. This is the highest

form of capital in terms of quality and loss

absorbency as defined under Solvency II.

Whilst the split of own funds varies by country,

in general the majority of European insurers

have a very high proportion of tier 1

unrestricted own funds, with all countries

reporting at least three quarters

14

of their own

funds as tier 1 unrestricted.

Tier 1 restricted own funds make up 2% of own funds on average across Europe. Tier 2 own funds make up 6%

of total own funds, and tier 3 own funds make up just 1% of total own funds on average.

14

The lowest proportion of tier 1 unrestricted own funds was observed in Norway (77%).

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IM IT LI LU NL UK NOR CEE ROE Europe

TIER 1 - UNRESTRICTED TIER 1 - RESTRICTED TIER 2 TIER 3

91% OF OWN FUNDS held by

European life insurers are

UNRESTRICTED TIER 1

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 13 September 2023

financial condition reports year-end 2022

Belgium and France have the highest proportion of tier 2 own funds when compared to other large European

countries, with tier 2 own funds accounting for 11% of total own funds in Belgium and 9% in France. The tier 2

own funds are primarily in respect of hybrid debt and subordinated loans in these markets.

Tier 3 own funds are held predominantly in the Netherlands, the UK and France, which together account for 79%

of all tier 3 own funds. Net deferred tax assets remain the main item categorised as tier 3 own funds in the Dutch

market, the large amount likely as a result of the combination of relative high interest guarantees given in the

past, combined with the long duration and tax rate. Approximately 80% of tier 3 own funds in the French market

is attributable to three firms which classify some of their subordinated liabilities as tier 3 own funds.

Although it cannot be seen individually on the chart, Norway is an outlier when it comes to the breakdown of own

funds by tier. Norwegian firms report 19% as tier 2, compared to the European average of 6%. Subordinated

liabilities are the major driver of the high levels of tier 2 own funds in Norway. In particular, Storebrand

Livsforsikring AS took out a subordinated loan of approximately £153 million in the fourth quarter of 2022, which

has been classified as tier 2 own funds to refinance another subordinated loan, as a result of early repayment.

There has been, overall, little change in the breakdown of own funds by tier when compared to year-end 2021

SFCRs, with a decrease in the total absolute amount of own funds of around 7%. This is driven mainly by a

decrease of 8% in restricted tier 1 own funds and a decrease of 10% in unrestricted tier 1 own funds, due to tier 1

being the dominant form of capital in the reported own funds. The absolute amount of tier 3 own funds has,

however, increased by 29% since our year-end 2021 analysis, indicating that some companies have

reconsidered their capital structures over 2022.

Analysis of solvency coverage

Figure 9 shows the weighted average solvency coverage ratios

15

for the solvency capital requirement (SCR) and

the minimum capital requirement (MCR) across European countries.

FIGURE 9: SOLVENCY COVERAGE RATIOS BY COUNTRY

Overall, the average solvency coverage ratios for European life insurers are more than double the Solvency II

requirement, with the weighted averages significantly in excess of the required solvency coverage ratio of 100%

in all the regions considered. The European average SCR coverage ratio is 244% based on the companies

included in our sample (an increase from the 240% observed at year-end 2021). Some countries in our sample

saw an increase in the weighted average solvency coverage in their market whereas others saw a decrease. The

largest increases were noted in Germany (+70% versus year-end 2021), UK (+26%), ROE (+27) and

Luxembourg (+19%). In Germany, this increase was predominantly driven by some of the largest firms seeing

significant decreases in solvency capital requirements over the year relative to smaller decreases in, or even

increases in, the firms’ eligible own funds over the same period. However, we do also note that part of the

increase could be caused by differences in the sample for Germany as companies were included this year which

were not included last year with relatively high solvency ratios. The addition of these firms has contributed +10%

to the average solvency coverage in Germany. The increase in UK is also driven by SCRs on average

decreasing by more than own funds over the year.

15

The weighted average solvency coverage ratios are calculated as the sum of all eligible own funds for all companies within our sample in a

given region divided by the sum of all the SCRs.

BE

DE

ES

FR

IE

IT

LU

NL

UK

NOR

CEE

ROE

Europe

RATIO OF

ELIGIBLE

OWN

FUNDS

TO SCR

199%

507%

241%

237%

197%

238%

178%

197%

189%

219%

221%

264%

244%

RATIO OF

ELIGIBLE

OWN

FUNDS

TO MCR

405%

1168%

668%

549%

508%

518%

445%

445%

601%

705%

620%

787%

634%

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 14 September 2023

financial condition reports year-end 2022

The regions that saw the largest decreases in SCR coverage ratio over the year were NOR (-39%) and Spain

(-14%). In NOR, this decrease was driven by a large overall increase in SCR compared to a relatively stable own

funds. There was a 20% increase to SCR in NOR, whilst there was a 2% increase in own funds. The country

which contributed most to the overall SCR coverage decrease for NOR was Sweden which saw an increase in

SCR over the year and a concurrent decrease in own funds.

The increase in solvency coverage between year-end 2021 and year-end 2022 may not have been predictable

given the changing economic environment over the past year. In general, this resulted from larger decreases in

SCR compared to own funds, leading to a stronger solvency position. This, in part, was driven by interest rates

rising over the year resulting in higher levels of discounting on both the asset and liability sides of the balance

sheet.

The average MCR coverage ratio for year-end 2022 is 634%. This has moved similarly to the SCR coverage ratio

over the year, increasing from 613%.

