Generating

social value

across the UK.

Pension Insurance CorporationGroup Limited

Solvency and Financial Condition Report 2022

About PIC

PIC is a specialist insurer

which has become a

leader in the UK pension

risk transfer market by

focusing on our purpose:

to pay the pensions of

our current and future

policyholders.

For over a decade, PIC has been a

significant investor in areas like social

housing, renewable energy and the

UK’s universities. These investments,

which are typically sourced privately,

provide the cash flows we need to

match our liabilities at maturities

when publicly available debt is

simplynot available.

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 2022

01 Directors’ Responsibility Statement

02 Report of the Independent ExternalAuditor

07 Summary

13 A. Business and performance

13 A.1 Business

14 A.2 Performance of underwriting activity

16 A.3 Performance of investment activity

16 A.4 Performance of other activities

16 A.5 Any other information

17 B. System of governance

18 B.1 Governance Function

25 B.2 Fit and proper requirements

25 B.3 Risk management system including

theOwnRisk and Solvency Assessment

28 B.4 Internal control system

30 B.5 Internal audit function

31 B.6 Actuarial function

31 B.7 Outsourcing

32 B.8 Any other information

33 C. Risk profile

33 C.1 Market risk

34 C.2 Underwriting risk

35 C.3 Operational risk

35 C.4 Expense risk

35 C.5 Credit risk

36 C.6 Liquidity risk

36 C.7 Any other information

37 D. Valuation for solvency purposes

39 D.1 Assets

42 D.2 Technical provisions

50 D.3 Other liabilities

52 D.4 Alternative methods for valuation

52 D.5 Any other information

53 E. Capital management

53 E.1 Own Funds

56 E.2 SCR and MCR

57 E.3 Use of the duration- based equity risk

submodule in the calculation of the SCR

57 E.4 Difference between the standard

formulaand any internal model used

58 E.5 Non-compliance with the MCR and

significant non-compliance with the SCR

58 E.6 Any other information

59 Appendix A – Glossary of terms

61 Appendix B – QRTs

Pension Insurance Corporation Group Limited is

theultimate parent company of Pension Insurance

Corporation plc. Pension Insurance Corporation plc

isregistered in England and Wales under company

number 05706720. It is authorised by the Prudential

Regulation Authority and regulated by the Financial

Conduct Authority and Prudential Regulation Authority

(FRN 454345). Itsregistered office is at 14 Cornhill,

London EC3V 3ND

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202201

Directors’ Responsibility Statement

We acknowledge our responsibility for preparing the Pension

Insurance Corporation plc (“the Company” or “the insurer”)

and Pension Insurance Corporation Group Limited (“the

Group”) Solvency and Financial Condition Report (“SFCR”)

inall material respects in accordance with the PRA Rules

andthe Solvency II Regulations.

We are satisfied that:

a) throughout the financial year in question, the insurer

andGroup has complied in all material respects with

therequirements of the PRA Rules and the Solvency II

Regulations as applicable at the level of the insurer

andGroup; and

b) it is reasonable to believe that the insurer and Group has

continued so to comply subsequently and will continue

soto comply in future.

Signed on behalf of the Board of Directors

5 April 2023

Report of the Independent External Auditor

Opinion

Except as stated below, we have audited the following

documents prepared by the Pension Insurance Corporation

Group Limited (‘the Parent Company’) and Pension Insurance

Corporation (‘the Company’) as at 31 December 2022:

•

the ‘Valuation for solvency purposes’ and ‘Capital

Management’ sections of the Solvency and Financial

Condition Report of the Entities as at 31 December 2022,

(‘theNarrative Disclosures subject to audit’); and

•

group templates S02.01.02, S22.01.22, S23.01.22, S32.01.22

and Company templates S02.01.02, S12.01.02, S22.01.21,

S23.01.01, S28.01.01 (‘the Templates subject to audit’).

The Narrative Disclosures subject to audit and the Templates

subject to audit are collectively referred to as the ‘Relevant

Elements of the Solvency and Financial Condition Report’.

We are not required to audit, nor have we audited, and

asaconsequence do not express an opinion on the Other

Information which comprises:

•

information contained within the Relevant Elements

oftheSolvency and Financial Condition Report set out

aboutabove which derive from the Solvency Capital

Requirement, as identified in the Appendix to this report;

•

the ‘Business and performance’, ‘System of governance’

and ‘Risk profile’ sections of the Solvency and Financial

Condition Report;

•

group templates S05.01.02, S05.02.01, S.25.02.22, S.25.03.22;

•

company templates S05.01.02, S05.02.01, S.25.02.21,

S.25.03.21;

•

information calculated in accordance with the

previousregime used in the calculation of the

transitionalmeasure on technical provisions, and

asaconsequence all information relating to the

transitional measures on technical provisions as

setoutinthe Appendix to thisreport;

•

the written acknowledgement by the Directors of

theEntities of their responsibilities, including for the

preparation of the relevant content of the Solvency

andFinancial Condition Report (‘the Responsibility

Statement’); and

•

information which pertains to an undertaking

thatisnotaSolvency II undertaking and has been

prepared inaccordance with PRA rules other than

thoseimplementing the Solvency II Directive or in

accordance with an EU instrument other than the

Solvency II regulations ‘the sectoral information’.

To the extent the information subject to audit in the Relevant

Elements of the Solvency and Financial Condition Report

includes amounts that are totals, sub-totals or calculations

derived from the Other Information, we have relied without

verification on the Other Information.

In our opinion, the information subject to audit in the Relevant

Elements of the Solvency and Financial Condition Report of

the Entities as at 31 December 2022 is prepared, inall material

respects, in accordance with the financial reporting provisions

of the PRA Rules and Solvency II regulations on which it is

based as modified by relevant supervisory modifications,

and as supplemented by supervisory approvals and

determinations in effect as atthedate of approval

oftheSolvency and Financial ConditionReport.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) including ISA (UK) 800

and ISA (UK) 805, and applicable law. Our responsibilities

under those standards are further described in the Auditor’s

Responsibilities for the Audit of the Relevant Elements of the

Solvency and Financial Condition Report section of our report.

We are independent of each of the Entities in accordance

with the ethical requirements that are relevant to our audit

of the Solvency and Financial Condition Report in the UK,

including the FRC Ethical Standard as applied to public

interest entities, and we have fulfilled our other ethical

responsibilities in accordance with these requirements.

Webelieve that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our opinion.

Emphasis of Matter – special purpose basis

ofaccounting

We draw attention to the ‘Valuation for solvency purposes’

and ‘Capital Management’ and other relevant disclosures

within the information subject to audit in the Relevant

Elements of the Solvency and Financial Condition Report,

which describe the basis of accounting of the information

subject to audit in the Relevant Elements of the Solvency

and Financial Condition Report. The Solvency and Financial

Condition Report is prepared in compliance with the

financial reporting provisions of the PRA Rules and Solvency II

regulations, and therefore in accordance with a special

purpose financial reporting framework. The Solvency and

Financial Condition Report is required to be published, and

intended users include but are not limited to the Prudential

Regulation Authority. As a result, the Solvency and Financial

Condition Report may not be suitable for another purpose.

Our opinion is not modified in respect of this matter.

Report of the external independent auditor to the Directors of Pension Insurance

Corporation Group Limited (‘Parent Company’) and Pension Insurance Corporation

(‘theCompany’) pursuant to Rule 4.1 (2) of the External Audit Part of the PRA Rulebook

applicable to Solvency II firms

Report on the Audit of the Relevant Elements of the Solvency and Financial

ConditionReport

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202202

Report of the Independent External Auditor continued

Going concern

The Directors of the Parent Company have prepared the

information subject to audit in the Relevant Elements of the

Solvency and Financial Condition Report for the Group on

the going concern basis as they do not intend to liquidate the

Group or the Parent Company or to cease their operations,

and as they have concluded that the Group and the Parent

Company’s financial positions mean that this is realistic.

They have also concluded that there are no material

uncertainties that could have cast significant doubt over

their ability to continue as a going concern for the going

concern period. The Directors of Pension Insurance Corporation

have prepared the information subject to audit in the Relevant

Elements of the Solvency and Financial Condition Report for

their respective entity on the going concern basis as they do

not intend to liquidate their respective entity or to cease its

operations, and as they have concluded that their respective

entity’s financial position means that this is realistic. They

have also concluded that there are no material uncertainties

that could have cast significant doubt over the ability of

theirrespective entity to continue as a going concern for

atleast a year from the date of approval of the Solvency

and Financial Condition Report (“the going concern period”).

We used our knowledge of the Group and Company, its

industry, and the general economic environment to identify

the inherent risks to its business model and analyzed how

those risks might affect the Group’s and Company’s financial

resources or ability to continue operations over the going

concern period. The risks that we considered most likely

toadversely affect the Group’s and Company’s available

financial resources over this period were:

•

a significant deterioration in longevity experience,

potentially caused by market wide event(s);

•

a deterioration in the valuation of the Group’s and

Company’s investments arising from fluctuation or

negative trends in the economic environment; and

•

the impact on regulatory capital solvency margins and

liquidity of changes in inflation and movements in foreign

exchange or interest rates.