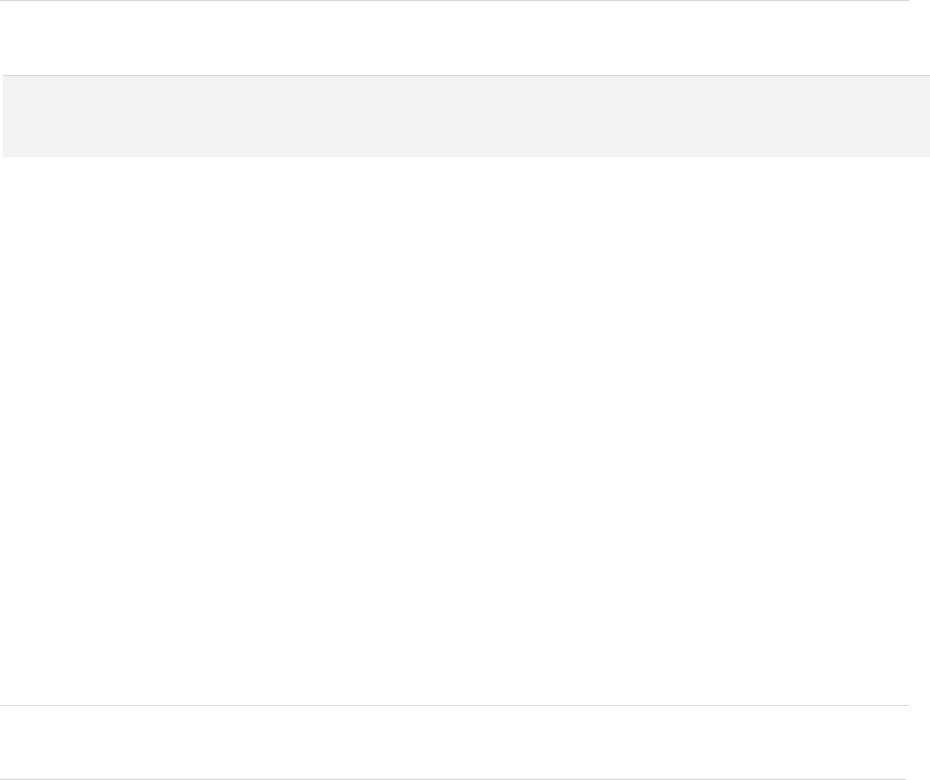

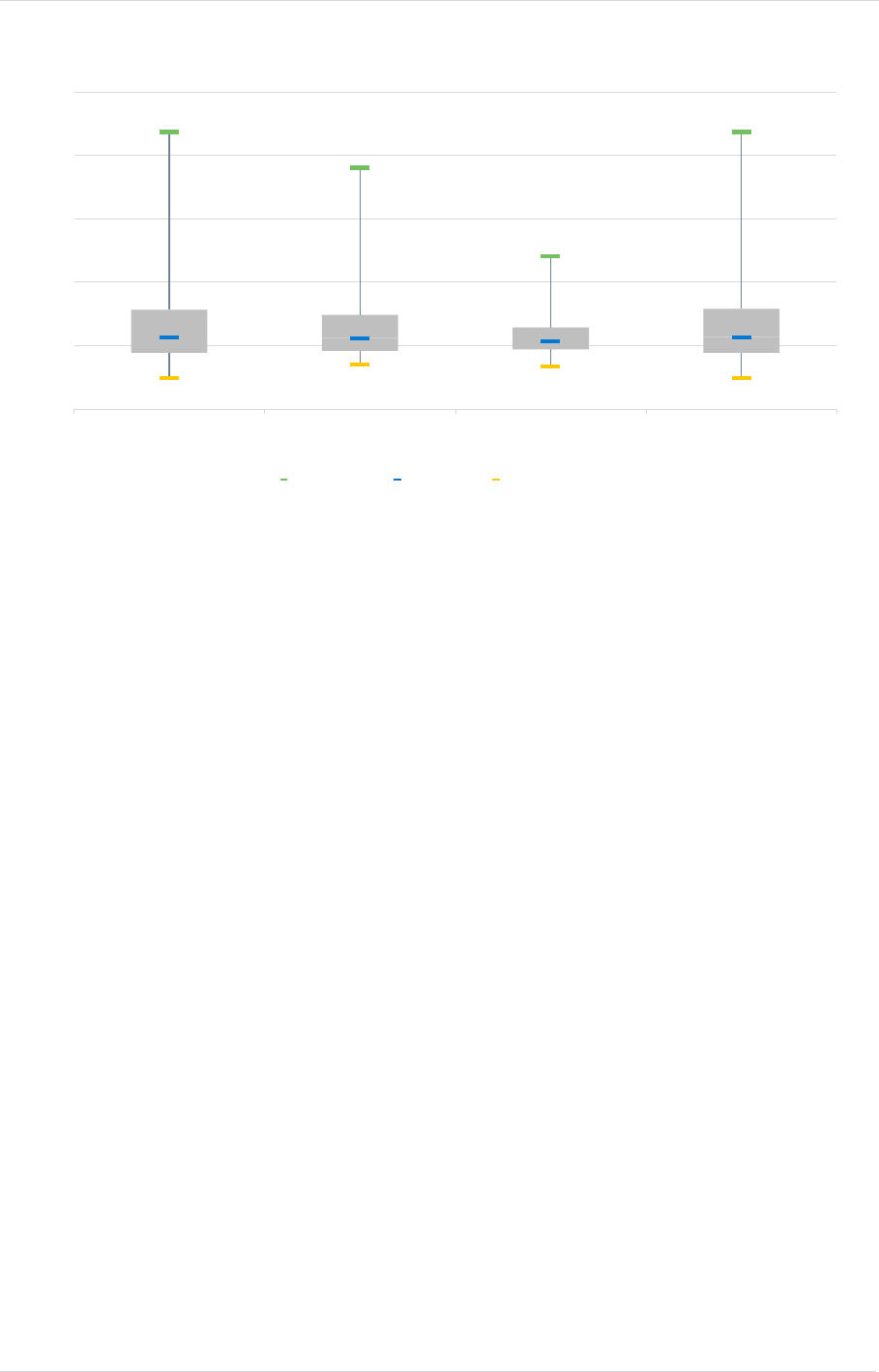

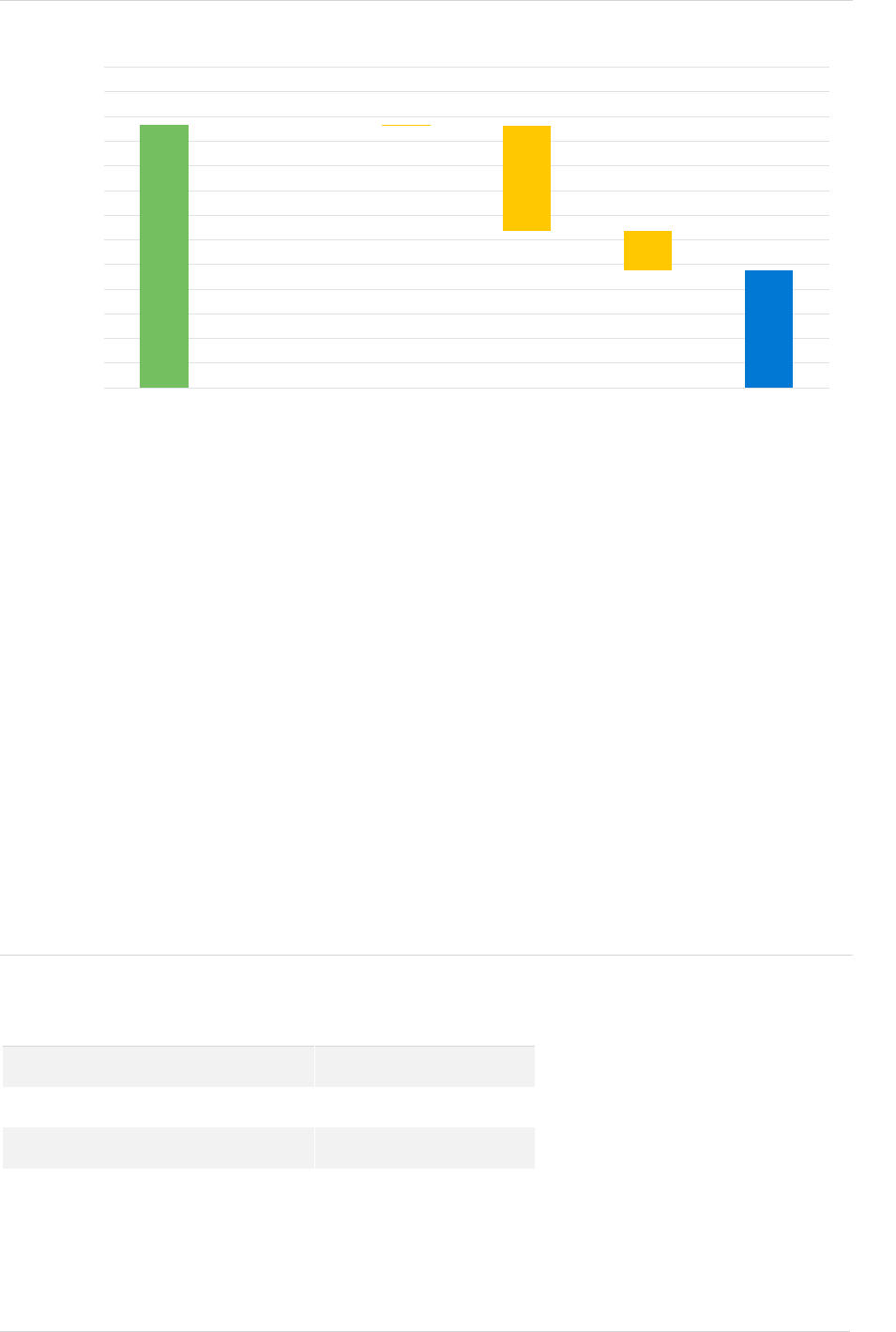

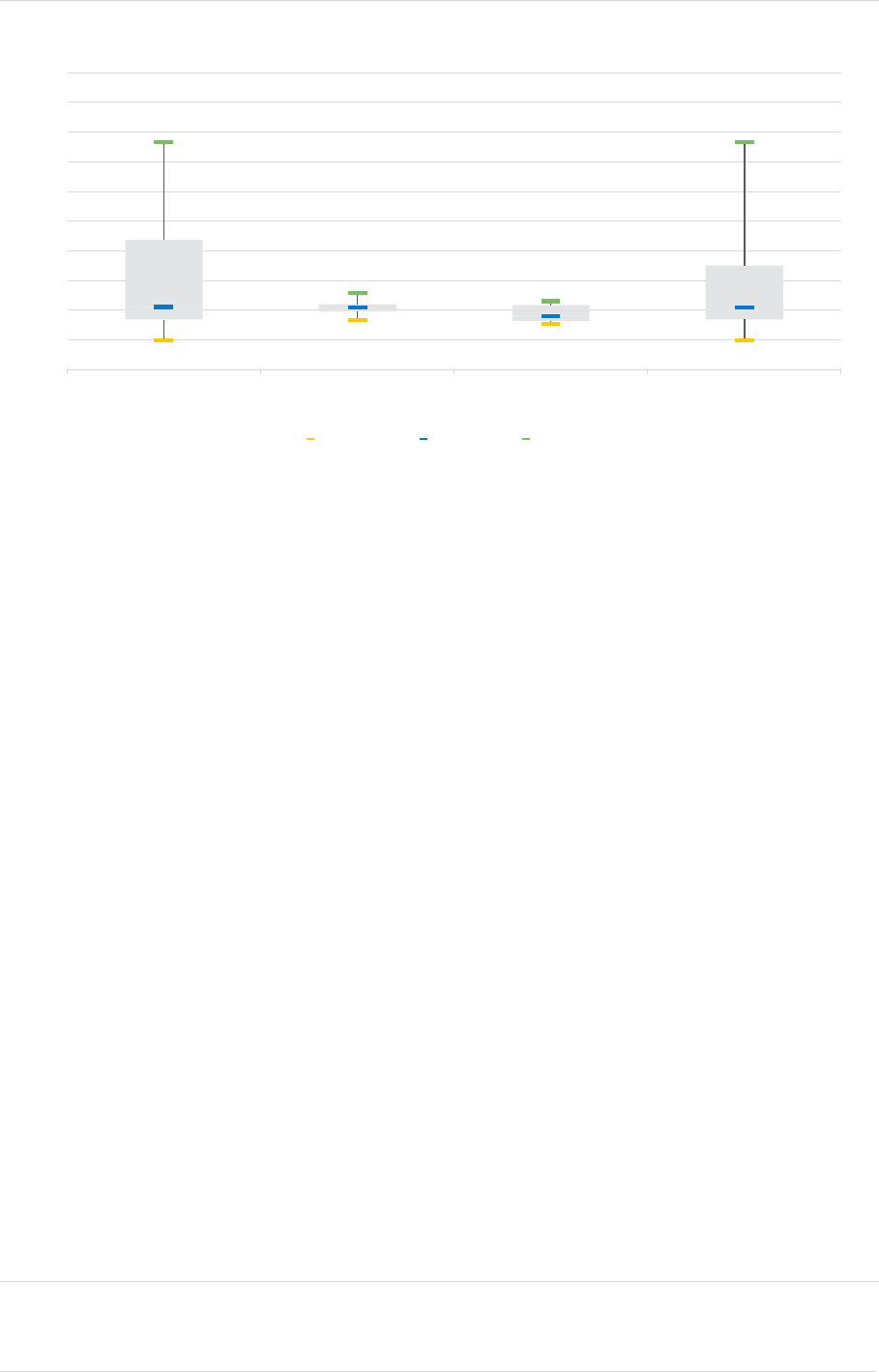

Figure 10 shows the distribution of the SCR coverage ratio by country at year-end 2022. The chart shows the

maximum coverage ratio in green, the minimum in orange and the median in blue. The median is a different

average measure from the weighted average solvency coverage used in Figure 9, and consequently the two

values will not necessarily be the same for each jurisdiction.

FIGURE 10: DISTRIBUTION OF SCR COVERAGE RATIO BY COUNTRY

16

Figure 10 shows that, for most countries, the distribution of SCR coverage ratios has a wide range, although this

does depend on the number of life insurers included in the analysis for each country. The largest ranges are seen

in the UK, France and Germany, where the number of companies included in our analysis is high. The full ranges

cannot be seen on the chart due to the SCR coverage ratios over 1,000% being excluded.

Germany has the highest median solvency coverage ratios in Europe at 587%. The second highest is Finland at

302% (included in NOR), followed by Denmark (also included in NOR) with the third highest at 281%.

16

Note that we have excluded companies where the SCR coverage ratio exceeded 1,000% to allow the chart to be more readable. This excluded

nine companies in the UK, 11 in Germany, one in France and one in the Netherlands.

0%

100%

200%

300%

400%

500%

600%

700%

800%

900%

1000%

BE DE ES FR IE IT LU NL UK NOR CEE ROE Europe

MINIMUM MEDIAN MAXIMUM

244%

The average European SCR coverage ratio

for year-end 2022 is

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 15 September 2023

financial condition reports year-end 2022

Based on the life companies included in our analysis, there was one Spanish insurer with an SCR coverage ratio

below 100% at year-end 2022.This situation has been caused mainly by the non-application of the firm’s TMTP

as a result of the sharp rise in market rates.Due to the reported ratio being below 100%, the entity is drawing up a

plan that allows it to recover its solvency level in the short and medium term in accordance with its risk appetite

level.

The second lowest SCR coverage ratio was 100% in respect of one company in the UK, which also reported

100% SCR coverage at year-end 2021. This is due to the company’s own funds being restricted by ring-fenced

fund restrictions such that the company’s own funds equal its SCR. All other firms in our analysis reported an

excess of own funds over their SCR.

Figure 10 shows a maximum SCR coverage ratio of 1,000% in the markets where the highest solvency coverage

is in excess of this. This means that the chart excludes 22 companies which reported SCR coverage ratios in

excess of 1,000% (nine in the UK, eleven in Germany, one in France and one in the Netherlands). The highest of

these companies was from the UK, and it reported an SCR coverage ratio of 4,051%. It should be noted that the

majority of firms with SCR coverage ratio over 1,000% are very small.

The range of the SCR coverage ratios is comparable to that seen in the 2021 year-end SFCRs, and there was a

small overall increase in the median solvency coverage from 221% to 225%.

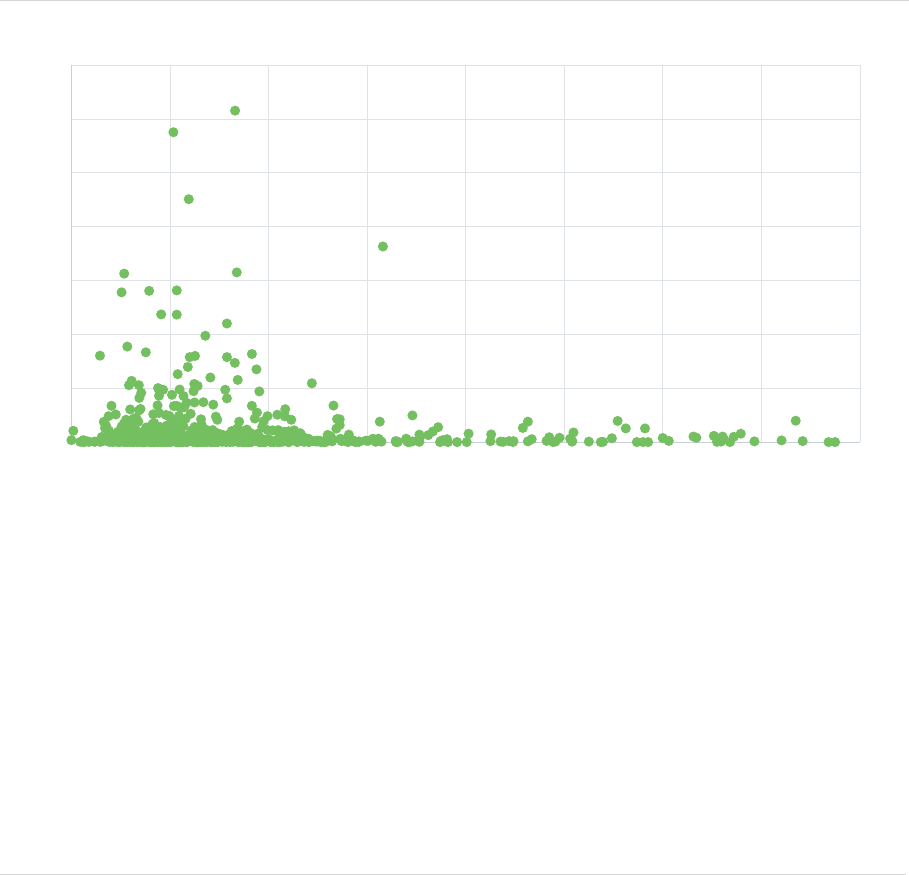

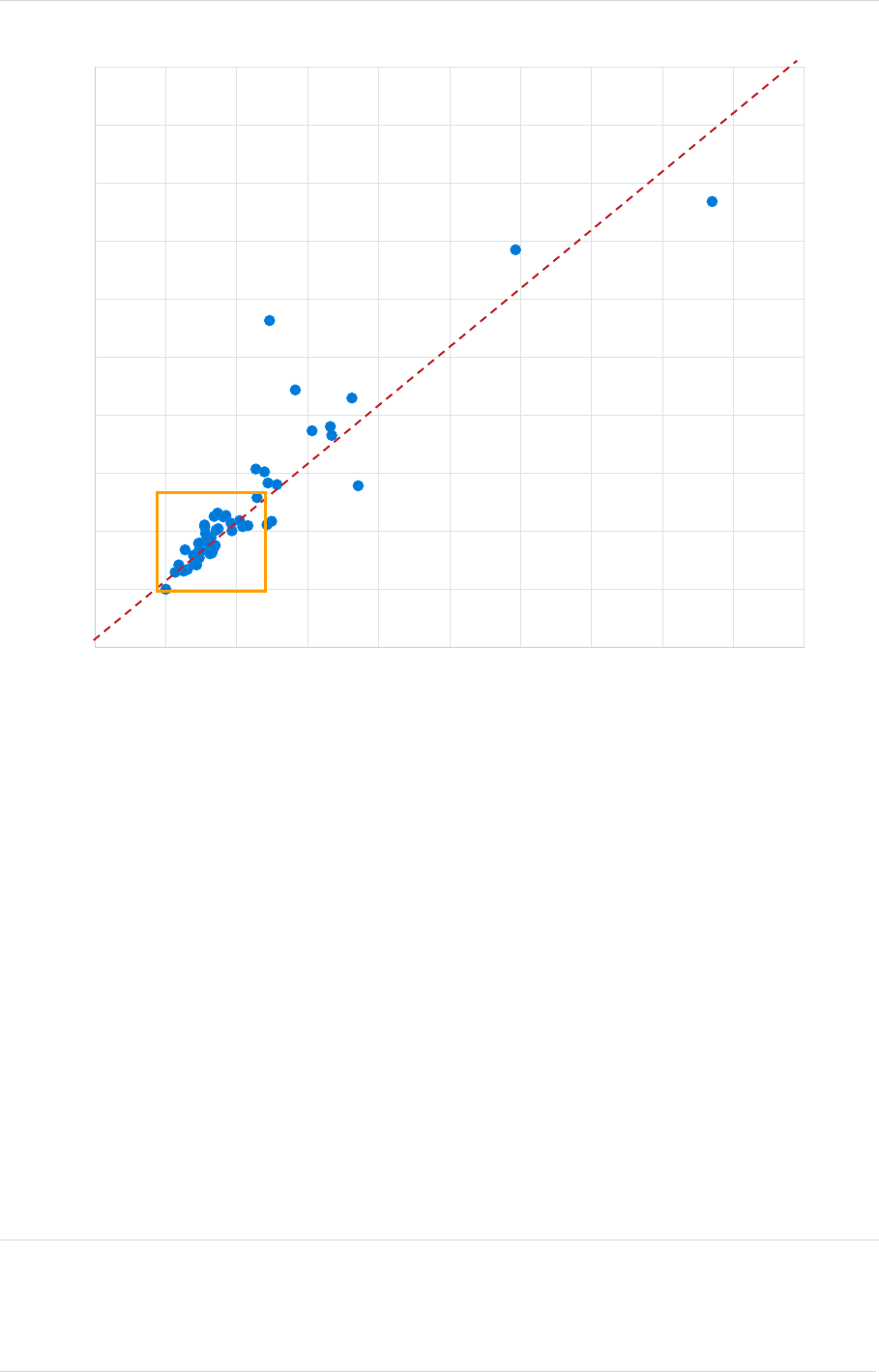

Figure 11 demonstrates the relationship between SCR coverage ratio and SCR size using a scatterplot. Each

point on the scatterplot represents an insurance company. Our whole sample of firms have been included with

the exception of the 22 firms noted above which reported SCR coverage ratios in excess of 1,000%.

FIGURE 11: RELATIONSHIP BETWEEN SCR SIZE AND SCR COVERAGE RATIO

The graph does not precisely display a negative correlation between size of the SCR and SCR coverage ratio;

however it does demonstrate that the firms with the highest SCR coverage ratios typically have smaller SCRs

and therefore are more likely to be smaller firms. Small insurance companies may have small SCRs due to

various factors associated with their size and scale of operations, including benefitting from simpler risk profiles

and lower regulatory requirements resulting from waivers and exemptions. In reality, for very small companies

their reported coverage ratio might be constrained by the absolute minimum capital requirement (AMCR) if this is

larger than their SCR.

Similarly, firms with the largest SCRs tend to have lower SCR coverage ratios, indicating that they likely manage

their capital more closely to an agreed level. Allianz Lebensversicherungs-AG was the only firm to have an SCR

above £1 billion and a coverage ratio above 400%.

0

2

4

6

8

10

12

14

100% 200% 300% 400% 500% 600% 700% 800% 900%

SCR (£ BILLIONS)