We also considered less predictable but realistic second

order impacts such as failure of counterparties who have

transactions with the Group (such as reinsurers) to meet

commitments and a sudden significant increase in policyholders

seeking to transfer their policies to other providers that could

give rise to a negative impact on the Group’s financial position

and increased illiquidity.

We considered whether these risks could plausibly affect

theliquidity or Solvency in the going concern period by

assessing the Directors’ sensitivities over the level of

available financial resources indicated by the Group’s

andCompany’s financial forecasts taking account of

severe,but plausible adverse effects that could arise

fromthese risks individually andcollectively.

Our conclusions based on this work:

•

we consider that the directors of the Entities use of the

going concern basis of accounting in the preparation of

the information subject to audit in the Relevant Elements

of the Solvency and Financial Condition Report for their

respective entity and the Group is appropriate; and

•

we have not identified and concur with the directors of the

Entity’s assessment that there is not, a material uncertainty

related to events or conditions that, individually or collectively,

may cast significant doubt on the Entity or the Group’s ability

to continue as a going concern for the going concern period.

However, as we cannot predict all future events or conditions

and as subsequent events may result in outcomes that

areinconsistent with judgements that were reasonable at

the time they were made, the above conclusions are not a

guarantee that the Entity or the Group will continue in operation.

Fraud and breaches of laws and regulations –

ability to detect

•

Identifying and responding to risks of material

misstatement due to fraud

To identify risks of material misstatement due to fraud

(“fraud risks”) we assessed events or conditions that

couldindicate an incentive or pressure to commit

fraudorprovide an opportunity to commit fraud.

Our risk assessment procedures included:

•

enquiring of directors, the audit committee, internal

auditand inspection of policy documentation as to

thecompanies’ high-level policies and procedures to

prevent and detect fraud, as well as whether they have

knowledge of any actual, suspected, or alleged fraud;

•

reading Board, and Audit Committee minutes, Risk

Committee and Credit Rating Committee minutes;

•

considering remuneration incentive schemes and

performance targets for management/directors.

We communicated identified fraud risks throughout

theauditteam and remained alert to any indications

offraud throughout the audit.

As required by auditing standards and taking into account

possible pressures to meet profit targets, we perform

procedures to address the risk of management override of

controls, in particular the risk that management may be in a

position to make inappropriate accounting entries and the risk

of bias in accounting estimates and judgements. Accordingly,

we identified a fraud risk related to accounting estimates and

judgements related to Best Estimate Liabilities ‘BEL’ in the

valuation of technical provisions in response to the potential

formanagement bias.

In order to address the risk of fraud specifically as it relates

to the technical provisions within the Solvency and Financial

Condition Report, we involved actuarial specialists to assist

in our challenge of management. We challenged management

in relation to the appropriateness of Best Estimate Liabilities

and the appropriateness of the rationale for any changes,

the consistency of the selected assumptions across different

aspects of the financial reporting process and in comparison,

to our understanding of various business areas.

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202203

Report of the Independent External Auditor continued

To address the pervasive risk as it relates to management

override, we performed procedures including:

•

identifying journal entries and other adjustments to test

based on risk criteria and comparing the identified entries

tosupporting documentation. These included those posted

by unauthorized users, approved by unauthorized approvers,

those posted and approved by the same user, those

including specific words based on our risk criteria, those

journals which were unbalanced, those with no descriptions

oruser IDs, those posted to seldom used accounts, unusual

journal entries posted to cash accounts. Identifying

journalentries and other adjustments to test based on risk

criteria and comparing the identified entries tosupporting

documentation. These included those posted by unauthorised

users, approved by unauthorised approvers, those posted

and approved by the same user, those including specific

words based on our risk criteria, those journals which were

unbalanced, those with no descriptions or user IDs, those

posted to seldom used accounts, unusual journal entries

posted to cash accounts; and

•

assessing significant accounting estimates for bias.

Identifying and responding to risks of material

misstatement due to non-compliance with laws

and regulations

We identified areas of laws and regulations that could

reasonably be expected to have a material effect on the

Solvency and Financial Condition Report from our general

commercial and sector experience, and through discussion

with management, and from inspection of the Group’s and

Company’s regulatory and legal correspondence and we

discussed with management the policies and procedures

regarding compliance with laws and regulations.

We communicated identified laws and regulations throughout

our team and remained alert to any indications of non-

compliance throughout the audit.

The potential effect of these laws and regulations on the

Solvency and Financial Condition Report varies considerably.

Firstly, the Group and Company are subject to laws and

regulations that directly affect the Solvency and Financial

Condition Report including financial reporting legislation

(related to PRA and Solvency II regulations) , and we assessed

the extent of compliance with these laws and regulations as

part of our procedures on the related financial statement items.

Secondly, the Group and Company are subject to many

other laws and regulations where the consequences of

non-compliance could have a material effect on amounts or

disclosures in the Solvency and Financial Condition Report,

for instance through the imposition of fines or litigation. We

identified the following areas as those most likely to have

such as effect: regulatory capital and liquidity requirements,

GDPR compliance, Health and Safety legislation, Employment

and Social Security legislation, Fraud, corruption and bribery

legislation, Misrepresentation Act, Environmental protection

legislation, including emissions trading & Climate Change Act

2008 and certain aspects of company legislation recognizing

the financial nature of the Group’s and Company’s activities

and its legal form. Auditing standards limit the required audit

procedures to identify non-compliance with these laws and

regulations to enquiry of the directors and inspection of

regulatory and legal correspondence, if any. Therefore, if

abreach of operation regulations is not disclosed to us or

evident from relevant correspondence, an audit will not

detect a breach.

Context of the ability of the audit to detect

fraudor breaches of law or regulation:

Owing to the inherent limitations of an audit, there is an

unavoidable risk that we may not have detected some

material misstatements in the Solvency and Financial

Condition Report, even though we have properly planned

and performed our audit in accordance with auditing

standards. For example, the further removed non-compliance

with laws and regulations is from the events and transactions

reflected in the Solvency and Financial Condition Report,

theless likely the inherently limited procedures required by

auditing standards would identify it.

In addition, as with any audit, there remained a higher risk

ofnon-detection of fraud, as these may involve collusion,

forgery, intentional omissions, misrepresentations, or the

override of internal controls. Our audit procedures are

designed to detect material misstatement. We are not

responsible for preventing non-compliance or fraud and

cannot be expected to detect non- compliance with all

lawsand regulations.

Other Information

The Directors of the Entities are responsible for their

relevantcontent of the Other Information.

Our opinion on the information subject to audit in the

Relevant Elements of the Solvency and Financial Condition

Report does not cover the Other Information and, accordingly,

we do not express an audit opinion or any form of assurance

conclusion thereon.

In connection with our audit of the information subject

toaudit in the Relevant Elements of the Solvency and

FinancialCondition Report, our responsibility is to read

theOther Information and, in doing so, consider whether

theOther Information is materially inconsistent with the

information subject to audit in the Relevant Elements of the

Solvency and Financial Condition Report, or our knowledge

obtained in the audit, orotherwise appears to be materially

misstated. If we identify such material inconsistencies or

apparent material misstatements, we are required to

determine whether there is a material misstatement in

theinformation subject to auditin the Relevant Elements of

the Solvency and Financial Condition Report or a material

misstatement of the Other Information. If, based on the work

we have performed, we conclude that there is a material

misstatement of this Other Information, we are required to

report that fact. We have nothing to report in this regard.

Responsibilities of Directors of the Entities for

theSolvency and Financial Condition Report

The Directors of the Entities are responsible for the preparation

of their relevant content of the Solvency and Financial

Condition Report in accordance with the financial reporting

provisions of the PRA rules and Solvency II regulations which

have been modified by the modifications and supplemented

by the approvals and determinations made by the PRA

under section 138A of FSMA, the PRA Rules and Solvency II

regulations on which they are based.

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202204

The Directors of the Entities are also responsible for such

internal control as they determine is necessary to enable

thepreparation of their relevant content of the Solvency

andFinancial Condition Report that is free from material

misstatement, whether due to fraud or error. The Directors

are responsible for assessing their respective entity’s ability

to continue as going concerns, disclosing, as applicable,

matters related to going concern; and using the going

concern basis of accounting unless they either intend to

liquidate their respective entity or to cease operations,

orhave no realistic alternative but to do so.

The Directors of the Parent Company are responsible

forassessing the Group’s and Parent Company’s ability

tocontinue as going concerns, disclosing, as applicable,

matters related to going concern; and using the going

concern basis of accounting unless they either intend to

liquidate the Group or the Parent Company or to cease

theiroperations, or have no realistic alternative but to do so.