SOLVENCY COVERAGE

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 16 September 2023

financial condition reports year-end 2022

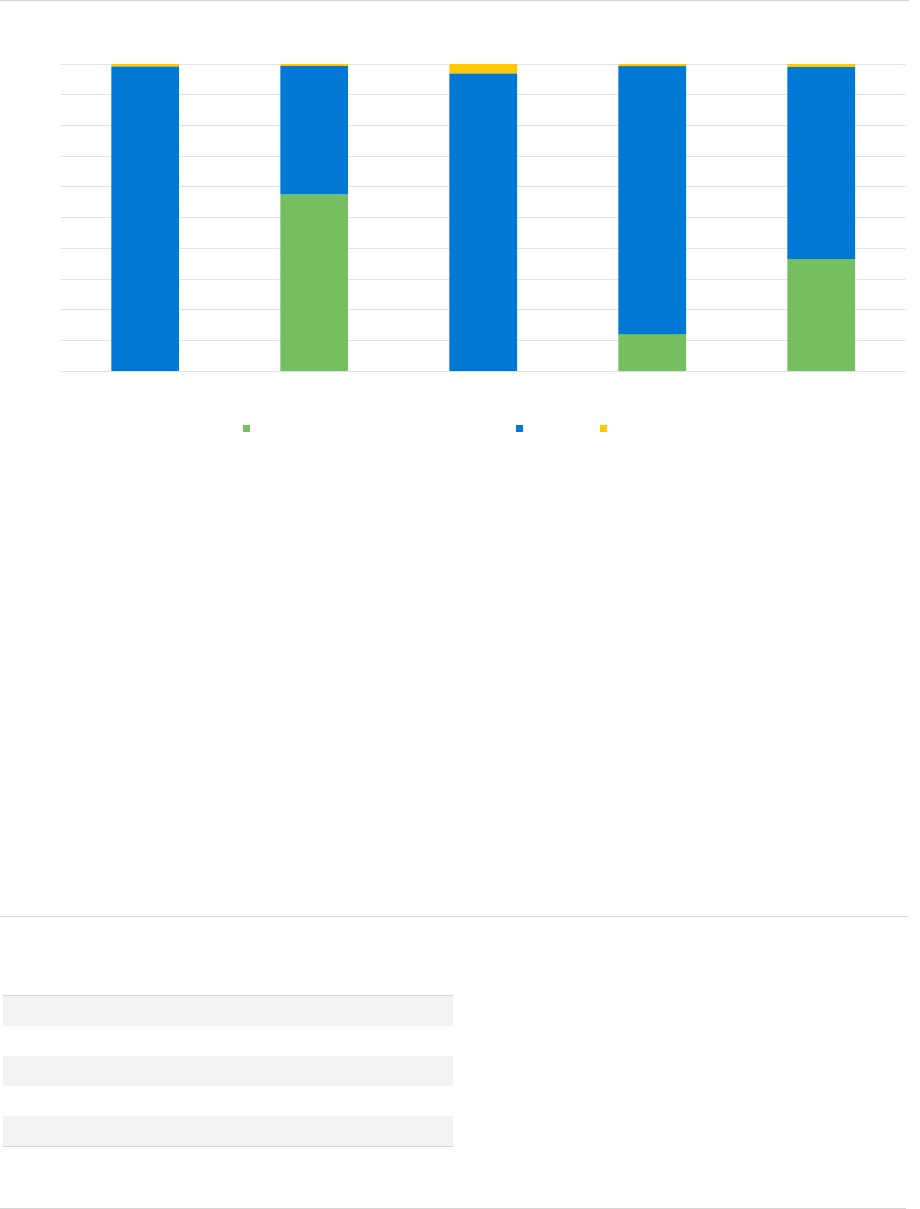

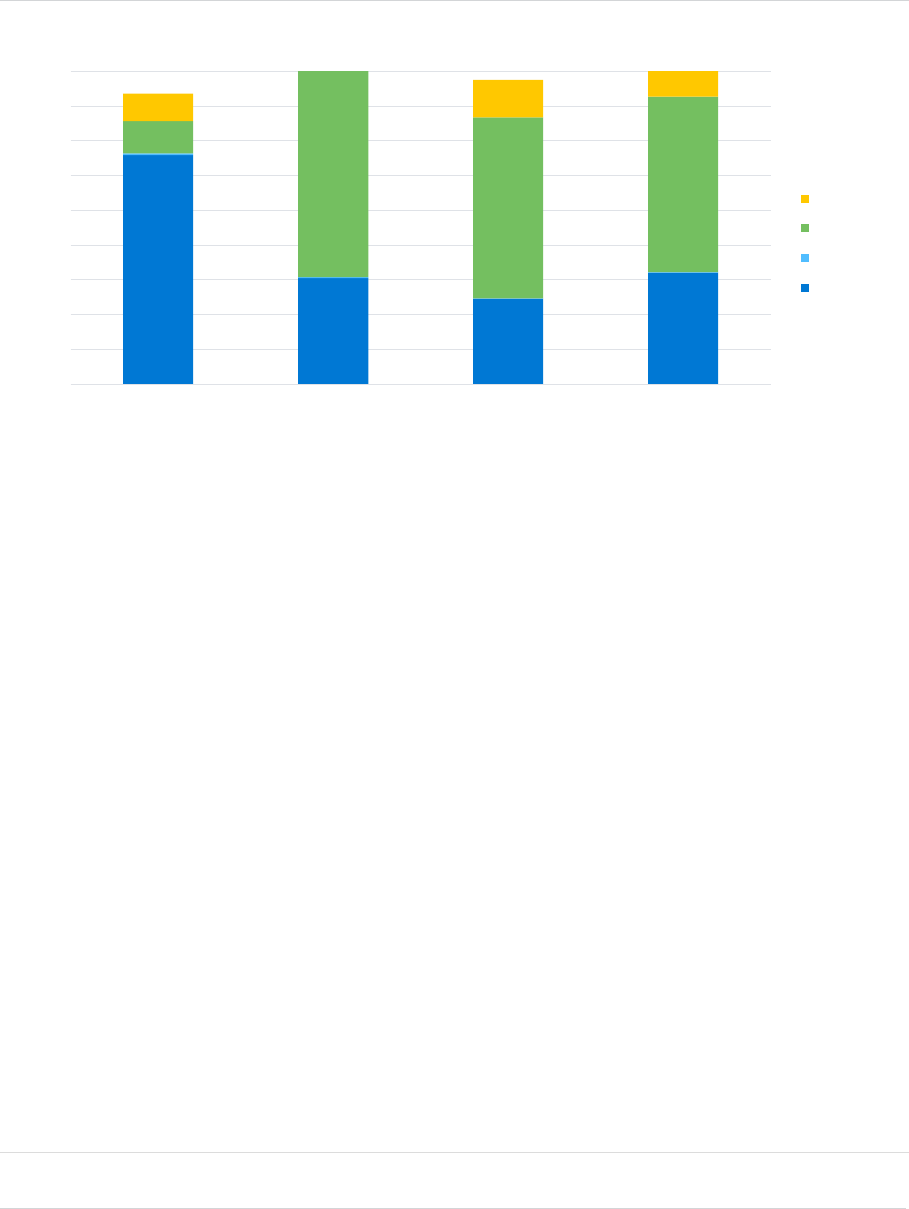

Figure 12 shows the relative uses of the Standard Formula, Partial Internal Model (PIM) and Full Internal Model

(FIM) to calculate the SCR in the various jurisdictions considered in our analysis. Any firms making use of

undertaking-specific parameters (USP) have been included with the Standard Formula companies. Standard

Formula firms are shown in green, PIM firms in dark blue and FIM firms in light blue.

FIGURE 12: SPLIT OF CALCULATION METHOD FOR THE SCR BY COUNTRY

Use of FIMs has proved to be most popular in the UK, Italy, Ireland and Germany, with 17%, 14%, 14% and 13%

of companies included in our sample respectively making use of this calculation method. Across Europe 6% of

firms are using a FIM to calculate the SCR.

The Netherlands, the UK, Denmark and Italy dominate approvals for PIMs. In the Netherlands, 29% of all firms in

our sample make use of a PIM despite no firms reporting the use of a FIM in that market. Across Europe, 5% of

firms are using a PIM to calculate the SCR.

Out of the 675 companies included in our analysis, 600 are companies which report under the Solvency II

Standard Formula (89%). Of the remaining 75 companies (11%), 37 companies were using a PIM, whilst 38

companies were using FIMs.

Most of the largest European markets report the use of some firms with PIM or FIM approval, except for

Luxembourg where all firms report using the Standard Formula. The remaining European market of NOR, CEE

and ROE generally report lower usage of PIMs and FIMs relative to the largest European markets.

Since our previous analysis at year-end 2021, we note one firm moving from using a PIM to using a FIM in

Germany. This is common for firms seeking to use a FIM where they gain approval for a PIM prior to FIM

approval to ease the regulatory burden of the Internal Model Approval Process (IMAP). Two firms moved from

using a FIM to using a PIM: one in Spain and the other in France.

There were no instances of firms moving to the Standard Formula over the year when previously reporting using

either a PIM or a FIM.