Auditor’s Responsibilities for the Audit of

theRelevant Elements of the Solvency

andFinancial Condition Report

It is our responsibility to form an independent opinion as

towhether the information subject to audit in the Relevant

Elements of the Solvency and Financial Condition Report is

prepared, in all material respects, with financial reporting

provisions of the PRA Rules and Solvency II regulations on

which it is based, as modified by relevant supervisory

modifications, and as supplemented by supervisory

approvals and determinations.

Our objectives are to obtain reasonable assurance about

whether the information subject to audit in the Relevant

Elements of the Solvency and Financial Condition Report

isfree from material misstatement, whether due to fraud

orerror, and to issue an auditor’s report that includes our

opinion. Reasonable assurance is a high level of assurance, but

it is not a guarantee that an audit conducted in accordance

with ISAs (UK) will always detect a material misstatement

when it exists. Misstatements can arise from fraud or error

and are considered material if, individually orinthe aggregate,

they could reasonably be expected toinfluence the decision

making or the judgement of the userstaken on the basis of

the information subject to audit inthe Relevant Elements

ofthe Solvency and Financial Condition Report.

A fuller description of our responsibilities is located

ontheFinancial Reporting Council’s website at:

www.frc.org.uk/auditorsresponsibilities.

Other Matter

The Company has authority to calculate the Group Solvency

Capital Requirement, and the Entities have authority to

calculate their respective entity’s Solo Solvency Capital

Requirement, using an internal model (“the Model”) approved

by the Prudential Regulation Authority in accordance with

the Solvency II Regulations. In forming our opinion (and in

accordance with PRA Rules), we are not required to audit

theinputs to, design of, operating effectiveness of, or outputs

from the Model, or whether the Model is being applied in

accordance with the Entities’ application or approval order.

Report on Other Legal and Regulatory requirements

Sectoral Information

In our opinion, in accordance with Rule 4.2 of the External Audit

Part of the PRA Rulebook for Solvency II firms, the sectoral

information has been properly compiled in accordance with

the PRA rules and EU instruments relating to that undertaking

from information provided by members of the Group and the

relevant insurance group undertaking.

Other Information

In accordance with Rule 4.1 (3) of the External Audit Part of

the PRA Rulebook for Solvency II firms we are also required

toconsider whether the Other Information is materially

inconsistent with our knowledge obtained in the audit of the

Entities’ statutory financial statements for the year ended

31 December 2022. If, based on the work we have performed,

we conclude that there is amaterial misstatement of this

other information, we are required to report that fact.

Wehave nothing to report in thisregard.

This engagement is separate from the audits of the annual

financial statements of the Entities and the report here

relates only to the matters specified and does not extend

tothe Entities’ annual financial statements taken as a whole.

As set out in our audit reports on those financial statements,

those audit reports are made solely to the members of the

respective Entities, as a body, in accordance with Chapter 3

of Part 16 of the Companies Act 2006. The audit work has

been undertaken so that we might state to the members

ofthe respective Entities those matters we are required to

state to them in an auditor’s report and for no other purpose.

To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the Entities and

the members, as a body, of each of the respective Entities

for the audit work, for the audit report, or for the opinions

wehave formed in respect of those audits.

The purpose of our audit work and to whom we owe

ourresponsibilities

This report of the external auditor is made solely to

thedirectors of the Entities, as their governing bodies,

inaccordance with the requirement in Rule 4.1 (2) of the

External Audit Part of the PRA Rulebook for Solvency II firms

and the terms of our engagement. We acknowledge that

thedirectors are required to submit the report to the PRA,

toenable the PRA to verify that an auditor’s report has

beencommissioned by the Entities’ directors and issued in

accordance with the requirement set out in Rule 4.1 (2) of the

External Audit Part of the PRA Rulebook for Solvency II firms

and to facilitate the discharge by the PRA of its regulatory

functions in respect of the Entities, conferred on the PRA by

or under the Financial Services and Markets Act 2000.

Our audit has been undertaken so that we might state to the

directors those matters we are required to state to them in

an auditor’s report issued pursuant to Rule 4.1 (2) and for no

other purpose. To the fullest extent permitted by law, we do

not accept or assume responsibility to anyone other than

the Entities through their governing bodies, for our audit,

forthis report, or for the opinions we have formed.

James Anderson

for and on behalf of KPMG LLP

15 Canada Square

London

E14 5GL

5 April 2023

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202205

Report of the Independent External Auditor continued

Report of the Independent External Auditor continued

Relevant Elements of the Solvency and Financial Condition

Report that are not subject to audit comprise:

Group

•

The following elements of Group template S.02.01.02:

•

Row R0550: Technical provisions–non-life

(excludinghealth) – risk margin

•

Row R0590: Technical provisions–health

(similar tonon-life) – risk margin

•

Row R0640: Technical provisions–health (similar to life)

– risk margin

•

Row R0680: Technical provisions–life (excluding health

and index-linked and unit- linked) – risk margin

•

Row R0720: Technical provisions–Index-linked and

unit-linked – risk margin

•

The following elements of Group template S.22.01.22

•

Column C0030 – Impact of transitional measures on

technical provisions

•

Row R0010 – Technical provisions

•

Row R0090 – Solvency Capital Requirement

•

The following elements of Group template S.23.01.22

•

Row R0020: Non-available called but not paid in

ordinary share capital at group level

•

Row R0060: Non-available subordinated mutual

member accounts at group level

•

Row R0080: Non-available surplus at group level

•

Row R0100: Non-available preference shares at

grouplevel

•

Row R0120: Non-available share premium account

related to preference shares at group level

•

Row R0150: Non-available subordinated liabilities

atgroup level

•

Row R0170: The amount equal to the value of net

deferred tax assets not available at the group level

•

Row R0190: Non-available own funds related to other

own funds items approved by supervisory authority

•

Row R0210: Non-available minority interests atgrouplevel

•

Row R0380: Non-available ancillary own funds atgrouplevel

•

Rows R0410 to R0440 – Own funds of other financialsectors

•

Row R0680: Group SCR

•

Row R0740: Adjustment for restricted own fund items

inrespect of matching adjustment portfolios and ring

fenced funds

•

Row R0750: Other non-available own funds

•

Elements of the Narrative Disclosures subject to audit

identified as ‘unaudited’

Solo

The relevant elements of the Solvency and Financial

Condition Report that are not subject to audit comprise:

•

The following elements of Solo template S.02.01.02:

•

Row R0550: Technical provisions–non-life

(excluding health) – risk margin

•

Row R0590: Technical provisions–health (similar to

non-life) – risk margin

•

Row R0640: Technical provisions–health (similar to life)

– risk margin

•

Row R0680: Technical provisions–life (excluding health

and index-linked and unit-linked) – risk margin

•

Row R0720: Technical provisions – Index-linked and

unit-linked – risk margin

•

The following elements of template S.12.01.02

•

Row R0100: Technical provisions calculated as a sum

ofBE and RM – Risk margin

•

Rows R0110 to R0130 – Amount of transitional measure

on technical provisions

•

The following elements of template S.17.01.02

•

Row R0280: Technical provisions calculated as a sum

ofBE and RM – Risk margin

•

Rows R0290 to R0310 – Amount of transitional measure

on technical provisions

•

The following elements of template S.22.01.21

•

Column C0030 – Impact of transitional measures

ontechnical provisions

•

Row R0010 – Technical provisions

•

Row R0090 – Solvency Capital Requirement

•

The following elements of template S.23.01.01

•

Row R0580: SCR

•

Row R0740: Adjustment for restricted own fund items

inrespect of matching adjustment portfolios and ring

fenced funds

•

The following elements of template S.28.01.01

•

Row R0310: SCR Elements of the Narrative Disclosures

subject to audit identified as ‘unaudited

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202206

The Solvency and Financial Condition Report (“SFCR”) is an annual report that is required to be produced under UK law,

aspart of the Solvency II regime. Any reference to SII Directive in this document is a reference to the UK version of that

regulation, unless otherwise stated.

This requirement to prepare the SFCR is set out in a direction made by the Prudential Regulatory Authority (“PRA”) on

6 November 2019. In April 2022, HM Treasury published a consultation on proposed changes to Solvency II regulation in the

UK.Proposed changes being consulted on include a reduction in the risk margin of around 60%-70% for long-term life insurers,

changes to the calibration of retained credit risk used to calculate the matching adjustment; an increase in flexibility to allow

insurers to invest in long-term assets such as infrastructure; and a reduction in the current reporting and administrative burden

on firms. Whilst the outcome remains uncertain, these changes could materially impact the future capital position of the Company.

The Group has permission to produce a single SFCR, covering both Pension Insurance Corporation plc (“PIC”, or “the Company”)

and Pension Insurance Corporation Group Limited (“PICG”, or “the Group”).

The SFCR is a public document and is published on the Company’s website. It is also provided to the Company’s prudential

regulator, the PRA.

The content of the SFCR is prescribed by PRA regulation, and must contain the following sections:

SECTION DESCRIPTION OF CONTENT

Business and Performance Provides the basic information on the Group and Company,

and gives a summary of the business performance during

the year in question.

System of Governance Provides governance information on the Group and

Company including Board and Committee structure,

responsibilities, and details of the principal process.

Risk Profile Provides qualitative and quantitative information regarding

the risks that face the Group and Company, and how they

are managed.

Valuation for Solvency Purposes Provides values for the Group and Company’s assets and

liabilities in accordance with International Financial

Reporting Standards (“IFRS”) and Solvency II rules, gives

details on the assumptions used in the valuations, and

provides explanations on valuation differences between

IFRS and Solvency II.

Capital Management Provides detail on the regulatory capital (own funds) which

the Group and Company must hold in line with Solvency II

rules, and on the composition of such own funds.

PIC is authorised to write long-term insurance business by the PRA and regulated by the PRA and the Financial Conduct

Authority (the “FCA”).

Pension risk transfer products are used by pension funds to transfer to an insurance company the risks and liabilities

arisingfrom the benefit promises made to pension fund members. Insurance is also used as a means by which the

ultimateresponsibility to pay the benefit promises is transferred to the insurance company through the issuance of

anindividual annuity insurance policy to the pension fund member.

The Company originates new business through active engagement with, and marketing to, pension fund trustees and

theiradvisors, as well as to corporate sponsors of such funds.

PIC is the primary operating subsidiary of the Group.

Summary (unaudited)

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202207

A summary of the content of each SFCR section is provided below:

Business and performance

2022 was a year of extreme market volatility, characterised by rising interest rates and inflation and the prospect of

recession. Despite this, both the Group and Company have delivered strong results, increasing their Solvency II ratio,

PICGto226% and PIC to 225% (2021: 169% in PICG and 168% PIC). The Group profit before tax was £1,240 million for the

year(2021: £393 million) and PIC’s profit before tax was £1,241 million (2021: £394 million).

Statement of comprehensive income highlights – PICG

2022

£m

2021

£m

Gross premiums written 4,095 4,702

Net premium revenue earned 4,021 3,856

Investment return (including commissions earned) (12,396) 210

Total net revenue (8,375) 4,066

Net claims paid (1,881) (1,785)

Change in net insurance liabilities 11,833 (1,601)

Operating expenses (247) (198)

Finance costs (90) (89)

Total net expenses 9,615 (3,673)

Profit before tax 1,240 393

Statement of comprehensive income highlights – PIC

2022

£m

2021

£m

Gross premiums written 4,095 4,702

Net premium revenue earned 4,021 3,856

Investment return (including commissions earned) (12,396) 210

Total net revenue (8,375) 4,066

Net claims paid (1,881) (1,785)

Change in net insurance liabilities 11,833 (1,601)

Operating expenses (246) (198)

Finance costs (90) (88)

Total net expenses 9,616 (3,672)

Profit before tax 1,241 394

Premiums

Gross premiums were £4,095 million in the year across 21 transactions (2021: £4,702 million across 14 transactions). 2022 was

another strong year for new business, with the reduction in gross premium levels reflecting the impact of higher interest rates.

Net premiums earned represent the gross premiums written less premiums ceded to reinsurers. Premiums ceded to reinsurers

decreased mainly due to the comparative including the impact of asset backed reinsurance transactions, which did not

reoccur in the current year. In total, eight (2021: seven) new reinsurance contracts were concluded in 2022.

Investment return

Investment return comprises income received on fixed income securities, derivatives and investment property, and

unrealised and realised gains and losses on these investments.

The net movement in the fair value of assets, including realised and unrealised items, was a loss of £13,813 million compared

with a loss of £1,029 million in 2021. Total investment income increased to £1,416 million in 2022 (2021: £1,238 million). The 2022

net investment loss was largely driven by significant increases in interest rates during the year. Commission earned in the

year amounted £1 million (2021: £1 million).

It is important to note that because our assets and liabilities are broadly matched, the rise in interest rates has also

materially reduced our insurance liabilities, a change also reflected in the income statement.

Claims paid

Net claims paid comprises of gross claims paid, which are pension payments to our policyholders, less any payments

received from reinsurers. Net claims paid increased to £1,881 million (2021: £1,785 million), mainly reflecting the increase

inpensioner numbers due to new business.

Summary (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202208

Change in net insurance liabilities

Change in net insurance liabilities represents the change in the gross insurance liabilities less the movement in reinsuranceassets.

The change in net insurance liabilities mainly reflects the impact of market movements, principally the increase in interest

rates, partially offset by the net increase in the number of policies by 20,600 to 310,200 (2021: 289,600).

Operating expenses

The operating expenses in 2022 were £247 million for Group, and £246 million for PIC (2021: PICG £198 million, PIC £198 million).

This includes project spend of £58 million (2021: £38 million) reflecting a higher spend on business-wide initiatives. Excluding

these project costs, the remaining increase in spend mainly reflects higher maintenance and investment management costs

to support growth of the business.

Finance costs

Finance costs represent the interest payable on borrowings. Finance costs for PIC and PICG of £90 million (2021: PICG

£89 million, PIC £88 million) reflect the interest payable on the five (2021: five) subordinated debt securities issued.

The Restricted Tier 1 (“RT1”) debt issued in July 2019 has been accounted for as equity under IFRS and as such interest on

these notes is not included in finance costs and is instead recognised as dividends when paid. These dividends amount

to£33 million in 2022 (2021: £33 million).

Statement of financial position review – PICG

Statement of financial position extract

2022

£m

2021

£m

Financial investments 40,951 51,143

Derivative assets 22,451 15,018

Reinsurance assets 1,199 3,350

Gross insurance liabilities (33,029) (47,013)

Derivative liabilities (25,348) (16,997)

Borrowings (1,592) (1,590)

Other net assets 807 554

Total equity 5,439 4,465

Statement of financial position review – PIC

Statement of financial position extract

2022

£m

2021

£m

Financial investments 41,108 51,316

Derivative assets 22,451 15,018

Reinsurance assets 1,199 3,350

Gross insurance liabilities (33,029) (47,013)

Derivative liabilities (25,348) (16,997)

Borrowings (1,592) (1,590)

Other net assets 619 345

Total equity 5,408 4,429

At the end of 2022, the Group had total financial investments of £41.0 billion (PIC: £41.1 billion), compared with £51.1 billion

(PIC:£51.3 billion) at the end of 2021. Our investment strategy is to select assets that generate cash flows to match our

futureclaims payments in both timing and amount. Therefore, although the size of the portfolio has decreased primarily

dueto the impact of rising interest rates, the value of our insurance liabilities has also fallen, and they now stand at

£33.0 billion for PICG and PIC (2021: PICG and PIC £47.0 billion). Note that our hedging strategy is primarily designed to

stabiliseour solvency position and consequently there may be some short-term volatility in the IFRS result, particularly

givenrecent volatile economic conditions.

The credit quality of our investment portfolio is actively managed and remains strong, ensuring that the Group did not

experience any defaults for the tenth consecutive year. This demonstrates the resilience of our investment strategy, which

continues to prioritise the management of key risks to protect the pensions of our policyholders over the coming decades.

The decrease in the reinsurance assets during the year primarily reflects the lower levels of insurance liabilities due to interest

rate rises. In 2022, the Group reinsured longevity exposure on £2.8 billion of reserves (2021: £4.0 billion), and at 31 December

2022, 87% of the Group’s gross longevity related reserves had been reinsured (2021: 85%). The Group has14 reinsurance

counterparties (2021: 14), all of which have a credit rating of A- or above.

The Group uses derivatives to hedge certain market risks associated with both new and existing business. Gross derivative

assets and derivative liabilities have both increased during the year, leading to an increase in the net liability position of

£918 million (2021: movement of £425 million). The net increase is a result of market movements, in particular rising interest

rates. It should be noted that a significant proportion of our derivative asset contracts are collateralised through the use

ofacustodian, and as such present little credit risk in the event of a derivative counterparty default.

As a result of the above movements, total equity has increased by £974 million (PIC: £979 million) (2021: PICG: £298 million;

PIC£286 million).

Summary (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202209

Dividend

In recognition of the continued financial strength of the business, the Board has decided, for the first time, to propose

adividend to the Group’s shareholders £100m (2021: nil). The dividend is driven by financial performance in 2022 but

willbereflected in the Group’s results in 2023.

The Group’s dividend policy is to retain sufficient capital to invest in future growth opportunities of the UK PRT market,

whilstpaying regular dividends to shareholders, based on the current and future projected capital position of the

business.The implications for solvency, leverage and liquidity are all considered when considering the appropriateness

ofdividend payments.