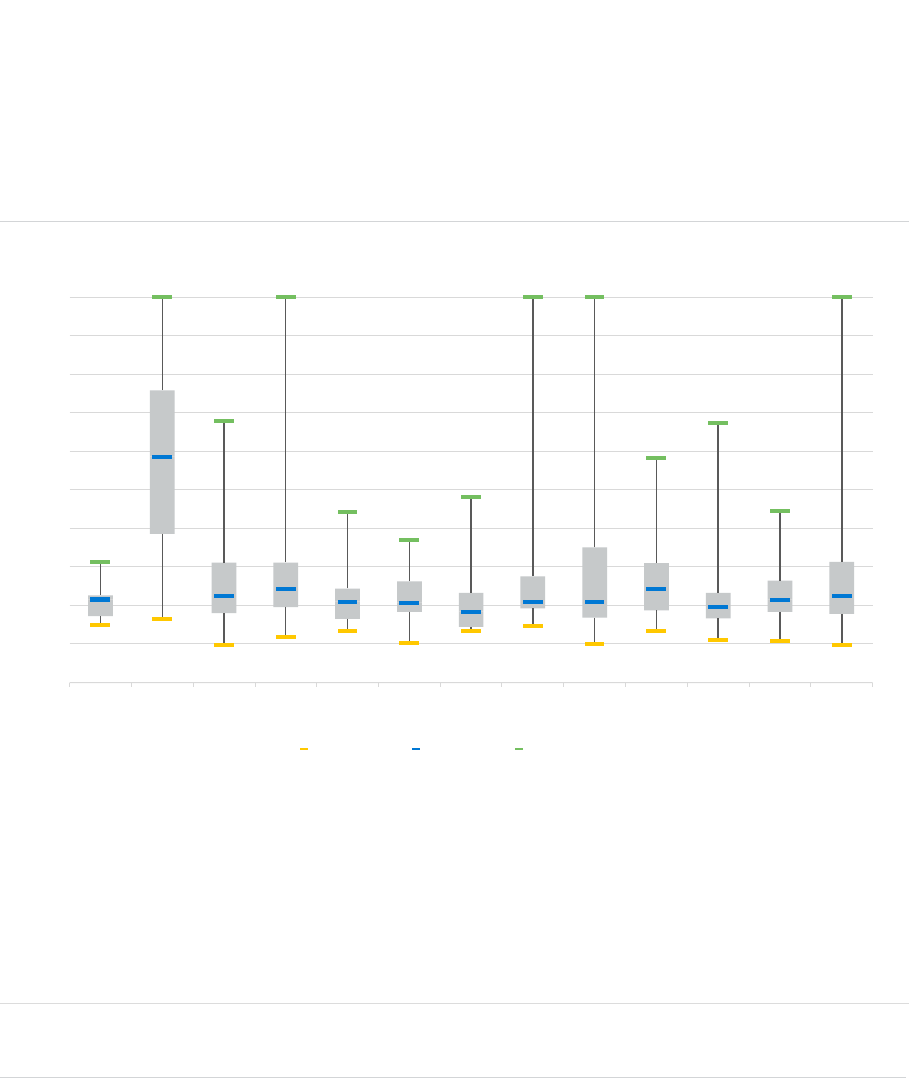

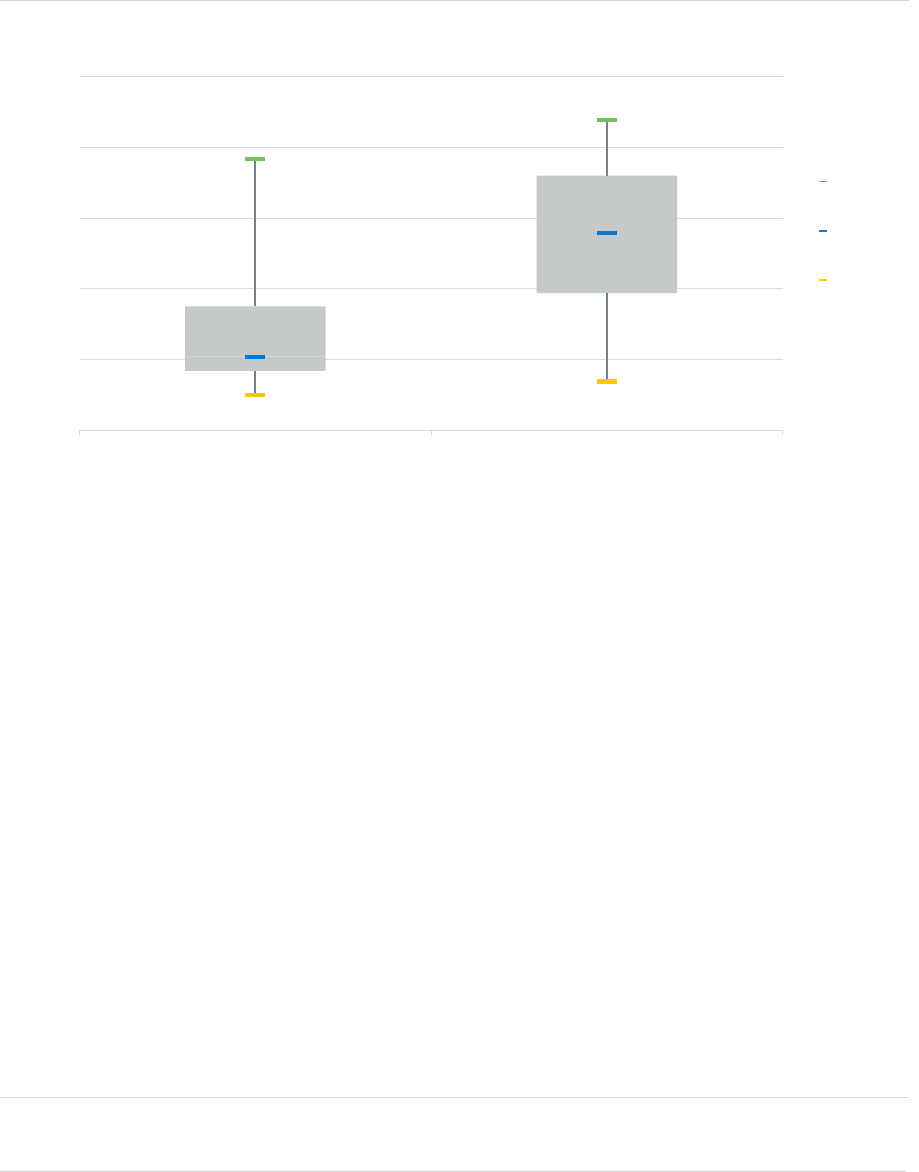

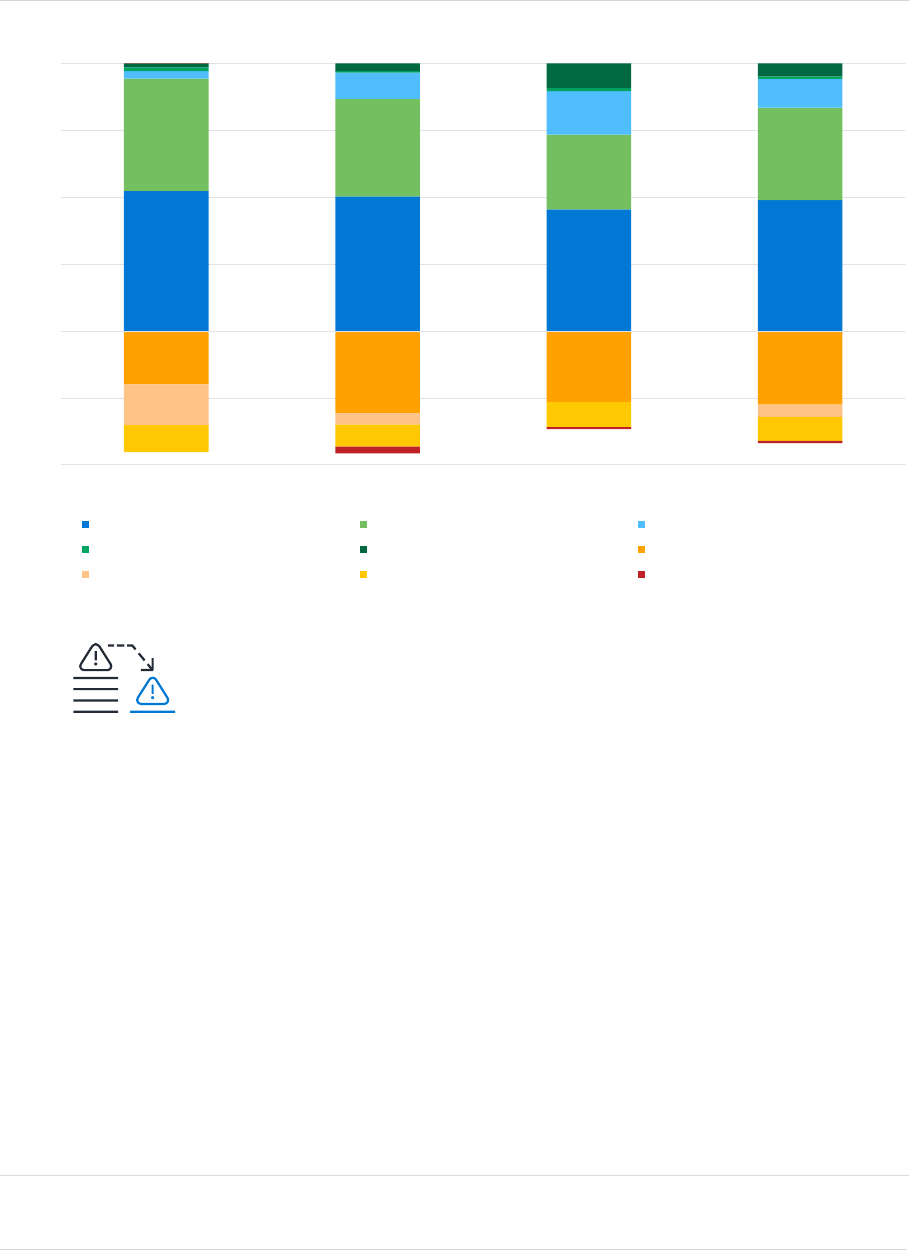

Figure 13 shows a split of the SCR coverage ratio distribution by SCR calculation type at year-end 2022. The

chart shows the maximum coverage ratio in green, the minimum in orange and the median in blue.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

BE DE ES FR IE IM IT LU NL UK NOR CEE ROE Europe

FULL INTERNAL MODEL

PARTIAL INTERNAL MODEL

STANDARD FORMULA

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 17 September 2023

financial condition reports year-end 2022

FIGURE 13: DISTRIBUTION OF SCR COVERAGE RATIOS BY SCR CALCULATION METHOD AT YEAR-END 2021

In our year-end 2021 SFCR analysis, we observed that the PIM and FIM companies had tighter distributions

when compared to Standard Formula. This broadly remains true at year-end 2022 with the key changes over the

year being:

A reduction in the range and interquartile range for FIM firms

An increase in the range for PIM firms but slight decrease in interquartile range

These changes are partly driven by the number of firms included in the FIM category being smaller which has

resulted in a narrower range. The two firms switched methodology from FIM to PIM over the year which helped to

reduce the FIM sample. There were three additional FIM firms added to our analysis for year-end 2022 which

were not included at year-end 2021. However, these firms experienced an average ratio of approximately 225%

resulting in a tighter distribution and smaller inter-quartile range for FIM companies’ SCR coverage ratios for

year-end 2022.

PIM and FIM firms continue to show narrower distributions and slightly lower median SCR coverage ratios than

Standard Formula firms, however, it is difficult to draw any inferences from this other than PIM and FIM firms are

likely to be managing their capital more closely. Figure 13 does suggest that capital may be more closely

managed in companies with a PIM and also, somewhat, by those using a FIM than in those using the Standard

Formula. This may be because internal model companies are more likely to be part of large insurance groups

and therefore may more actively manage their capital. This is consistent with our conclusions drawn from

previous SFCR results.

As in Figure 10, SCR coverage ratios in excess of 1,000% have been excluded from the chart. Of the 22

companies in the 2022 sample with solvency coverage ratios in excess of 1,000%, 21 are classified as Standard

Formula firms and the other uses a FIM. This differs from year-end 2021 where one PIM firm also reported an

SCR coverage ratio in excess of 1,000%.