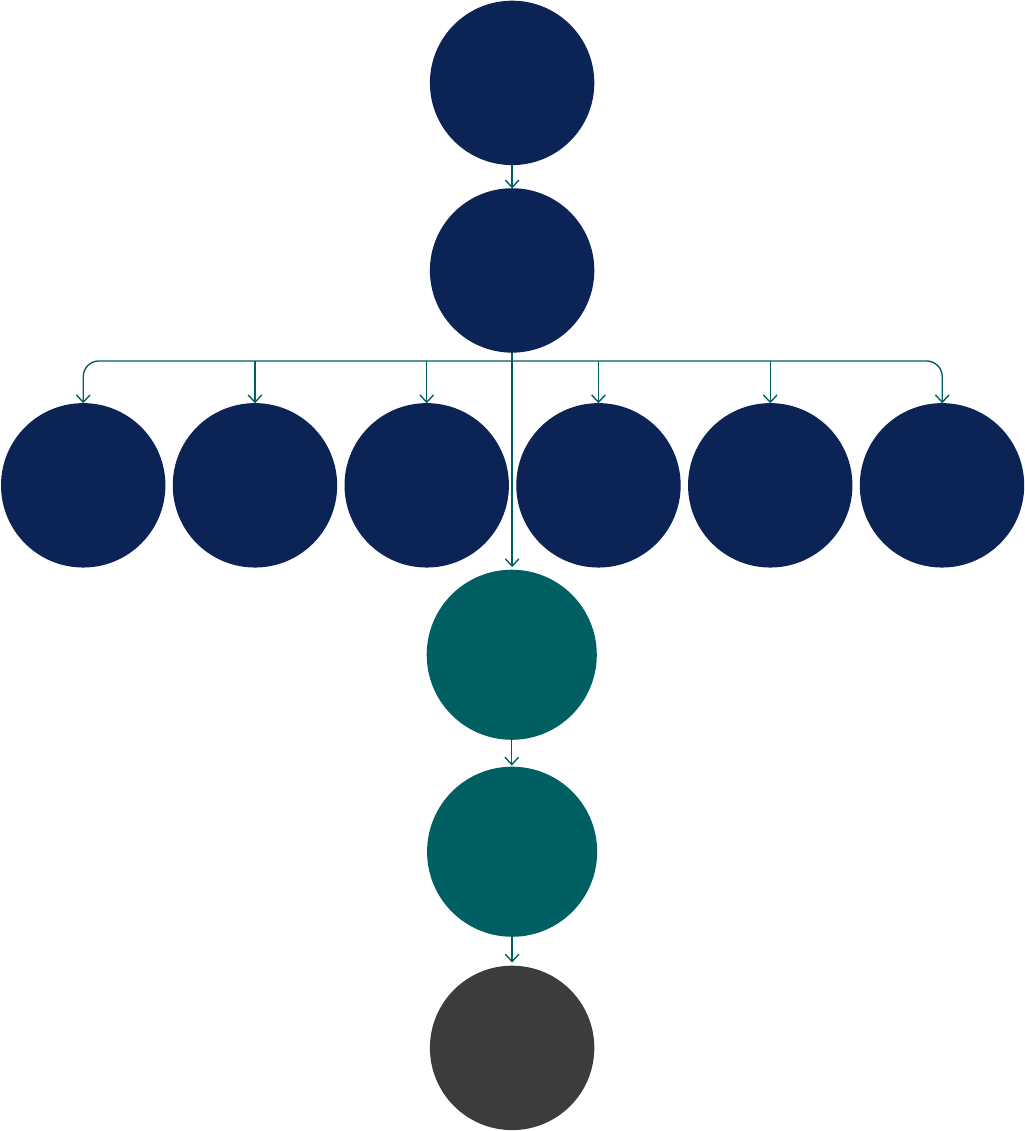

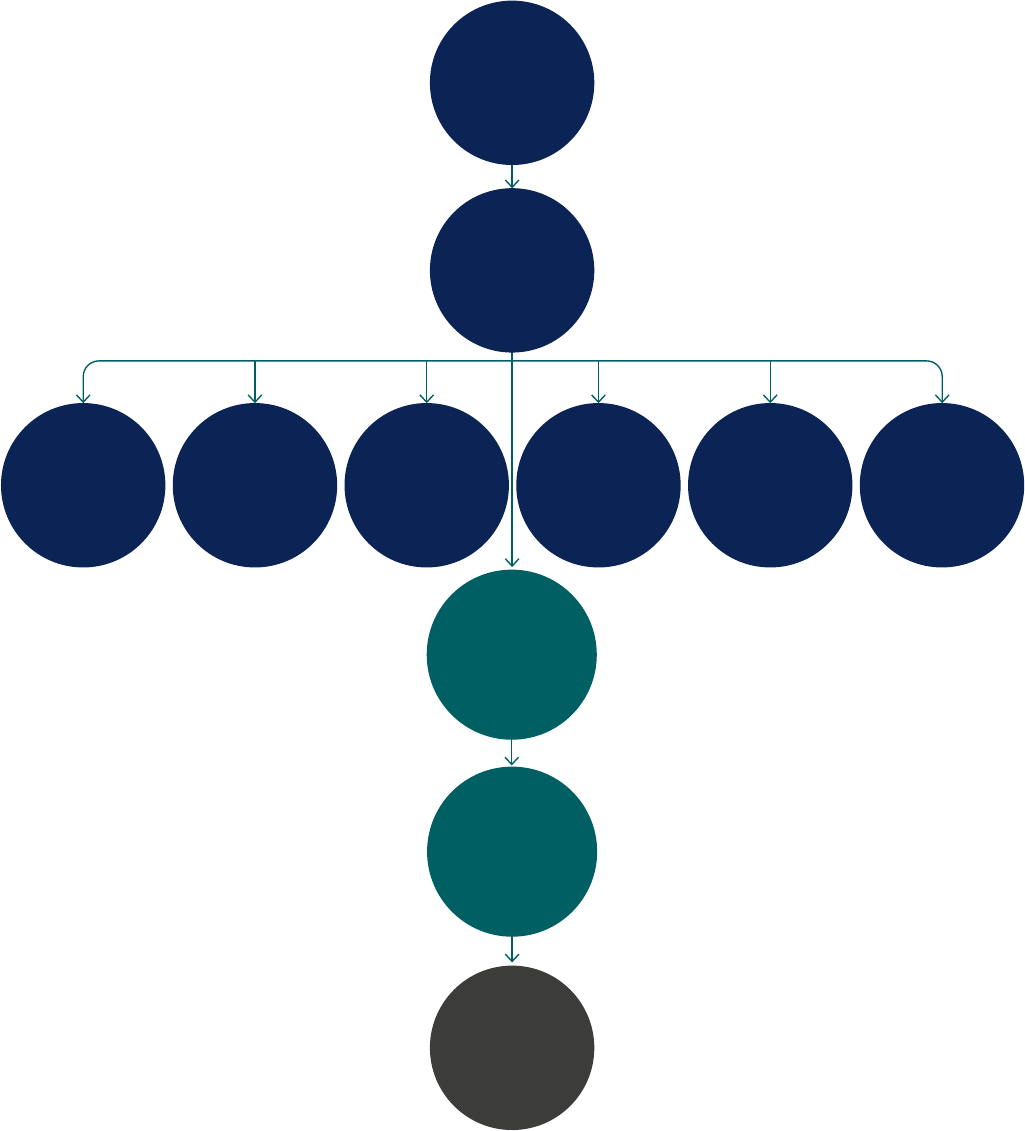

System of Governance

Summary (unaudited) continued

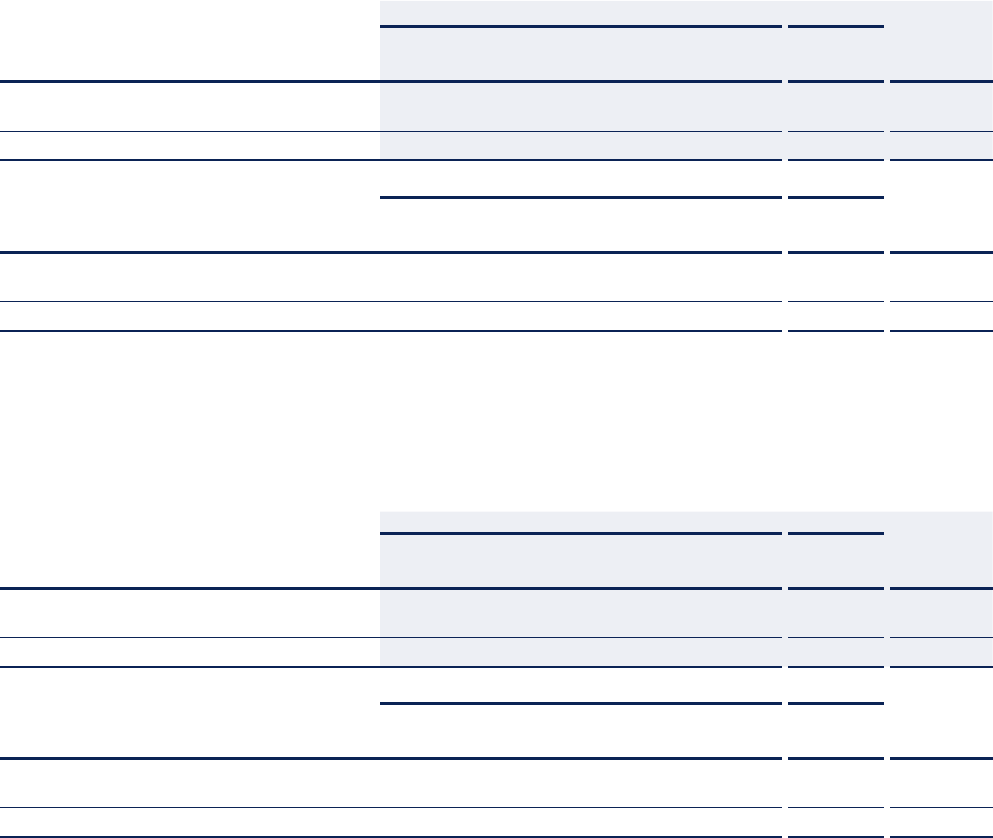

PICG

Board

Executive

Committee

Chief

Executive

Officer

Investment

and Origination

Committee

ESG Committee

Nomination

Committee

Remuneration

Committee

Risk

Committee

Audit

Committee

Management

and Operating

Committees

PIC

Board

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202210

System of Governance continued

PIC’s governance structure is in line with the “three lines of defence” model which is operated by the Group. The “First Line”

represents the business operating which have prime day-to-day responsibility for the management of risks within the agreed

risk management framework. The “Second Line” consists of independent risk and compliance functions, who have responsibility

for setting, monitoring and oversight of the risk framework within which the First Line operates, and the Head of The Actuarial

Function. The “Third Line” comprises Internal Audit and External Audit which have responsibility for assessing the operation

of the risk and control environment.

The Board delegates specific responsibilities to the Board committees, which assist the Board in its oversight and control of

thebusiness. There are currently six Board committees: Audit, Environmental, Social and Governance (“ESG”), Investment

and Origination, Nomination, Remuneration and Risk. The Investment and Origination Committee considers matters specific

to PIC. The five remaining committees consider matters specific to PIC and the Group, as per the delegations in their terms of

reference (further details are provided below). Members of the committees are appointed by the Board on recommendation

of the Nomination Committee in consultation with the committees’ chairs.

Audit Committee

The Committee works closely with the Risk Committee and has responsibility for ensuring the company fulfills its responsibilities

regarding financial reporting, the effectiveness of internal controls, the risk management systems and processes, compliance

matters, and the internal audit function and external audit process.

ESG Committee

In December 2021 the Group established an ESG Committee which meets quarterly to consider and oversee all ESG related

matters. The purpose of the Committee is to ensure that the Board and its Committees provide oversight of the Group’s ESG

strategy and activities, and that the Group complies with legal and regulatory requirements in respect of ESG, enabling the

Group to make the right decisions for the long-term benefits of our policyholders.

Investment and Origination Committee

The Committee oversees the investment policy and investment strategy for PIC, ensuring that ESG is integrated into

decisionmaking and provides oversight of the operation of PIC’s investment portfolios. It also oversees PIC’s new

businessand reinsurance origination.

Nomination Committee

The Committee is responsible for reviewing the structure, size and composition of the Board and its committees and for

recommending changes to the Board and setting succession plans for executive and non-executive directors and senior

management within the Group.

Remuneration Committee

The Committee oversees the establishment and implementation of a remuneration policy for employees and directors,

designed to support the long-term business strategy and values of the Group as a whole, as well as promoting effective

riskmanagement and complying with applicable legal and regulatory requirements.

Risk Committee

The Committee provides oversight and advice to the Board on the current and future risk exposure of the Group including

oversight of the future risk strategy; determination of risk appetite and tolerance; and internal controls required to manage

risk and the effectiveness of the risk management framework, in conjunction with the Audit Committee.

Risk Profile

The Group and Company quantify their exposure to different types of risk using their Internal Model, which was approved

foruse by the PRA in December 2015. Major Model Changes were approved by the PRA in December 2017 relating to longevity

and inflation and in December 2020 relating to Equity Release Mortgages.

The Group’s total Solvency Capital Requirement (“SCR”) represents the amount of capital the firm must hold to protect

itfrom extreme risk events and comply with regulatory requirements. The component risks which make up the SCR are

detailed in Section C.

The Group’s risk profile has remained stable over the reporting period.

Summary (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202211

Valuation for Solvency Purposes

The table below summarises the Group and Company’s assets and liabilities valued in accordance with its statutory

accounting basis (IFRS), and the Solvency II regulatory basis at 31 December:

2022

Group Company

Solvency

£m

IFRS

£m

Solvency

£m

IFRS

£m

Total Assets 65,461 65,642 65,429 65,607

Total Liabilities 59,582 60,203 59,596 60,199

Excess of Assets over Liabilities/Equity 5,879 5,439 5,833 5,408

2021

Group Company

Solvency

£m

IFRS

£m

Solvency

£m

IFRS

£m

Total Assets 69,676 70,293 69,626 70,242

Total Liabilities 64,555 65,828 64,555 65,813

Excess of Assets over Liabilities/Equity 5,121 4,465 5,071 4,429

Differences in the valuation of assets and liabilities between the two bases are driven by the following:

•

the Solvency II Risk Margin (net of transitional measures for technical provisions (“TMTP”)) which is an addition to the

Solvency II best estimate liabilities but is not required under IFRS;

•

IFRS prudent margins in the projected liability cashflows (for example, via the expense and demographic assumptions)

which increase IFRS liabilities relative to the Solvency II best estimate liabilities;

•

differences in the valuation discount rate, used to discount the liability cashflows, which is prescribed for Solvency II

butdetermined by PIC for IFRS (and includes prudent margins);

•

valuation of subordinated debt liabilities, which are at amortised cost for IFRS purposes and are at fair value under

Solvency II; and

•

differences related to deferred tax assets and liabilities.

The valuation differences above are explained in greater detail in section D.

Capital Management

At 31 December 2022, PICG’s Solvency II ratio was 226% (PIC: 225%) (2021: PICG 169% and PIC: 168%) and it had surplus funds

of£4,037 million (PIC: £4,011 million) (31 December 2021: PICG: £2,731 million; PIC: £2,701 million) in excess of its SCR as calculated

by the internal model. The increase in the year was largely driven by favourable market movements and returns from the

in-force book, partly offset by the impact of writing new business. The result is net of a recalculation of the TMTP performed

at 30 June 2022.

The table below summarises the Group and Company’s capital and solvency position as at 31 December:

2022 Group Company

Own Funds (£m) 7, 236 7,210

SCR (£m) 3,199 3,19 9

Solvency II surplus (£m) 4,037 4,011

Solvency II ratio % 226% 225%

2021 Group Company

Own Funds (£m) 6,699 6,669

SCR (£m) 3,968 3,968

Solvency II surplus (£m) 2,731 2,701

Solvency II ratio % 169% 168%

Summary (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202212

A.1 Business

The full legal name of the undertaking is Pension Insurance Corporation plc. It is a Public Limited Company, registered

inEngland and Wales with the company registration number 05706720.

PIC is authorised by the Prudential Regulation Authority, 20 Moorgate, London EC2R 6DA and regulated by the Financial

Conduct Authority, 12 Endeavour Square, London, E20 1JN and the Prudential Regulation Authority (FRN 454345).

The principal activity of PIC is the provision of pension risk transfer contracts to corporate pension schemes (also known as

“pension insurance” or “bulk annuities”). Pension risk transfer products are used by pension funds to transfer to an insurance

company the risks and liabilities arising from the benefit promises made to pension fund members. Insurance is also used as

a means by which the ultimate responsibility to pay the benefits promised is transferred to the insurance company through

the issuance of an individual annuity insurance policy to the pension fund member.