0%

200%

400%

600%

800%

1000%

ALL FULL INTERNAL MODEL PARTIAL INTERNAL

MODEL

STANDARD FORMULA

MAXIMUM MEDIAN MINIMUM

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 18 September 2023

financial condition reports year-end 2022

Analysis of SCR

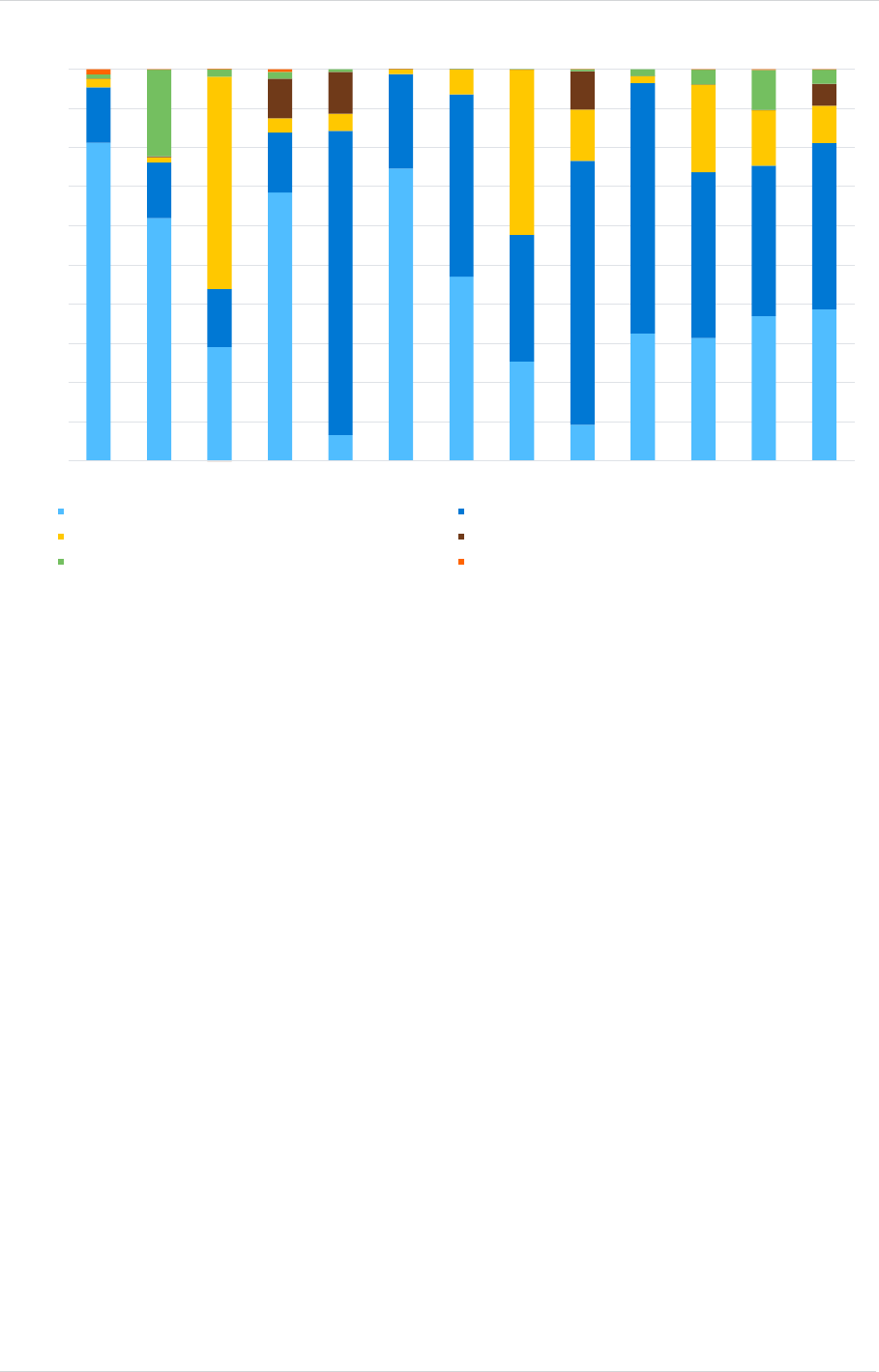

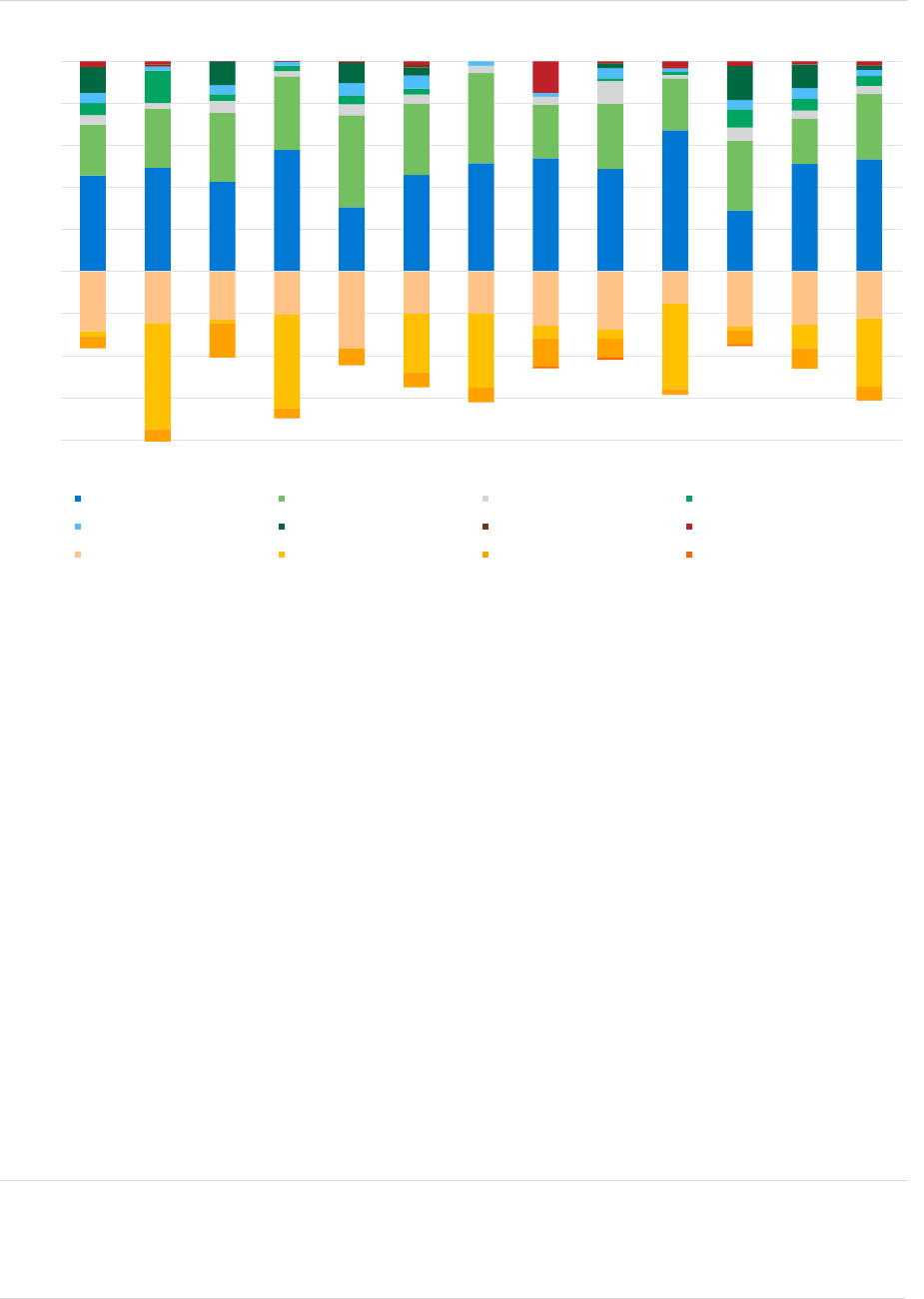

Figure 14 shows the breakdown of the SCR by risk module for companies across Europe at year-end 2022, with

the European average represented in the last bar on the chart, labelled as ‘Europe.’

FIGURE 14: BREAKDOWN OF SCR BY COUNTRY

17

On average across the EU, market risk makes up the highest proportion of the undiversified SCR (53%) for life

insurers. However, this is a decrease in proportion from the 62% shown in the year-end 2021 SFCR analysis.

Life underwriting risk makes up the second-largest portion (31%). The highest proportion of the undiversified

SCR in Ireland (44%) and in the CEE (33%) is represented by life underwriting risk, whilst for all other regions

market risk is the largest proportion.

The remainder of the undiversified SCR is mostly made up of health underwriting risk (5%), operational risk (4%)

and counterparty default risk (3%). Non-life underwriting risk, other positive adjustments (including capital add

ons) and other risks (including intangible asset risk and underwriting risk which has not been specified as life,

non-life or health) make up the remainder, accounting for around 2%, 2% and less than 1%, respectively.

In countries such as Spain, Belgium and countries in the CEE and ROE categories,

18

some of the companies are

reinsurers or composites, and as such it was difficult to define the distinction between life and non-life companies.

These regions display a greater proportion of their SCRs held in respect of non-life underwriting risk relative to

other regions, as a result.

17

The amounts within this figure are as a percentage of the total of the capital requirement for each risk module, including operational risk (the

undiversified SCR). Each element has been calculated as the sum across the companies within the region.

18

In particular, there is a high proportion of non-life underwriting risk in our sample in Romania, Bulgaria, Slovenia, Czechia, Croatia and Slovakia

in CEE, and Austria and Greece in ROE.

-80%

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

BE DE ES FR IE IT LU NL UK NOR CEE ROE Europe

MARKET RISK LIFE U/W RISK OP RISK HEALTH U/W RISK

COUNTERPARTY DEFAULT NON-LIFE U/W RISK OTHER RISKS OTHER (+)

DIVERSIFICATION LACTP LACDT OTHER (-)

22%

The

LEVEL OF DIVERSIFICATION

between risk modules of the SCR across Europe (on average)

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 19 September 2023

financial condition reports year-end 2022

The diversification of risk results in a reduction of 22% of the undiversified SCR on average across Europe, a 2%

increase from the level of diversification seen at year-end 2021 (20%). This is diversification between the risk

modules and not within the risk modules (which most companies do not disclose in their SFCRs). The amount of

benefit varies widely by country, with diversification benefits highest where there is a wider spread of risk

exposure. For example, Ireland has the highest diversification benefit, reflecting the fact that Irish insurers have a

wide range of risk exposures across market risk, life underwriting risk, health underwriting risk and non-life

underwriting risk, resulting in a reduction of 36%. Other markets with high levels of diversification include Belgium

(28%), the UK (27%), the Netherlands (26%) and CEE (26%).

In addition to diversification benefits, there are two additional adjustments available to companies after diversification:

1. Loss-absorbing capacity of technical provisions (LACTP), which reflects the ability to reduce future

discretionary benefits under stress scenarios. This is particularly common for business which is classed as

‘Insurance with Profit Participation.’

2. Loss-absorbing capacity of deferred tax (LACDT), which reflects the reduction in the future corporation tax

payable under stress scenarios.