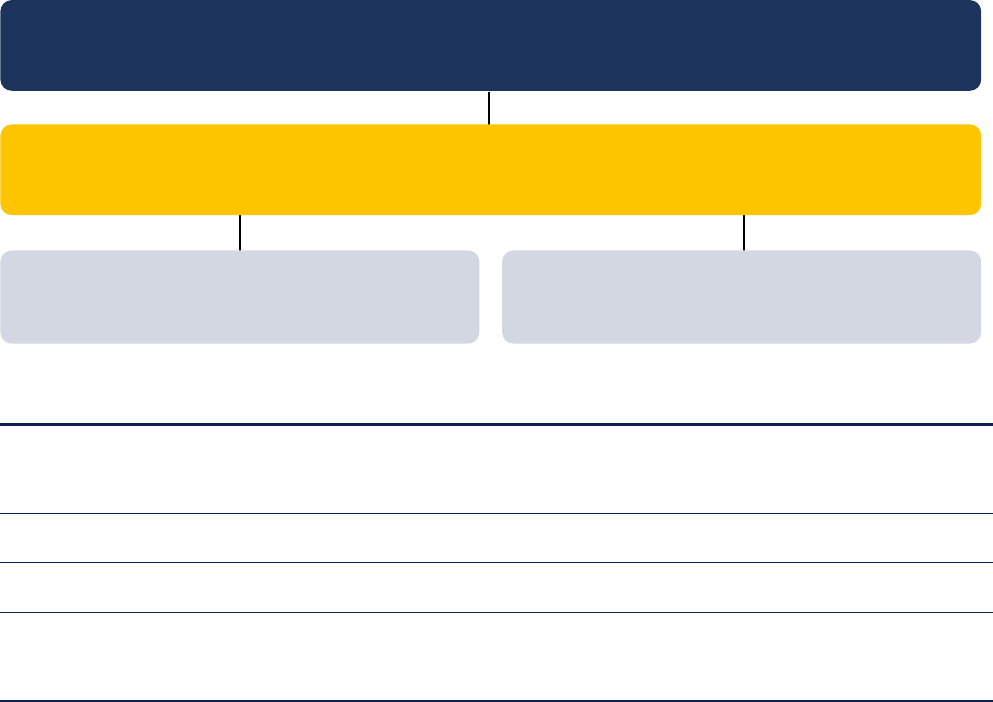

A simplified group structure chart, and a description of the Group as at 31 December 2022 is set out below:

Pension Insurance Corporation Group Limited (“PICG”)

PIC Holdings Limited (“PICH”)

Pension Services

Corporation Limited (“PSC”)

Pension Insurance

Corporation PLC (“PIC”)

Group Undertakings

Country of

Incorporation

Principal

Activity

Pension Insurance Corporation

GroupLimited

England Holding company for the other companies within the Group,

owning 100% of the equity. It has no employees, and incurs

minimal administrative expenses. It also operates share

incentive plans for the benefit of the employees of the Group.

PIC Holdings Limited England An intermediate holding company, and has no material assets

or liabilities in the context of the Group.

Pension Insurance Corporation plc

(Regulated entity)

England Provision of insurance annuity products to corporate

pensionschemes and their members.

Pension Services Corporation Limited England Service company of the Group, and employs all the staff which are

responsible for the performance of the Group’s activities. It also

enters into the majority of material contracts (with the exception

of pension insurance contracts) on behalf of the Group.

The Group and Company prepare their financial statements in accordance with IFRS in conformity with the requirements

ofthe Companies Act 2006. The Group is required to adopt IFRS 17 for its financial year beginning on 1 January 2023. The

standard provides a comprehensive approach for accounting for insurance contacts, including measurement, income

statement presentation and disclosure. It is expected to have a significant impact on the Group’s IFRS based metrics.

There are no differences between the scope of the Group for the consolidated financial statements and the scope under

the default accounting consolidation method for Solvency purposes. The External Auditor to the Group is KPMG LLP, 15

Canada Square, London E14 5GL.

As presented in the Summary, the Group made an IFRS profit before tax of £1,240 million in 2022 (2021: £393 million), and the

Company made an IFRS profit before tax of £1,241 million in 2022 (2021: £394 million).

The tables in sections A.2 to A.4 below present extracts from the Group’s and Company’s IFRS Statements of Comprehensive

Income, splitting the IFRS income and expense items between underwriting activity (section A.2), investment activity (sectionA.3)

and other activity (section A.4). Comparative information has been presented where available.

A. Business and Performance (unaudited)

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202213

A.2 Performance of underwriting activity

In addition to the statutory results presentation as outlined above, the Group also chooses to analyse its IFRS results on

analternative performance metric, ‘adjusted operating profit before tax’, which is a non-GAAP measure of long-term value

creation, a key outcome of the Group’s business model. It reflects the Group’s activities which are core to our business and

themanagement choices and decisions around those activities. These activities include the writing and management

ofpension insurance contracts (buyouts and buy-ins), the management of risk through reinsurance, and the day-to-day

investment and management of the insurance assets and liabilities. In essence, it gives stakeholders a more accurate view

ofthe expected long-term investment returns on the assets backing policyholder and shareholder funds, with an allowance

forthe corresponding expected movements in liabilities. This basis reflects the long-term trading activities of the Group

better than the IFRS reported profit before taxation.

Information on premiums, claims and changes in technical provisions, which can be considered as key elements of underwriting

performance, is presented by Solvency II line of business in Quantitative Reporting Template (“QRT”) S.05.01.02 inAppendix B

of this report.

Adjusted operating profit before tax

2022 2021

PICG

£m

PIC

£m

PICG

£m

PIC

£m

Expected return from operations 426 426 288 288

New business and reinsurance profit 228 228 167 167

Underlying profit 654 654 455 455

Change in valuation assumptions (6) (6) 315 315

Experience and other variances (79) (78) (77) (77)

Finance and project costs (181) (181) (160) (159)

Adjusted operating profit before tax 388 389 533 534

Investment related variances 819 819 (173) (173)

Add back: RT1 coupon (treated as a dividend for statutory purposes) 33 33 33 33

Profit before taxation 1,240 1,241 393 394

The Group’s adjusted operating profit before tax (“AOPBT”) was £388 million (PIC: £389 million), a decrease of 27% from 2021

(PIC: 27%).

Underlying profit

This item comprises the expected returns arising from the management of the Group’s assets and liabilities. This is derived

byusing assumptions about long-term returns on the underlying investment portfolio backing liabilities, and on the surplus

assets of the Group.

It also includes the impact on profit of writing new pension risk transfer contracts based on target asset mix assumptions

andthe impact of entering into new contracts of reinsurance.

Underlying profits have increased to £654 million (2021: £455 million). Included within this:

•

Expected return from operations reflects the expected returns arising from the management of the Group’s assets and

liabilities. This is derived by using assumptions about returns on the underlying investment portfolio backing liabilities, and

on the surplus assets of the Group. Expected returns of £426 million were above the prior year (2021: £288 million), mainly

driven by the increase in interest rates and higher levels of surplus assets.

•

New business and reinsurance profit represents the impact on profit of writing new pension risk transfer contracts based on

target asset mix assumptions, and the impact of entering into new contracts of reinsurance. New business and reinsurance

profit of £228 million was higher than 2021 (£167 million), resulting from the £4.1 billion of new business premiumswritten.

A. Business and Performance (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202214

Changes in valuation assumptions

The Group’s focus remains on long-term profitability, which is achieved by setting prudent assumptions in respect of the

in-force liabilities and new business acquired during the year. Management regularly review these assumptions to ensure

thatthey reflect the characteristics of our book and wider market practice.

As part of management’s regular review of assumptions in 2022, several assumptions were updated that were broadly

neutral in aggregate (2021: £315 million profit).

In the year we have made changes to the way we model pension revaluation increases, which contributed to a release

ofreserves of £62 million.

For longevity, we adopted CMI_2021, which is the latest version of the Continuous Mortality Investigation’s (“CMI”) projections

model, to generate future mortality improvements. The impact of Covid-19 has also been removed from the derivation of

current mortality rates. These changes lowered management’s view of future average life expectancies, and consequently

generated a reduction in reserves of £60 million.

We increased our cash commutation take-up rate to reflect more recent economic conditions and PIC’s new longevity

assumptions. This generated a reserve release of £30 million.

Following an in-depth review in the year, we increased our reserves by £106 million to reflect Management’s latest view

ofmaintaining the cost of our Limited Price Index (“LPI”) inflation linked obligations.

Finally, we have updated our maintenance expense assumptions to reflect the latest expense budget and policy count

information. This increased reserves by £52 million. In addition, there were several other smaller assumption changes made

inthe year, including an update to our ERM valuation, reinsurance, investment expense and project costs assumptions.

In 2021, several assumptions were updated including those in respect of credit defaults, maintenance expenses, investment

management fees, inflation and the IFRS liquidity premium rate, which together resulted in a total reserve release of

£315 million.

Experience and other variances

Experience variances gave rise to a loss in the year of £79 million for PICG and £78 million for PIC (2021: PICG loss of £77 million;

PIC loss of £77 million). The loss in the current period largely reflects differences between assumptions used for pricing and

reserving on new business. In 2021, the loss largely related to experience variances on new business, actual claims experience

compared to expectation and the impacts of data updates from underlying policyholder information.

Finance and project costs

The interest costs of the subordinated Tier 2 debt capital issued by PIC and transaction costs increased slightly to £90 million

in 2022 (PICG: £90 million) from £88 million the previous year (PICG: £89 million).

Interest coupons paid on the RT1 Debt issued by PIC were £33 million (PICG: £33 million) and were unchanged from 2021

(PIC:£33 million, PICG:£33 million).

Project costs in 2022 were £58 million (PICG: £58 million) compared to 2021 costs of £38 million (PICG: £38 million) due to

higherspend on business-wide initiatives.

Investment related variances

Investment related variances include the differences between the expected long-term investment return and the actual

investment return earned in the period; changes in economic assumptions on liabilities and the differences between the

short-term actual asset mix against the expected long-term asset mix on new business transactions.