The LACTP

19

and the LACDT result in further reductions of 33% and 6%, respectively. This demonstrates a

slightly bigger adjustment in LACTP compared to the results at year-end 2021 where LACTP resulted in a 29%

reduction to the undiversified SCR. This seems to largely be driven by Italy and Luxembourg which have seen

notable increases in the benefit arising from LACTP. The LACDT adjustment remains broadly unchanged from

the year-end 2021 figure of 7%.

LACTP is largest in Denmark and Norway

20

with a 58% reduction in both markets. This is reflective of Danish and

Norwegian life insurance TPs being around 40% and 65% ‘Insurance with Profit Participation’ business, respectively,

as well as a few large firms in these countries holding almost exclusively this type of business and receiving a

significant benefit from LACTP. LACDT is largest in Spain with a 16% reduction in SCR similar to last year-end.

The regions with the highest exposure to market risk are France (58%), Netherlands (54%), Luxembourg (51%),

Germany (49%) and the NOR (67%). Two of these regions, France and Germany are also amongst the regions

with the largest proportions of TPs in respect of ‘Insurance with Profit Participation,’ making up 69% and 81% of

TPs, respectively. This is somewhat unsurprising, as the investment guarantees associated with these contracts

can result in a high exposure to market risk.

These countries also benefit from significant reductions as a proportion of the undiversified SCR reflecting the

LACTP associated with ‘Insurance with Profit Participation’ business, including a 50% reduction for Germany and

45% for France.

Unfortunately, due to the nature of the public disclosure requirements for PIMs and FIMs, it is not straightforward

to make a direct comparison with Standard Formula firms to analyse the SCR breakdown by risk type, as the risk

exposures captured in the internal models vary by company. Where reasonable we have mapped the risks

resulting from the PIMs and FIMs into the Standard Formula structure for comparison in Figure 14.

The breakdown of the SCR has not changed significantly since the previous set of SFCRs were published.

19

Some companies reported their other risk modules after the risk-mitigation generated by their LACTP. Where this has happened, we have

assumed that the LACTP is offsetting the market risk module and adjusted it to be pre-LACTP. This method of reporting is common in certain

markets such as France.

20

Included within the NOR. The third highest LACTP is found in Germany.

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 20 September 2023

financial condition reports year-end 2022

Long-term guarantee measures

A number of European life insurers in our sample use long-term guarantee measures (LTGMs). The measures

which are available to insurers and are discussed in this report are:

Matching adjustment (MA)

Volatility adjustment (VA)

Transitional measure on technical provisions (TMTP)

We have not included any analysis on the transitional measure on interest rates due to the very small uptake of

this LTGM across Europe.

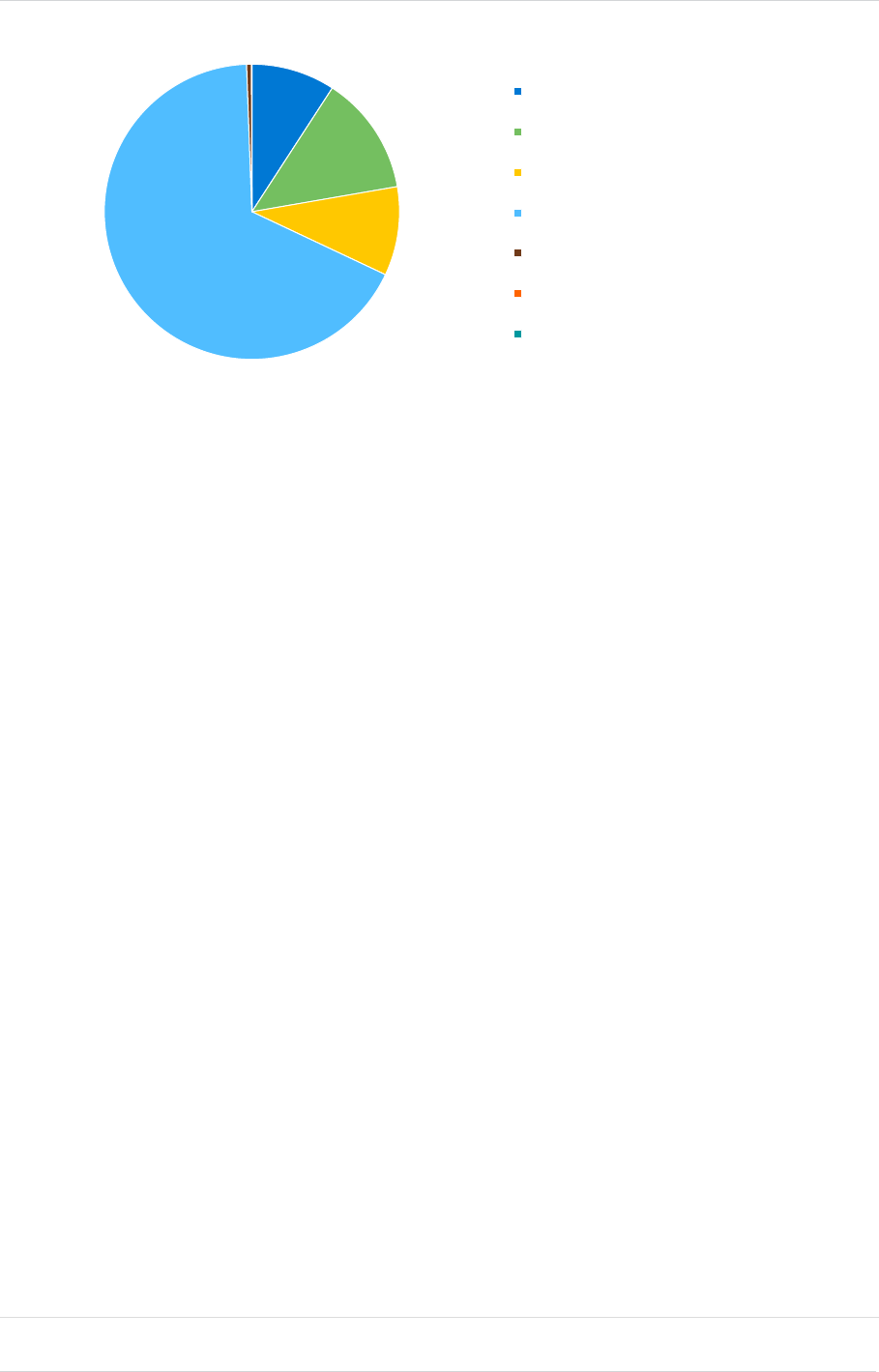

Figure 15 shows the breakdown of the SCR coverage ratio by the different LTGM and non-LTGM components (at

year-end 2022) for each of the regions analysed in this report. The total across all companies in our sample is

also shown.

FIGURE 15: BREAKDOWN OF SCR COVERAGE RATIO BY LONG-TERM GUARANTEE MEASURE

Figure 15 shows that different countries place

different levels of reliance on the various LTGMs.

The VA is the most widely used measure, used by

52% of all companies in our sample, including

having some impact on all of the largest markets

shown on the chart. It has the largest impact in the

Netherlands, where it increased the SCR coverage ratio by 91 percentage points on average. Since last year’s

analysis, we have seen no change in the benefit arising from the VA on European life insurer’s solvency

coverage ratios remaining at 14 percentage points.

In general, usage of the VA is lower in countries where prior approval by the regulator is required, such as the UK

and Ireland (increasing the SCR by approximately one percentage point in each country).

0%

50%

100%

150%

200%

250%

300%

350%

400%

450%

BE DE ES FR IE IT LU NL UK NOR CEE ROE Europe

NO LTGM VA MA TMTP

of all companies

in our report apply the VA

52%

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 21 September 2023

financial condition reports year-end 2022

Approval to use the VA is also required in Denmark; however, there is slightly higher VA usage there

(contributing 7 percentage points of the SCR coverage ratio). There are also substantial VA impacts in Germany

(59 percentage points), Belgium (26 percentage points), Austria (25 percentage points) and Italy (17 percentage

points). Higher take-up in countries such as Germany and the Netherlands could be due to the possibility of using

the dynamic volatility adjustment (DVA). The DVA is an adjustment to the Solvency II yield curve as with the non-

dynamic VA, but with allowance for variation under stress, i.e., the size of the VA applied will vary across the

different SCR stresses. The DVA is not currently permitted in all jurisdictions in our analysis, nor is it reported

separately to the non-dynamic VA, and consequently we are unable to separate the DVA out in our analysis.

The TMTP is currently being used by 15 of the countries in our sample. The SCR coverage ratio in Germany is

208 percentage points higher on average due to the use of the TMTP, the highest impact of any country from any

LTGM measure in our sample. 69% of the German companies in our report apply the TMTP, with some showing

very large benefits from its use. The large impact of the TMTP in Germany can be primarily attributed to the

Solvency I regime in Germany using a book value accounting method and the rates of interest used in the

valuation of the liabilities being relatively high when compared to the current Solvency II discount curve.

The other countries which receive significant benefits from using the TMTP are Portugal (25 percentage points),

Austria (25 percentage points), the UK (23 percentage points) and Finland (19 percentage points). Across

Europe the TMTP contributes 25 percentage points to European life insurers’ SCR coverage ratios.

The MA is the least frequently used LTGM, with impacts arising only from insurers in the UK and Spain. It

contributes 101 percentage points to the UK and 8 percentage points to Spain for each country’s SCR coverage

ratio based on the companies in our sample. Despite the low number of markets utilising the MA, across Europe

the MA contributes 33 percentage points to European life insurers’ SCR coverage ratios. This is driven by the

significant benefit arising in the UK which is the largest market by TPs in our analysis.

There are a number of countries where no companies in our sample report the use of LTGMs: Croatia, Cyprus,

Iceland, Latvia, Lithuania, Malta, Poland and Romania, as well as Gibraltar, Guernsey and the Isle of Man.

Meanwhile in Bulgaria, Czechia, Hungary, Ireland, Liechtenstein, Luxembourg, Norway and Sweden, take-up has

been low, with only a small number of companies using either the VA or the TMTP (contributing less than five

percentage points to the total solvency coverage ratio).

When comparing the results in this report to the previous SFCR report, in aggregate there has been a decrease

of six percentage points in the benefit received for using LTGMs across European life insurers. These decreases

are likely due to the following:

The TMTP benefits reduce by one-sixteenth each year as they run off, although on some occasions,

recalculations of the measure, where required, have led to increases in the TMTP benefit in a number of

jurisdictions. Since our previous analysis, the TMTP benefit has increased in Germany (+31%), Belgium

(+1%), Ireland (+0.3%) and CEE (+0.1%). However, these increases were not material enough to cause an

overall increase in the level of TMTP benefit across all of Europe relative to the year-end 2021 SFCRs, with

the overall benefit reducing by four percentage points over the year.

MA benefit has decreased over the year across all of Europe, down by two percentage points when

compared with year-end 2021. This is despite an increase to the MA benefits in the UK (increasing from an

80 percentage point benefit in 2021 to 101 percentage points in 2022) and Spain (increasing from a 5

percentage point benefit in 2021 to 8 percentage points in 2022). This overall decrease to the MA benefit can

be attributed to a slight dilution of the UK’s market share since 2021 year-end, with the UK’s TPs as a

percentage of the whole of Europe’s TPs falling from 29% to 28%. In particular, the total UK SCR as a

percentage of the total European SCR fell by three percentage points from 21% to 18%, whilst the total UK-

eligible own funds as a percentage of the total European-eligible own funds fell only by one percentage point

from 15% to 14%.

MILLIMAN RESEARCH REPORT

Analysis of life insurers’ solvency and 22 September 2023

financial condition reports year-end 2022

VA benefit has remained relatively stable when compared to year-end 2021, increasing by 0.3 percentage

points, with different impacts seen across the various European markets. For example:

− Increases in the VA rates for some currencies including Bulgarian lev (+39bps), British pound sterling

(+21bps), euro (+16bps), Hungarian forint (+12bps), Czech koruna (+3bps) and Icelandic króna (+1bp).

− Decreases in the VA rates for some currencies including Danish krone (-32bps), Norwegian krone

(-27bps), Swedish krona (-14bps), Swiss franc

21

(-7bps) and Croatian kuna (-1bp).

The decreases in the VA in the Nordic countries resulted in an 8% reduction in the VA benefit for the region

as a whole, whilst the increases in the VA in the euro and the British pound resulted in a 1% increase in the

VA benefit in CEE and a 2% increase across the nine largest markets. Given the significance of these

largest markets, the decrease in the VA benefit in the Nordic countries was broadly offset by the increase in

the VA benefit from the largest markets.

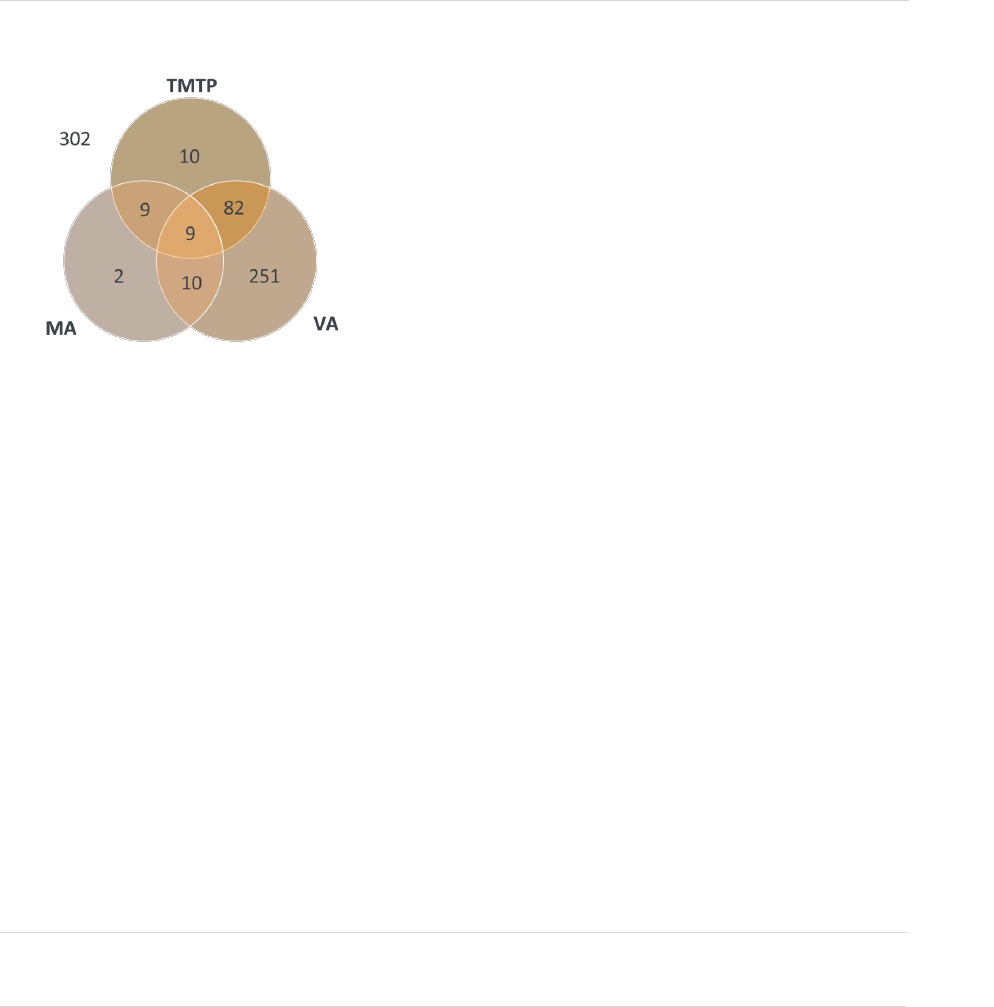

Of the companies in our sample, 352 are using the VA, 30 are using the MA (of which 19 are in the UK) and 110

are using the TMTP (of which 54 are in Germany) at year-end 2022. Some companies use different combinations

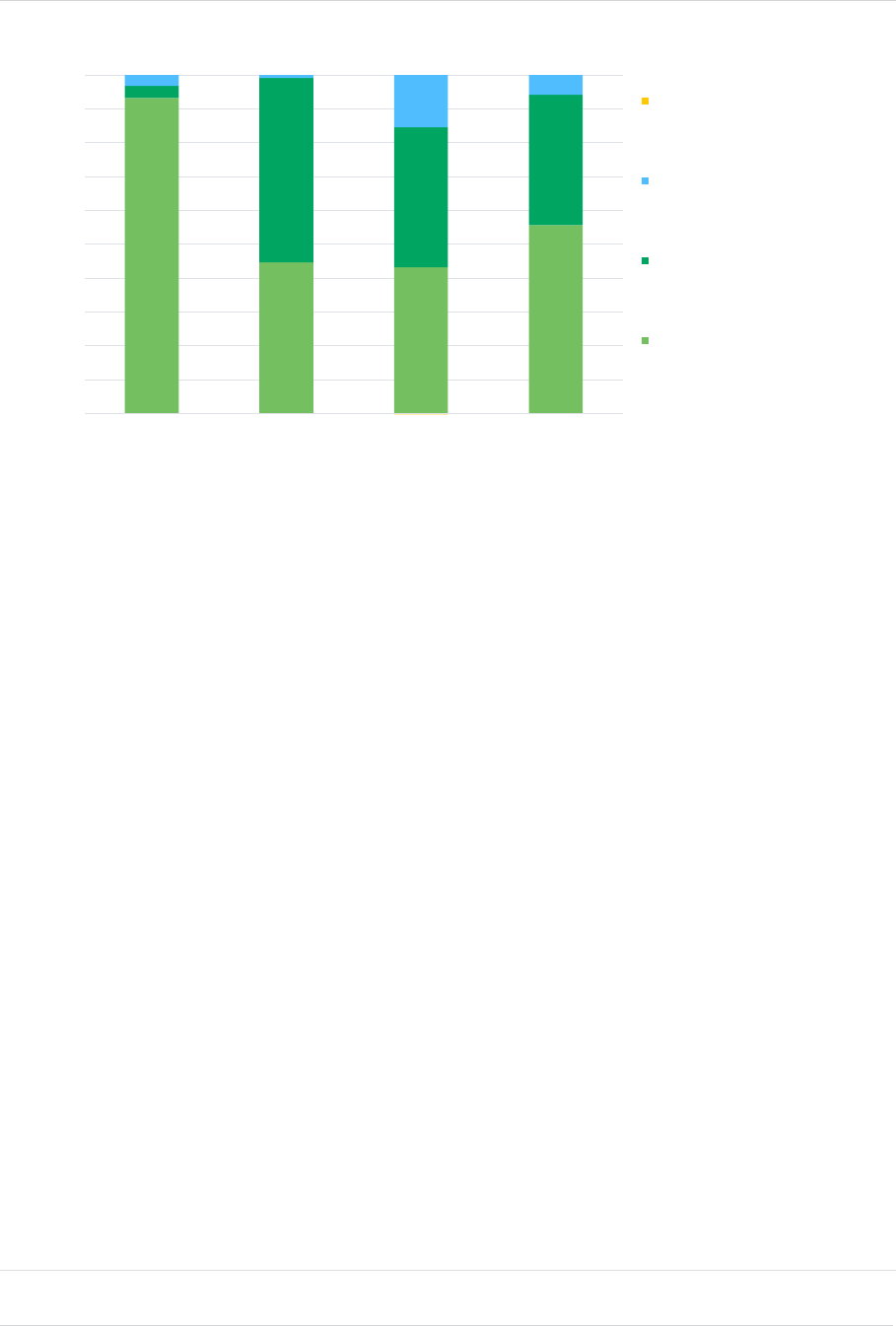

of the LTGMs as shown in the Venn diagramme in Figure 16. Of the European life companies in our sample, 302

did not use any of the LTGM at year-end 2022.

FIGURE 16: NUMBER OF COMPANIES USING LONG-TERM GUARANTEE MEASURES

The number of firms in our sample using the VA and the MA has increased over the year, whilst the number of

firms using the TMTP has decreased. At year-end 2021, 342 firms were using the VA, 29 firms were using the

MA and 140 firms were using the TMTP. There was also a reduction in the number of firms not using any LTGMs

(322 firms at year-end 2021). The reductions are reflective of the smaller overall sample size which is driven by

availability of data in Solvency II Wire at the time of analysis and also reflects the general trend of consolidation

across Europe.

21

Although Switzerland is not included in our analysis as it does not report under Solvency II, the Swiss franc has been included as it is the

reporting currency used by a number of firms in Liechtenstein.

Of our sample of

European Life Firms:

used the

VOLATILITY ADJUSTMENT

used the

MATCHING ADJUSTMENT

used the

TMTP