We carefully manage our risk to market and other economic factors and enter into derivative hedging contracts to manage

these exposures in accordance with our risk appetite. Our hedging strategy is primarily designed to actively manage risk over

the long-term in the solvency balance sheet, and there exists a mismatch between this hedging strategy and the IFRS balance

sheet. This mismatch, and the resulting volatility, is included within the investment related variance line. The impact of changes

in credit ratings and timing variances for asset purchases backing new business are also included here.

Investment related variances resulted in a gain of £819 million (2021: loss of £173 million), largely from favourable market

movements and management actions to optimise the risk profile of our portfolio. The year-on-year improvement was

mainlydriven by higher interest rates, rising inflation and wider credit spreads.

Other operational highlights

In total, in 2022, PIC was responsible for the current and future pension payments of 302,200 (2021: 282,900) policyholders,

including those with individual policies, and those for whom the trustees of the underlying pension schemes retain

ultimateresponsibility.

At 31 December 2022, 87% of the Group’s gross longevity related reserves had been reinsured (2021: 85%). The Group has

14reinsurance counterparties, all of which have a credit rating of A- or above.

A. Business and Performance (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202215

A.3 Performance of investment activity

The investment performance (including commissions earned), as presented in the table below, is a reflection of income,

gains(realised and unrealised), losses and expenses arising from the investment portfolio owned by the Group.

Group and Company

Investment return: by Solvency II Asset Class

2022

£m

2021

£m

Government bonds (5,763) 59

Corporate bonds (3,914) (188)

Collective Investment undertakings 293 119

Cash and deposits 12 (2)

Collateralised securities (52) 1

Mortgages and loans (3,197 ) (220)

Derivative based instruments 224 440

Commissions earned 1 1

Investment Return (12,396) 210

Investment management expenses (57) (42)

Total (12,453) 168

Investment return comprises income received on fixed income securities, derivatives and investment property, and

unrealised and realised gains and losses on these investments. The above table allocates investment return across

theSIIasset classes.

It is important to note that because our assets and liabilities are broadly matched, the rise in interest rates has also

materially reduced our insurance liabilities, a change also reflected in the income statement.

A.4 Performance of other activities

Pension Insurance Corporation Group Limited

Group corporation tax charges, including those incurred by PIC, were £229 million during the year (2021: £82 million).

Pension Insurance Corporation plc

The Company incurred corporation tax charges of £229 million for the year ended 31 December 2022 (2021: £81 million).

A.5 Any other information

Economic uncertainty and market volatility

The global economic outlook has weakened further through 2022 due to high inflation and low growth rates. Central banks

globally are increasing interest rates to combat inflation, which is exacerbated by energy and food price shocks. Geopolitical

risks are high across the globe, and in particular the Russian invasion of Ukraine continues which has worsened Europe’s

energy security.

The financial impacts on PIC of these conditions can be both positive and negative. On the negative side, the current market

conditions have resulted in higher risk of credit downgrades and defaults, and heightened risk overall. We constantly monitor

market conditions and have risk appetite limits set for PIC’s exposure to market risks. PIC also holds capital to protect the

business against market movements, downgrades and defaults, and we continue to refine our methodology for calculating

the amount of capital to hold. On the positive side, rising yields improve the funding position of pension schemes, which

accelerates their ability to move to buyout, which in turn increases new business opportunities. Higher yields also improve

PIC’s solvency position.

Whilst the Liability Driven Investment (“LDI”) crisis in the pension market did impact PIC’s liquidity as a result of rapidly increasing

gilt yields and the decreasing value of GBP against USD, PIC remained within its liquidity and capital risk appetite limits.

Alongside managing the day-to-day market volatility, the risk management capabilities of the Group have been enhanced.

This includes significantly improving asset stress and scenario testing capabilities with the implementation of a new asset

stressing model and development to our Risk Appetite Framework.

Rounding convention

The SFCR is presented in pound sterling rounded to the nearest million which is consistent with the presentation in

theIFRSfinancial statements. The QRTs are presented in pound sterling rounded to the pound. Rounding differences

of+/-one unit can occur.

A. Business and Performance (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202216

B. System of Governance (unaudited)

The below chart shows the Group’s governance structure. Along with other annual reviews of our governance processes, the

structure is reviewed to make sure that it is fit for purpose and remains as such in the context of the Group’s growthprospects.

PICG

Board

Executive

Committee

Chief

Executive

Officer

Investment

and Origination

Committee

ESG Committee

Nomination

Committee

Remuneration

Committee

Risk

Committee

Audit

Committee

Management

and Operating

Committees

PIC

Board

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202217

B.1 Governance Function

Board of Directors

Pension Insurance Corporation Group Limited

PICG is governed by its Board consisting of 13 directors, 12 of whom are non-executive.

Of the non-executive Board members, two are nominated by Reinet PC Investments (Jersey) Limited which as at

31 December 2022, holds a 49.49% interest in PICG, one is nominated by Luxinva S.A., a wholly owned subsidiary of the

AbuDhabi Investment Authority, which holds a 18.42% interest in PICG, one is nominated by Blue Grass Holdings Limited,

aCVC entity, which holds a 17.37% interest in PICG, and one is nominated by MP 2019 K2 Aggregator, L.P., an HPS Investment

Partners entity, which holds a 10.23% interest in PICG.

The Board maintains overall responsibility for PICG Limited as an entity and an oversight responsibility for the Group to

ensure the Group operates in the best interests of its policyholders, shareholders, employees and other stakeholders.

TheBoard is also responsible for setting the Group’s long-term objectives and commercial strategy.

The main activities of the Group are conducted through its principal operating subsidiary, PIC.

The Board has delegated the day to day management and administration of the Company to the Chief Executive Officer

(“CEO”) who has established the Executive Committee at the operating entity level, PIC, to assist the CEO in day to day

running of PIC.

PICG Board

Director Approved Function

Jon Aisbitt SMF 7 Group Entity Senior Insurance Manager Function

SMF 9 Chairman

SMF13 Chair of the Nomination Committee

Stepped down as SMF 7,9 and

13and retired from the Board

on1October 2022

David Weymouth SMF 7 Group Entity Senior Insurance Manager Function

SMF 9 Chairman

SMF 13 Chairman of the Nomination Committee

Board member from 1 October

2022 and approved by the PRA

on19 December 2022

Tracy Blackwell SMF 1 Chief Executive Function

SMF 7 Group Entity Senior Insurance Manager Function

Jake Blair SMF 7 Group Entity Senior Insurance Manager Function

Judith Eden SMF 12 Chair of Remuneration Committee

Tim Gallico SMF 7 Group Entity Senior Insurance Manager Function

Julia Goh Non-executive Director

Stuart King Non-executive Director

Arno Kitts Non-executive Director

Josua Malherbe SMF 7 Group Entity Senior Insurance Manager Function

Roger Marshall SMF 11 Chair of the Audit Committee

SMF 14 Senior Independent Director

Jérôme Mourgue D’Algue SMF 7 Group Entity Senior Insurance Manager Function

Mark Stephen Non-executive Director

Wilhelm Van Zyl SMF 7 Group Entity Senior Insurance Manager Function

Pension Insurance Corporation plc

PIC is governed by its Board consisting of 14 directors, 12 of whom are non-executive. Eight of PIC’s directors are independent,

including the Chairman.

Of the non-executive Board members, one is appointed by Reinet PC Investments (Jersey) Limited, one is appointed by Luxinva

S.A., a wholly owned subsidiary of the Abu Dhabi Investment Authority, one is appointed by Blue Grass Holdings Limited, a CVC

entity, and one is nominated by MP 2019 K2 Aggregator, L.P., an HPS Investment Partners entity.

Pension Insurance Corporation plc is a wholly owned subsidiary of Pension Insurance Corporation Group Limited.

The Board has overall responsibility for the operations of PIC and oversees the management of the Company in the best

interests of its policyholders, shareholders, employees and other stakeholders, and to set the Company’s long-term

objectives and commercial strategy.

The Board has delegated responsibility for a number of functions to Board Committees as set out below. The Committees

allhave Terms of Reference setting out in more detail their responsibilities.

B. System of Governance (unaudited) continued

Pension Insurance Corporation Group Limited | Solvency and Financial Condition Report 202218

PIC Board

Director Approved Function

Jon Aisbitt SMF 7 Group Entity Senior Insurance Manager Function

SMF 9 Chairman

SMF13 Chair of the Nomination Committee

Stepped down as SMF 7,9 and

13and retired from the Board

on31 October 2022

David Weymouth SMF 7 Group Entity Senior Insurance Manager Function

SMF 9 Chairman

SMF 13 Chair of the Nomination Committee

Board member from 1 October

2022 and approved by the PRA

on19 December 2022

Tracy Blackwell SMF 1 Chief Executive Function

SMF 7 Group Entity Senior Insurance Manager Function

Sally Bridgeland SMF 10 Chair of the Risk Committee

Jake Blair SMF 7 Group Entity Senior Insurance Manager Function

Judith Eden SMF 12 Chair of the Remuneration Committee

Julia Goh Non-executive Director

Stuart King Non-executive Director